The federal Internal Revenue Service (IRS) and every state revenue department across the country unequivocally say a capital gains tax is an income tax. Now thanks to public records we can see what Washington’s Department of Revenue (DOR) has been saying about capital gains income tax proposals. For example, DOR warned (any emphasis was used by DOR):

- “The federal capital gains tax is characterized as an income tax. One potential challenge to a capital gains tax proposal is that opponents may characterize the Washington capital gains tax as an income tax and argue that it is not allowed under the Washington constitution”;

- "The IRS considers taxes on investment income (dividends, a tax on net gains from the sale or exchange of a capital asset, or tax on the net taxable income of an unincorporated business) an income tax";

- "Today states tax capital gains as income and a deduction may be taken on the taxpayer’s federal income tax return for state taxes paid on capital gains";

- “significant costs to administer and enforce a capital gains tax upon tens of thousands of taxpayers that would need to be registered”;

- "Because Washington does not have an income tax, most individuals are not registered to pay taxes to the Department, requiring substantial work to register taxpayers";

- "Some individuals may move their domicile out-of-state to avoid paying capital gains tax on investments in Washington State";

- “susceptible to constitutional challenge as an income tax prohibited by the Washington state constitution”;

- “uncertain revenues due to potential legal challenges as well as revenue fluctuation due to volatility in the financial and real estate markets”; and

- “potential confusion stemming from Washington’s proposed ‘excise’ tax on capital gains when the IRS characterizes the federal capital gains tax as an income tax.”

On September 13 last year, I sent DOR an email asking this:

“I saw your presentation handout for today’s Finance hearing on the opportunity zones. You reference that Washington could impose an ‘excise tax’ on capital gains with various strategies for the opportunity zones.

Is DOR aware of any state in the country with an ‘excise tax’ on capital gains?

The IRS issued a letter last year saying taxes on capital gains are not ‘excise tax’ but income taxes.

I contacted every state revenue agency in the country and each state said the same thing.

Thank you for the assistance.”

After no response from DOR, I followed up on September 19 with this email:

“Following up on this email from last week. Hoping you can point me to any other state or federal authority that DOR is basing its comments that a tax on capital gains is an ‘excise tax.’

After researching this topic for the past several years, I haven’t been able to find any tax authority in the country or world that doesn’t classify a capital gains tax as an income tax.”

Still with no response, I submitted this public records request on October 3 asking for:

“A copy of the following information and records: All Department of Revenue records (emails, memos, etc.) between the dates of January 1, 2010 and October 2, 2019, discussing what type of tax a capital gains tax is - whether it is an excise tax or income tax.”

Among the public records I received was this internal September 23 DOR email:

"FYI. I have not responded to Jason."

Last Friday I received the final installation of my records request. Here are screen shots of some of the interesting records I received (full copies available on request):

(2014 record)

(2015 record)

(2016 record)

(2016 record)

(2015 record)

(2014 record)

