For years Washington’s Department of Commerce has highlighted the state not having an income tax as being a competitive advantage for employers. Surprisingly, Commerce recently updated its “Choose Washington” website to remove the reference about the state not having an income tax on its “Pro-Business” webpage. Commerce’s sudden removal is contrary to years of statements acknowledging that no income tax was a powerful inducement to locate business in the state.

When testifying on SB 5096 (9% income tax on capital gains) last week, I mentioned that Commerce had changed that webpage but didn’t know why. I now have the details after this exchange with Commerce:

- Me: “WA Department of Commerce runs a website called ‘Choose Washington.’ Earlier this week that website said: ‘We offer businesses some competitive advantages found in few other states. This includes no personal or corporate income tax.’ That page has now been updated to remove the reference to no personal or corporate income tax. Could you please tell me why that sentence was removed, when it was removed, and who made the decision?”

- Commerce: “Our team continually makes updates to the website and many of our marketing materials. The specific change you reference was made earlier this month and is consistent with updates we’ve made to other materials over the past several months. Why? Many national publications have noted WA as a top state for business and emphasize our numerous competitive advantages such as our highly-skilled workforce, world-class research universities and high quality of life. We want our marketing materials to reflect those advantages, along with the other factors most important to the companies we work with, such as proximity to customers, suppliers and partners, energy costs and available property/buildings.”

Here is how the “Choose Washington” no income tax discussion has changed (based on the Wayback Machine archives):

- December 13, 2012: “We offer businesses some competitive advantages found in few other states. These include no taxes on capital gains or personal or corporate income. We also offer industry-specific tax breaks to spur innovation and growth whenever possible.”

- May 1, 2015: “We offer businesses some competitive advantages found in few other states. This includes no personal or corporate income tax. We also offer industry-specific tax breaks to spur innovation and growth whenever possible.” – You’ll note the reference to no capital gains tax was removed (here is what Commerce said then when asked why).

