While the majority party insists state government is facing revenue shortfalls, the data show we have simply built a bureaucracy designed to grow faster than taxpayers' ability to pay for it. House Republicans’ have released a validation of that fiscal reality with their new Affordability First budget framework.

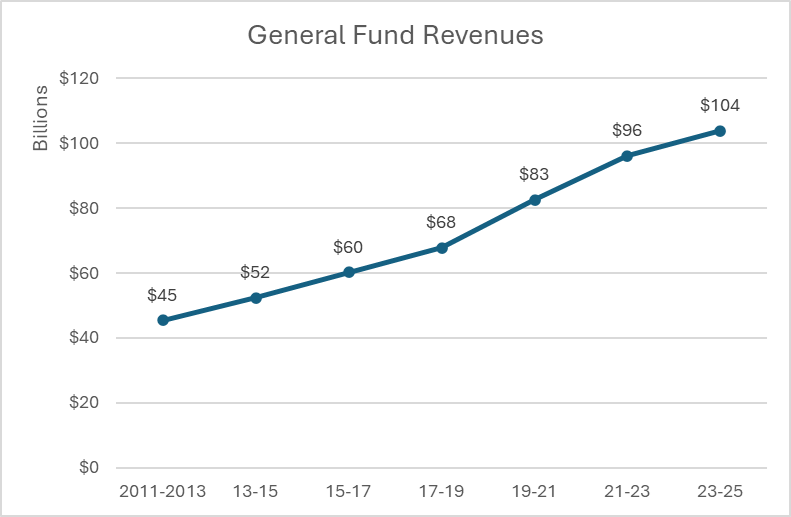

Some prominent democrats claim our budgetary problems are due to a "revenue crisis." They say our tax system is broken, or "the wealthy aren't paying their fair share." They’re also saying the state needs more resources because “state revenue as a percentage of total personal income has declined.” This chart displays General Fund revenues beginning in 2011. Do these figures indicate shortages in the state's tax collections?

fiscal.wa.gov/revenue

Democrats will also tell you Washington is a "low tax state.” But look at the facts. We have one of the highest combined sales tax rates in the nation. The Gross Receipts Tax (B&O) is an anti-business, destructive tax because it taxes revenue, not profit. That’s one reason Washington state has one of the highest business failure rates in the nation.

Businesses alone pay 49.7% of all state and local taxes, ranking Washington as the 10th highest business tax burden in the nation per employee. Just 3,755 individuals (0.06% of WA’s population) paid nearly $900 million in one year through the capital gains tax. Our budget is relying upon a tiny subset of individuals to fund large operations within state government.

Legislators tried to fix our “regressive tax system” ranking with the Capital Gains Tax and the Working Families Tax Credit. This barely moved the needle because you cannot fix a regressive system by adding more taxes. You fix it by also lowering the regressive taxes (sales and B&O), which the legislature refuses to do.

Our current deficits exist because of historic spending on new programs and government employee compensation, not a lack of revenue. The problem is the post-pandemic "return to normal" never happened.

Emergency spending levels became the new floor, and the budget just kept climbing from there. Since 2019, the state's biennial operating budget has ballooned 66%, from around $100 billion to $166 billion. The single largest driver of maintenance level spending, outside of K-12 education, is the state workforce.

Affordability First: A Budget for the Working Class, Washington House Republicans

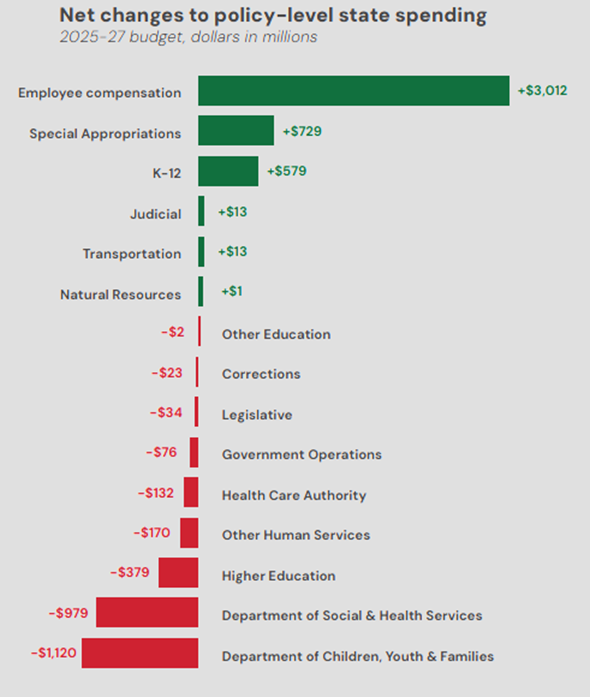

For the 2025-27 biennium alone, employees got a 3% raise effective July 2025 and another 2% in July 2026. This follows 4% and 3% increases in the previous biennium. Add in the new $18 minimum wage floor and other regulations for state employee pay, and taxpayers are looking at roughly $3 billion in new costs. That's now baked into the permanent baseline for all future budgets.

Then there's the health care split. Taxpayers now pay 85% of premium costs while employees pay 15%. The Republicans’ new Affordability First proposal aims for adjustment to align with private sector reality. Maintaining the current ratio required $300 million in new funding.

Labor costs are just part of the story. The legislature has also created entirely new categories of government obligations.

Take the Apple Health Expansion launched in July 2024. This extends Medicaid-like coverage to undocumented immigrants. The initial enrollment cap was 13,000 people. Nearly 12,000 enrolled in the first three days. By August 2024, over 17,000 applicants were denied or wait-listed because the program hit capacity so quickly.

The Health Care Authority has requested doubling the program size to meet demand, adding thousands of slots. Current maintenance costs run about $142 million per biennium. Full expansion would drive costs toward $300 million or more. Once lawmakers establish a "program of need", political pressure makes it nearly impossible to cap enrollment. What starts as a fixed cost becomes an open-ended liability. The Affordability First proposal would eliminate the Apple Health Expansion program.

There are other contributors that fly under the radar but still cost hundreds of millions. The Working Families Tax Credit requires significant administrative overhead to verify eligibility and process payments. The Housing Trust Fund has seen record appropriations, over $400 million, often treated as one-time infusions that change into ongoing subsidies for nonprofits.

There are dozens of other, smaller public programs that are telling the same story. The $4.3 billion deficit in front of us is the mathematical result of the legislature's refusal to say no. Revenue growth projections of 3.5%-4.5% can't keep pace with spending growth built to run at double or triple that rate.

Another issue is layering volatile new revenue sources on top of fixed, rapidly compounding labor and entitlement costs.

For example, the capital gains tax generates somewhere between $500 million and $900 million per year and is earmarked for K-12 costs. That revenue figure swings wildly based on stock market performance and the willingness of the tax-paying populace to stay in WA. When those revenues drop, the programs still need funding, forcing money to come from elsewhere in the budget.

Olympia has built itself a structural deficit. The Affordability First framework offers spending limits through a statutory cap on budget growth and no new taxes.

Revenue is already growing at historical levels. Spending must slow down. Rapid acceleration of government compensation must slow down. Low priority programs must be cut. Washington will thrive once government gets back to focusing on its core priorities and stops spending money it doesn’t have.