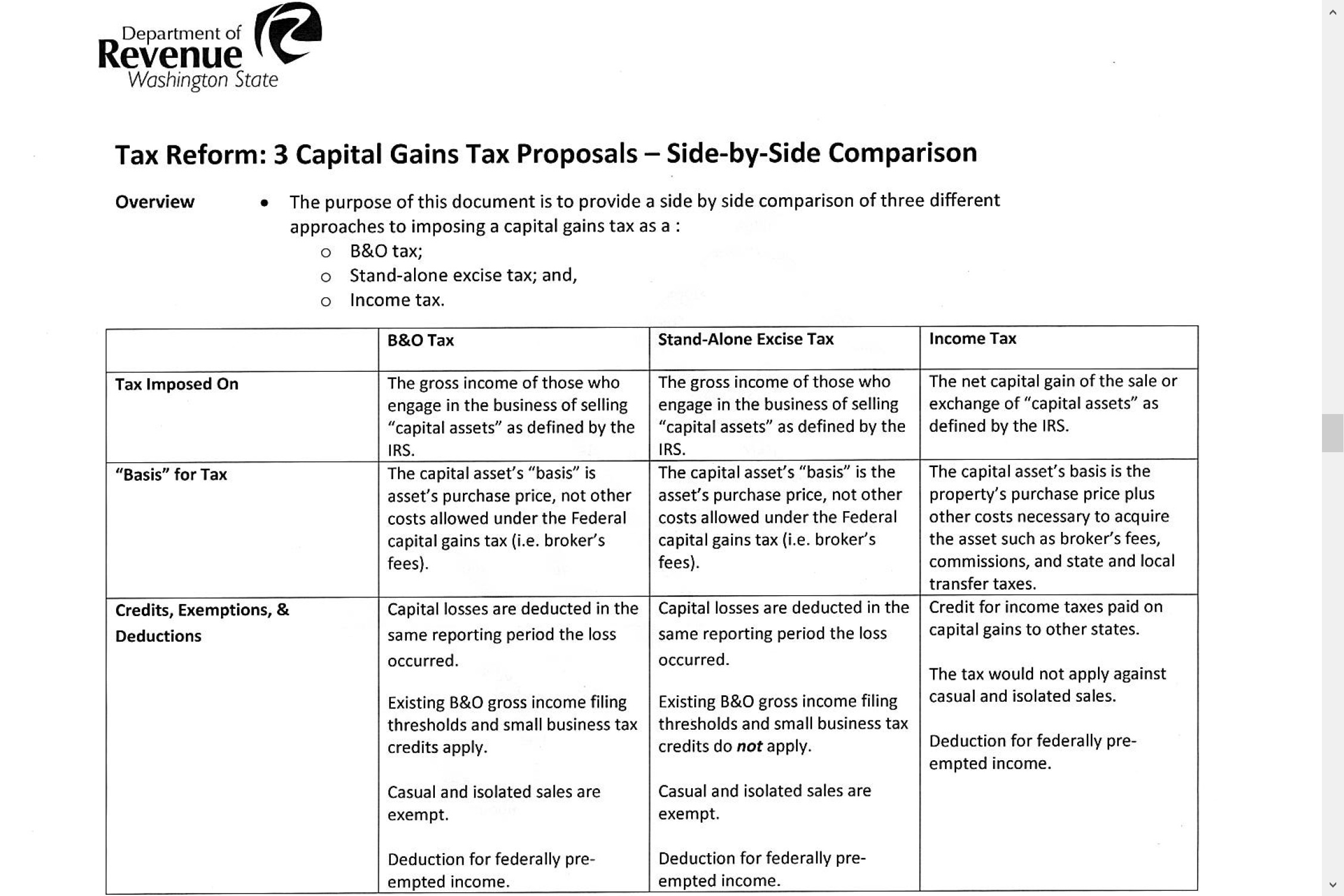

The income tax column above is noteworthy. The Washington proposals would tax the "net long-term capital gain" and provides a credit against "any legally imposed income or excise tax paid by the taxpayer to another taxing jurisdiction on capital gains"

In fact, the 2019 bills describe the state capital gain tax reporting requirement as:

“In addition to the Washington return required to be filed under subsection (1) of this section, taxpayers owing tax under this chapter must file with the department on or before the date the federal return is required to be filed a copy of the federal income tax return along with all schedules and supporting documentation.”

Does any of this sound like an “excise tax” to you?

Every tax authority in the country has made clear a capital gains tax in an income tax. The only ones who appear to be confused by this fact are those trying to circumvent Washington’s constitution and voters’ consistent rejection of income taxes.

Additional Information

IRS: Capital gains tax "is an income tax"

State Revenue Departments Describe Capital Gains Income Taxes

WA Department of Commerce: No state income tax "is great marketing" for Washington

A Capital Gains Tax IS an Income Tax: Irrefutable Proof in About Two Minutes (short video)

Bad policy: An Income Tax on Capital Gains for Washington (short video)

State tax officials across country agree – capital gains income taxes are extremely volatile and unpredictable

Washington Capital Gains Proposal Not Helped by Analogy to Real Estate Excise Tax

Nonpartisan legislative staff summarizes Governor’s capital gains tax proposal