For years, warnings about Washington’s unsustainable spending growth went unheeded. You cannot triple the size of government in a decade without eventually hitting a wall. That reality is now coming into a sharp focus. As legislative assembly days kicked off this week, we got our first look at the latest revenue projection and budget outlook. Coming as no surprise, the latest numbers out of Olympia confirm those fears, telling a story that will alarm every Washington taxpayer.

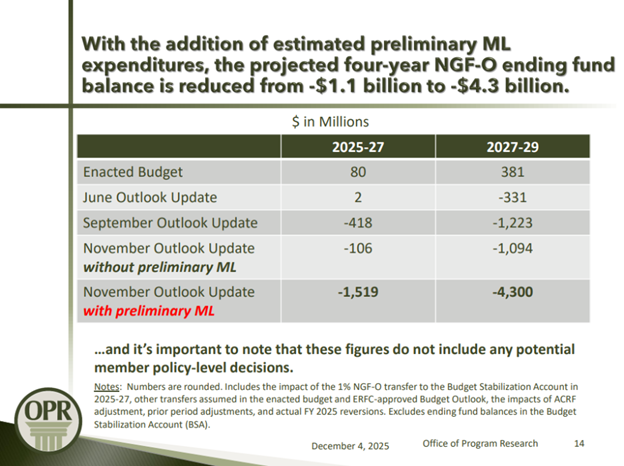

A presentation from The Office of Program Research (OPR) shows that Washington faces a projected $4.3 billion deficit for the 2027-29 biennium once accounting for "preliminary Maintenance Level" costs—the expenses required to continue current service levels mandated by state law. Even for the current 2025-27 cycle, despite yesterday’s revenue forecast increase of $105 million, the outlook has expanded to a $1.5 billion deficit. Just earlier this year, the enacted budget assumed a surplus.

As noted in the forecast, “these figures don't include any new policy decisions.” What that really means is these figures don’t include any new tax increases that the legislature will be looking to pass in 2026 to fill this gap. This massive hole exists simply to keep the current system running.

Did revenue collapse? No. The state collects more money than ever. The problem is spending discipline, or the complete lack of it.

Media coverage typically focuses on revenue fluctuations, but Washington’s main budgetary woes sit on the spending side of the ledger. In FY 2012, total budgeted expenditures were roughly $30 billion. By FY 2019, that number reached $50 billion. In FY 2025, preliminary actual spending is nearly $95 billion. State spending has more than tripled in just over a decade.

Inflation and population growth explain some of that increase, but nowhere near all of it. In fact, since 2013, real state spending—adjusted for inflation and population growth—has surged by more than 50%. Washington has rapidly expanded what government does and how much it spends doing it, with very little in the way of visible improvements.

As the next legislative session approaches, voices in Olympia will look at these multi-billion dollar shortfalls and claim Washington has a "revenue problem." They'll propose new taxes, higher fees, and more burdens on Washington families and businesses to fill the gap. The data tells a different story. Washington doesn't have a revenue problem. It has a spending problem. The legislature must look at that vertical spending trajectory and recognize that bending the curve downward is the only responsible solution.