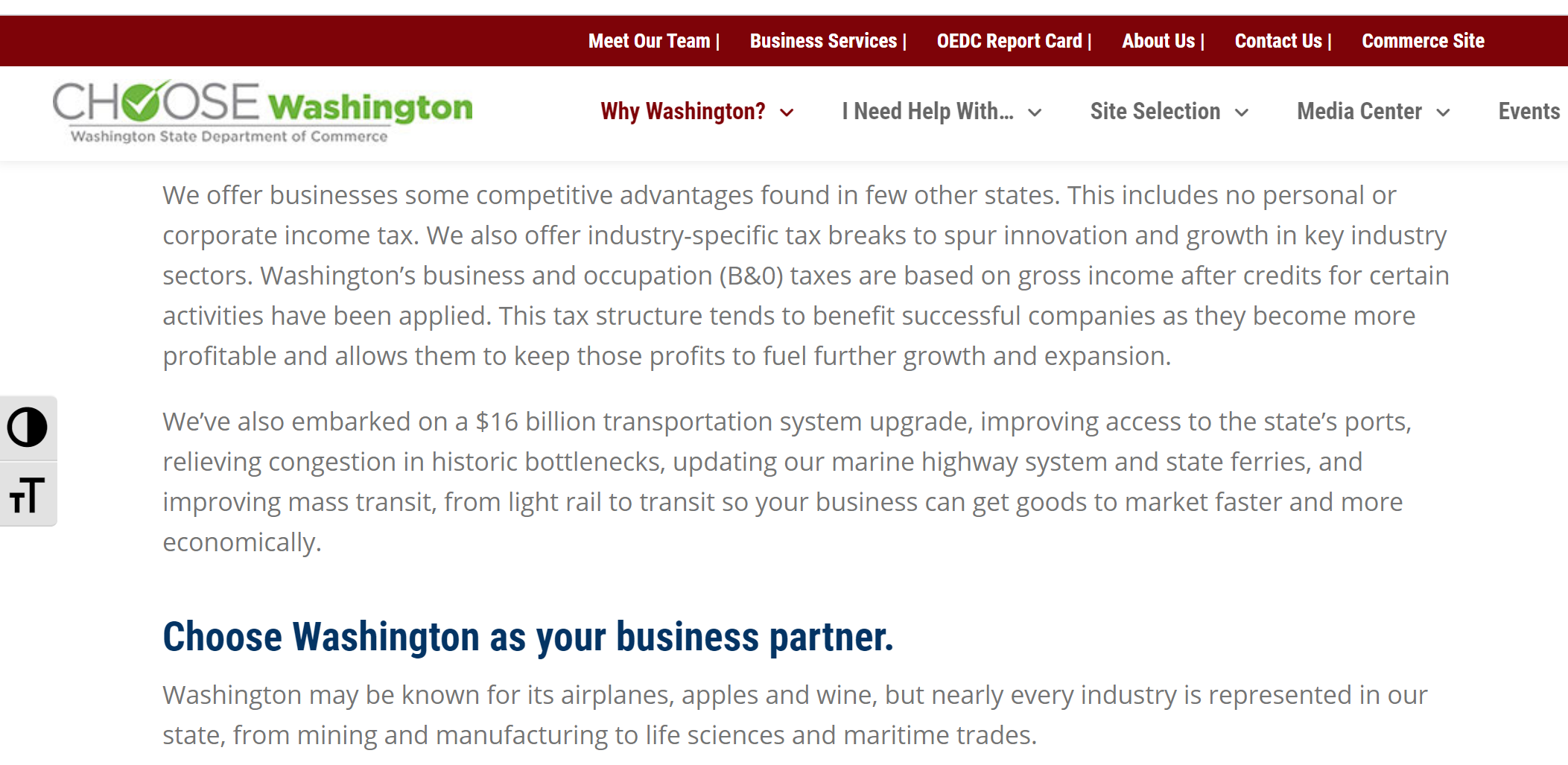

This was the language that existed on the “Choose Washington” website when I was writing my analysis of SB 5096:

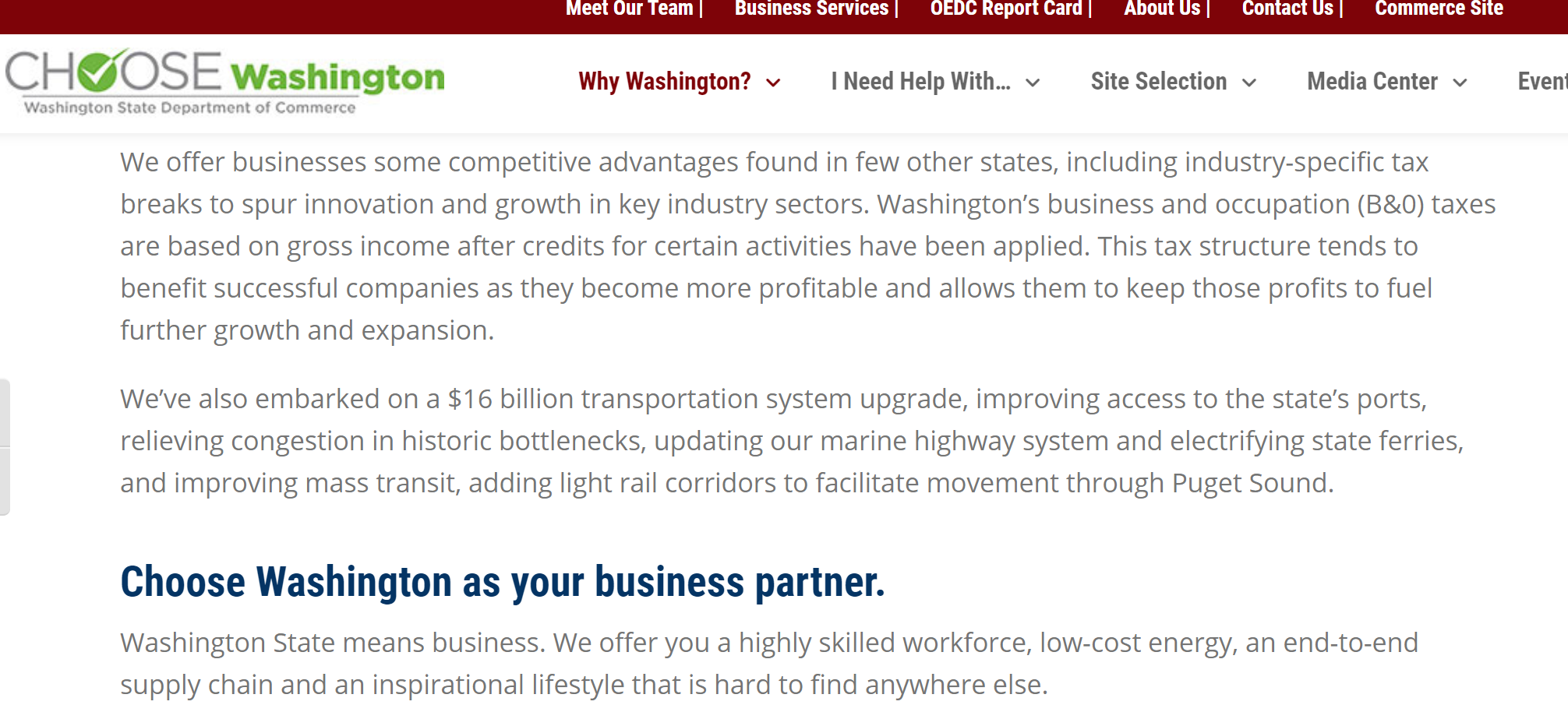

Here is the current language on that page:

Although Commerce removed the no income tax language from the “Pro-Business” page, that language still exists (as of now) on the summary page for the state’s strengths.

I also had an exchange with Commerce about its plans for that summary page:

- Me: “Does Commerce also plan to update the summary page for the state’s strengths? That page currently says: ‘Pro-Business Climate - Washington is one of a handful of states that do not have a personal or corporate income tax. We also offer companies that do business in the state incentives to spur growth in the form of tax deferrals and credits for specific industries or activities.’”

- Commerce: “We’re regularly making updates to the site and our marketing materials.”

- Me: “I’ll keep an eye on the summary page to see if that no income tax language is removed in the future to make sure I reflect the state’s position correctly.”

Interestingly, Commerce hasn’t changed this webpage yet either: “A competitive tax rate. Washington State offers businesses many tax advantages, including no personal or corporate income tax and tax incentives, deferrals and credits for specific high growth industries.”

The “Choose Washington” website is not the only time state officials have highlighted the state not having an income tax as being an advantage for employers. When Amazon was deciding in 2017 where to locate its second headquarters, state and local officials made this pitch about why Washington should be the choice:

- "Business-friendly environment - No personal income tax."

- “The stable and business-friendly environment is a major asset to companies in the Puget Sound region . . . Additionally, the region has a favorable tax structure (e.g., no personal income tax, cap on property tax growth)"

- "Washington is one of just seven states without personal income tax, increasing effective take home pay, making it easier to attract talent to the region. The state also limits increases in property tax to 1% annually, keeping property tax growth at a lower rate than inflation."

- "At the state level, Washington State does not levy corporate or personal income tax."

- "Seattle-King County is a global center, where businesses large and small thrive by turning great ideas into world-changing companies. Our advantages include . . . No personal income tax, no tax on interest, dividends or capital gains, and low corporate taxes."

Despite the recent changes Commerce made to the “Choose Washington” website, it was correct the first time highlighting the fact that no income tax is a competitive advantage for employers.

Additional Information

WA Department of Commerce: No state income tax "is great marketing" for Washington