Despite the state budget being balanced, revenues currently projected to increase by more than 7% and a preliminary economic report showing the possibility for a big revenue jump at the March 17 forecast, an income tax on capital gains proposal (SB 5096) is moving in the Senate. SB 5096 currently sits in the Rules Committee and could be pulled to the floor for a vote by the full Senate at any time. This rushed effort to impose a constitutionally suspect income tax has caught the public’s attention. Here is some of the editorial and other news coverage from the past week:

- Don’t be fooled. WA Dems are using the backdoor to slip us an income tax – Tri-City Herald editorial: “State Democrats once again are trying to slip an income tax plan through the backdoor and this time they think they have the votes to do it. What’s even more upsetting is that they have declared Senate Bill 5096 an emergency even though it’s not. But adding an emergency clause to the bill means it would take effect right away, and citizens wouldn’t be allowed to launch a referendum campaign to overturn it if it’s approved. This is a clear abuse of power and taxpayers should be outraged.”

- Capital gains tax is wrong for many reasons – Yakima Herald Republic editorial: “A capital gains tax is by all definitions an income tax, no matter how lawmakers otherwise describe it (the bill calls it an excise tax). As such, its constitutional status in Washington, where court precedent clearly labels income as property and therefore not subject to a graduated income tax, is dubious on the best of days.”

- Legislators must drop hasty, flawed capital-gains tax push – Seattle Times editorial: “This bill’s deficiencies are numerous. There is no clear justification for raising the money, because there are few specifics available for what it will go toward. It is virtually certain to tie the state up in court litigating whether it’s a constitutionally prohibited income tax. And it perpetuates the Legislature’s troubling misuse of emergency clauses to thwart potential voter challenges.”

- Former Washington AG: Proposed capital gains tax is income tax in disguise – KIRO Radio: “An income tax is well-understood. Capital gains are form of income, so every jurisdiction in the country — state, local, and federal — treats capital gains taxes as income taxes because that’s in fact what they are . . . If you ask the IRS they’ll say, ‘Oh, no, capital gains on selling stock? Clearly an income tax.’ Subject to income tax, not an excise tax.”

- A capital gains income tax is not needed and will hurt Washington’s economy – Seattle Times op-ed: “Most Washingtonians don’t know that Gov. Jay Inslee and the state Legislature are quietly betraying the will of the people by creating a state income tax and denying citizens, by labeling it an ‘emergency,’ the opportunity to reject it again. They are doing it right now in Olympia, and a few state senators can make the difference in stopping this misguided policy.”

- Capital gains tax a distraction – Peninsula Daily News op-ed: “This is not a new idea. It has been tried and rejected many times before, and for good reason. It should be rejected again. A capital gains tax would hurt small businesses, open the door to an income tax on all Washingtonians and take away one of Washington’s best competitive advantages.”

- Latest capital gains tax plan is still an income tax – Walla Walla Union Bulletin editorial: “A disingenuous proposal to impose an income tax — cloaked as a financial transaction tax — in Washington state is gaining momentum in the Senate . . . its supporters continue to insist that a capital gains tax is not an income tax. They seem to be trying to fool the public, and perhaps themselves. The U.S. Internal Revenue Service wouldn’t accept that reasoning (or lack of reasoning) from any American whose tax returns were audited. The federal government considers money gained through the sale of a capital asset — such as stocks and bonds — as taxable income. How is the capital gains tax being seriously considered in the state Senate any different? It isn’t.”

- How to raise Washington taxes during COVID-19 pandemic: very cautiously or not at all – Tacoma News Tribune editorial: “No matter how constructed, a capital gains tax is arguably an unconstitutional income tax in disguise and may not survive the inevitable court challenge. We’re also concerned that the bill has an emergency clause that would block a citizen referendum. Why shouldn’t Washington voters, who’ve rejected income tax proposals 10 times previously, have a direct voice in a major course correction in tax policy?”

- Protect Washington’s Innovative Startup Ecosystem – Letter from 120+ Tech CEOs and Founders to lawmakers: “Recognizing the importance of startups to Washington’s economy, we wanted to draw your attention to the harmful impacts of SB 5096 on Washington’s startups, entrepreneurs, broader innovation ecosystem, and competitiveness as a technology hub . . . A capital gains tax would remove a meaningful attraction and retention mechanism and will harm our competitiveness even more.”

- Washington doesn’t need a capital gains tax – Vancouver Business Journal op-ed: “Washington is one of just nine states without a capital gains tax. This helps us attract entrepreneurs and passive investors, who live, work, shop, lead, and join our local communities. This trend should increase, now that people have discovered they can work from home for any employer anywhere in the world. Those people are looking to move away from states with income taxes, including capital gains taxes. Washington can benefit from this migration . . . Capital gains taxes are a tax on the profit (i.e. income) realized from investments or other non-business/non-inventory assets. In short, it is an income tax.”

