The American Medical Association (AMA) recently voted to oppose a federal requirement that says states must seek to recover long-term care (LTC) Medicaid costs from the estates of deceased beneficiaries. That’s bad advice from the AMA and implies that states are doing a good job with estate recovery efforts. They’re not.

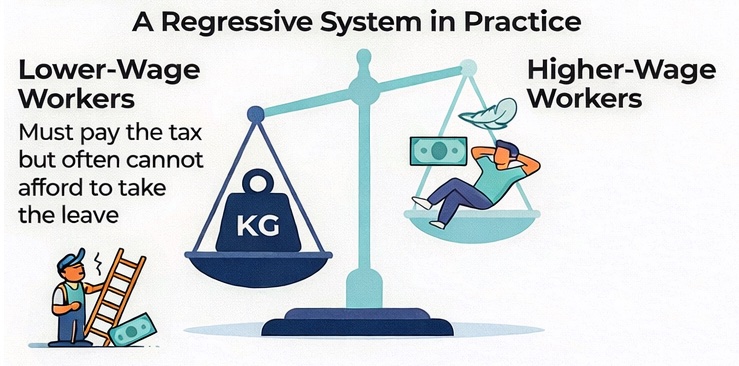

Estate recovery is meant to reimburse taxpayers when a person receives long-term care through Medicaid. And while the taxpayer help is meant for low-income Americans with few assets, not all LTC Medicaid recipients are poor. Loopholes and legal workarounds allow some individuals with substantial home equity or hidden wealth to qualify. The result? Misuse of a generous taxpayer-provided safety net, allowing people with means to pass resources and assets onto their heirs, while letting taxpayers pick up the bill for their long-term care.

An AMA delegate in favor of repealing the estate-recovery rule called the practice "state-sanctioned exploitation.” But in reality, estate recovery is a modest and reasonable check on whether a benefit designed for the needy is being used by the needy. The AMA should recommend that states employ stronger recovery efforts, coupling them with stricter LTC eligibility criteria in the first place. That could protect a needed safety net and save state and federal taxpayers a lot of money. A 2025 Kaiser Family Foundation fact sheet shows that long-term care made up 20 percent of the total federal-state Medicaid budget in Washington state, which is more than $29 billion each year.

Federal law has required estate recovery since 1993. It targets Medicaid-paid nursing home care and related services for individuals age 55 and older. The law also allows exemptions for hardship, surviving spouses and disabled or minor children. These protections ensure that estate recovery does not harm those living who shared a home with the person who received LTC services from taxpayers. (The state can pursue recovery after the exempted person — such as a surviving spouse or dependent — has passed away, unless a permanent hardship waiver applies and cancels the claim entirely.)

Implementation varies wildly, and most states recover close to nothing. A 2005 study by the U.S. Department of Health and Human Services shows that most states recovered less than 1% of their long-term care Medicaid spending. In that report, Washington state looked better than many states, making it into the top 10 with just 1.8% of nursing home expenditures recovered. Sadly, those were the good old days. This week, the Washington State Department of Social and Health Services told me that in fiscal year 2025, the state recovered just 0.34% of more than $5 billion spent in Washington state for Medicaid long-term-care services. That’s 0.34% returned to a system that spends billions.

Despite the modest return, estate recovery serves an important purpose: It helps preserve limited Medicaid resources for those who truly need them, and it could offer some incentive not to take those resources.

It would help if stricter eligibility requirements in our state and others made it harder for people to shield their assets, pass down their homes and draw unlimited public benefits for long-term care. In our graying population, unless we have tighter eligibility and pursue more estate recovery, the safety net will fray. Getting more private dollars and decision-making into the LTC system could also improve the quality of care available.

Estate recovery is not a call for cruelty. It is a call for truth-in-programming. Medicaid should be available to those in need. When the government pays for years of costly care for someone and that person leaves behind a sizable estate, it’s fair for taxpayers to ask for repayment.

Stephen Moses, a longtime advocate of estate recovery and president of the Center for Long-Term Care Reform, has argued for years that strong recovery policies promote personal responsibility and discourage Medicaid gaming. He’s right. Pretending that all estate recovery is punitive or unjust ignores the fact that the real injustice lies in allowing people of means to use a safety net they do not need.

The AMA's vote of opposition sends the wrong message, and lawmakers just missed a cost-saving beat in their big bill. Medicaid is not an inheritance-preservation program. It is a last-resort lifeline. Federal and state lawmakers should not be shamed for treating it that way.