There never should have been any debate about whether a capital gains tax is an income tax. As we have previously highlighted, every state revenue department considers a capital gains tax to be an income tax. Today we have a direct response from the IRS that unequivocally should put this deceitful tax game to bed. According to the IRS, a capital gains tax "is an income tax."

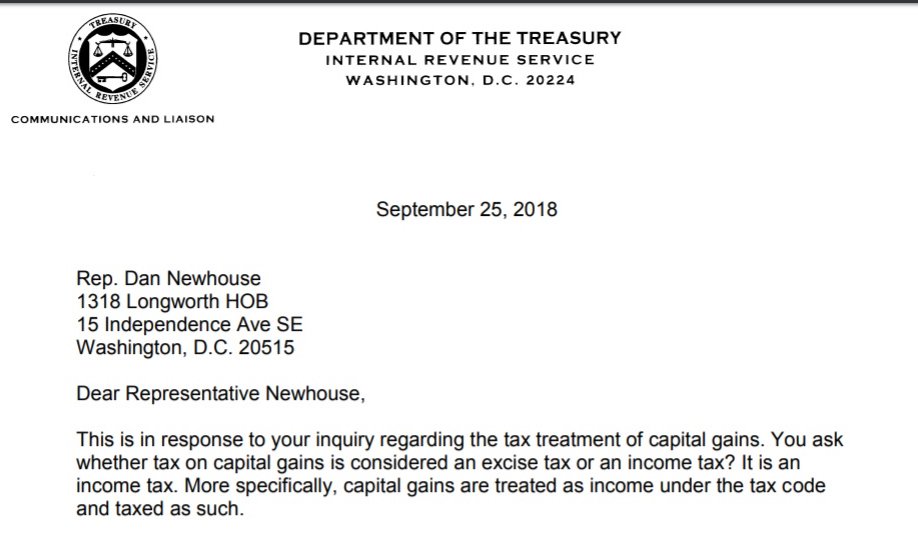

With discussion yet again that a capital gains tax would be proposed next session, I asked my Congressman, Rep. Newhouse, if he could seek clarification from the IRS on this question. Today the IRS responded saying:

"Dear Representative Newhouse,

This is in response to your inquiry regarding the tax treatment of capital gains. You ask whether tax on capital gains is considered an excise tax or an income tax? It is an income tax. More specifically, capital gains are treated as income under the tax code and taxed as such."

Can we finally stop the "excise tax" games now? A capital gains tax is an income tax. Full stop.

The state Department of Commerce has repeatedly said the lack of an income tax is a "competitive advantage" and "is great marketing" for Washington. If other state officials disagree and still wish to pursue an income tax exceeding a flat 1%, they will need to propose a constitutional amendment. Playing word games and calling an income tax an "excise tax" won't cut it.

No state calls a capital gains tax an "excise tax" and now we have the IRS point blank saying it is an income tax.

Additional Information

IRS letter to Rep. Newhouse on capital gains taxes

WA Department of Commerce: No state income tax "is great marketing" for Washington

Washington officials say no state income tax is competitive advantage

State Revenue Departments Describe Capital Gains Income Taxes

Lawmakers again propose capital gains income tax

New poll shows strong opposition to income tax in any form