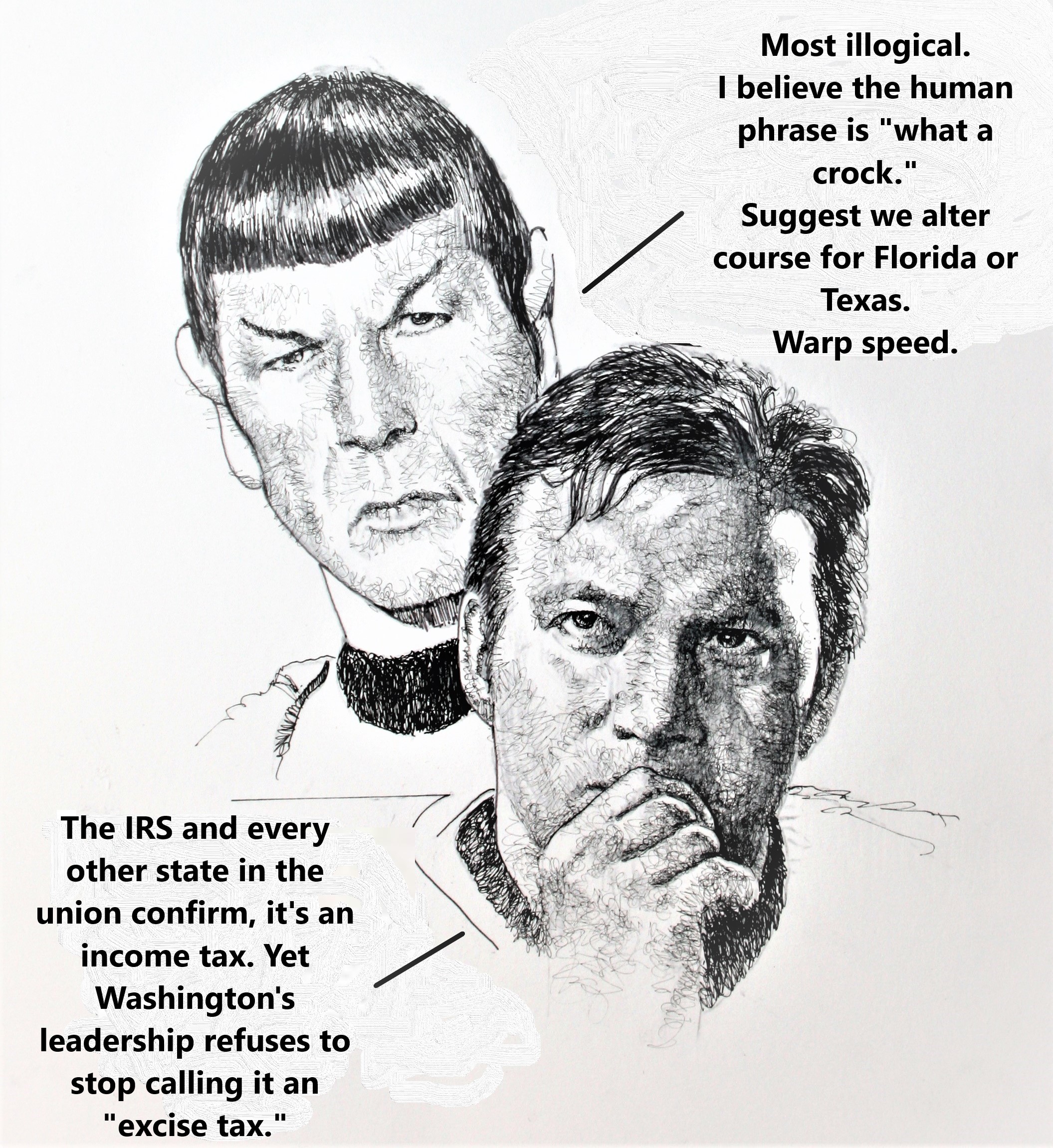

- Taxing capital gains is an income tax - Kitsap Sun op-ed: "What determines the incidence of a tax is what it is applied to. An excise tax applies at point of sale on price or volume. An income tax, as explained by the IRS and every other state revenue department, is imposed on income. This fact is not in dispute anywhere else in the country. A capital gains tax is an income tax, full stop."

Washington lawmakers proposing an "excise tax" on income? I find that highly illogical.

There is no debate anywhere in the galaxy - A capital gains tax is an income tax.

Additional information

WA Capital Gains Income Tax Proposal: What You Need to Know!

A Capital Gains Tax IS an Income Tax: Irrefutable Proof in About Two Minutes (short video)

BAD POLICY: An Income Tax on Capital Gains for Washington (short video)