SIGN THE PETITION:

KEEP WASHINGTON INCOME TAX FREE!

Say NO to the Capital Gains Income Tax | |||

Help us fight the unconstitutional capital gains income tax by adding your name and email to our list. Not only does this send a clear message that voters are tired of the legislature trying to circumvent the will of the people, but it also will keep you up to date on the latest news regarding the illegal tax. |

Contents:

1. An "excise tax" or an income tax?

2. If it is an income tax, doesn't that make it illegal?

3. More income taxes on the way? What emails reveal.

4. Is the state in a financial crisis?

5. Would an income tax on capital gains be a good policy for Washington or the end of our "no income tax" advantage?

6. Additional resources

1. Excise Tax or Income Tax?

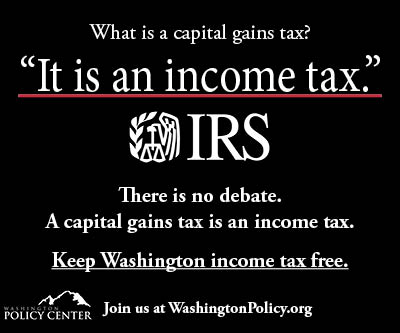

Proponents of a capital gains tax need to be honest and call it what it is, an income tax. There is no honest debate.

The IRS answered this question directly saying, “It is an income tax.” Every state revenue department in the country, all 49 states other than Washington, treat capital gains taxes as income taxes.

Imposing an income tax, however, will throw away what Washington’s Department of Commerce calls a “competitive advantage” and “great marketing” for the state. A capital gains tax in particular will inject extreme volatility into the state’s revenues and budget.

Don't want to read? This video proves a capital gains tax IS an income tax!

2. If it is an income tax, doesn't that make it illegal?

Based on the last 90 years of precedent from the court, yes! More recently, in early 2022 an Inslee appointed Douglas County superior court judge ruled that this capital gains income tax was unconstitutional. Advocates for the illegal tax have appealed this decision and now the state Supreme Court is set to hear the case on January 26th. While there are plenty of arguments filed as amicus briefs, the unavoidable truth is that based on the definitions from every other taxing authority in the U.S., a capital gains tax is an income tax, whether the Attorney General wants you to know that or not. This hasn't stopped the Department of Revenue from starting to collect the tax, however. To hear a robust explanation of the case and where it stands, click here to watch a video breakdown.

3. More income taxes on the way? What emails obtained through a public records request reveal.

“But the more important benefit of passing a capital gains tax is on the legal side, from my perspective. The other side will challenge it as an unconstitutional property tax. This will give the Supreme Court the opportunity to revisit its bad decisions from 1934 and 1951 that income is property and will make it possible, if we succeed, to enact a progressive income tax with a simple majority vote.”

Those words were among the emails we obtained thanks to a public records request for the correspondents of certain legislators, Washington Policy Center obtained emails from key advocates proving what we've been warning for years-- that the motive for the income tax on capital gains is to spark a court challenge that would enable a new State Supreme Court to overturn nearly a hundred years of precedent and allow for a broad-based income tax. You can read more about it here. In fact, the WEA has directly asked the Supreme Court to rule that your income is not your property in order to set a new precedent for further income taxes to be collected!

4. Is there a state fiscal crisis that requires an income tax to fix?

To put it simply, the answer is no. State Spending increased 20 percent in the last biennium and even with the COVID pandemic, lockdowns and forced economic retraction, state revenue is expected to GROW by more than seven percent. Of course, some lawmakers want to spend more, but after years of big spending increases, any argument that Washington State is in a revenue "crisis" is an argument that requires one to avoid the context of the past several years. Spending is up... way up. State funding for schools has doubled since the McCleary ruling. Teacher salaries are way up.

With years of state spending increases and a signifcant increase in revenue even amidst the pandemic, there's no reason to be looking at creating an income tax. But when the "we need money" argument falls flat, inevitably there is a cry for "fairness" -- a claim that lower and middle income citizens pay more of their income to taxes than those better off. Yet, while callls for broadening taxes on the so-called rich abound,calls to lower taxes on lower and middle class citizens fall on deaf ears.

UPDATE: Washington state has even MORE tax revenue at its disposal! Here's $3 billion plus reasons to stop talk of imposing an income tax! In fact, the lack of an income tax was part of Gov. Inslee's justification for not including any broad based tax relief for Washingtonians in times of record inflation.

5. Would a Washington State income tax on capital gains be a good policy or the end of our "no income tax" advantage?

Capital gains taxes are volatile and unreliable sources of tax revenue. Delaware described the tax as "exremely volatile and unpredictable." Massachussetts as "among the most volatirle and unpredictable major sources of revenue." California described their capital gains income tax as "among the more significant sources of revenue volatility." And Virginia described them as "the most volatile tax source that any state has to forecast." The S&P has also declared Washington's credit rating higher due to the no income tax status.

Not only is a capital gains tax an income tax, it is also bad policy for Washington state! In case you are not convinced yet, here's a video that explains why an income tax on capital gains would be bad policy for Washington state.

Click here for a presentation on the 2021 capital gains tax proposal created by WPC Center for Governemnt Reform Director Jason Mercier.

6. Additional resources

- Statewide print editorial coverage

- Tech CEO: Capital gains tax talk costing WA jobs

- Lots of income tax discussion in nonpartisan bill report for SB 5096 (capital gains)

- "Choose Washington" - No income tax

- Powerpoint presentation on the proposed Income Tax on Capital Gains from Jason Mercier

- SB 5096 would impose a 9% income tax on capital gains in Washington state

- A warning from France on wealth taxes

- New state tax proposals examined by Jason Mercier

- Per-Capita Inflation adjusted state spending has more than doubled since 1970s

- This is not the great recession - WA revenues still growing every year

- Is capital gains income a stable and sustainable tax source?

- Which states don’t have a capital gains income tax?

- WA Department of Commerce: No state income tax "is great marketing" for Washington

- Are capital gains taxes "secure and stable" or highly volatile?

- New poll shows strong opposition to income tax in any form

- Timeless advice from WA Supreme Court on income taxes

- National tax experts agree – capital gains taxes are income taxes

- Income tax on capital gains: Follow the bouncing ball edition

- Call capital-gains tax for what it really is — an income tax