State government is entitled to a fixed portion of what you earn, even if it is wasted or isn’t needed to fund important programs. That is the crux of the argument being made to justify yet more tax increases, just a year after the Legislature adopted the largest tax increase in history.

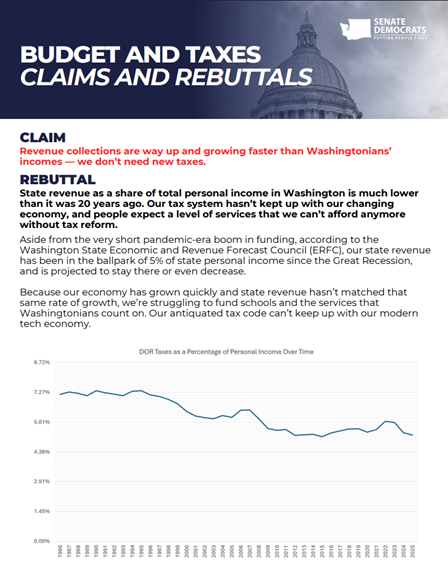

Leadership of Washington State Senate Democrats have circulated a communications document arguing Washington's tax code is "broken." They assert the state is being "defunded" because state revenue as a percentage of “total personal income” has declined over 20 years, from a historical 6-7% to approximately 5%. The document attempts to push back against the mounting opposition from Washingtonians who want relief from the state's relentless tax increases.

The document’s main argument is that share of “total personal income” is the "best way to track the overall size of the state's economy" and implies that government spending should track perfectly with it. This flawed metric relies on the premise that government is entitled to a fixed equity stake in your economic success.

When the private sector grows faster than government, causing that "share of income" line to dip, that is not a crisis. That is what success looks like. It means the productive sector of the economy is outpacing the redistributive sector.

Those who support a “more taxes” approach to budgeting will point to Washington's population growth, arguing we need a greater share of income to serve more people. This ignores economies of scale. When an organization grows, it becomes more efficient, not less. A gym with 100 members has high costs per member. When it reaches 1,000 members and the fixed costs (building, equipment, utilities) spread across more people, per-member costs decrease.

As fixed costs of government are spread across a larger tax base, this should drive per-capita costs down. When lawmakers argue that a larger or wealthier population requires a larger percentage of our income, they admit government suffers from diseconomies of scale—that the bureaucracy becomes less efficient as it grows. Yet this is exactly the logic of the “total personal income” argument. They seem to believe the cost of paving a road, funding a court system, or running a DMV should automatically rise simply because the citizens accessing those public services are wealthier.

Our tax system already captures revenue from population growth. More people mean more property taxes are paid, more sales taxes are collected, and more business activity generates Business & Occupation (B&O) tax. This system is designed to capture revenue from new residents. Arguing that the state needs to raise tax rates simply because more people live here means taxing the same growth twice.

This fixation on the "share" of income that government feels entitled to overlooks a central question: Would government rather have 7% of a stagnating economy, or 5% of a thriving one? In which scenario does the state actually end up with more money to “pay for services”? Senate Democrats are fighting for a larger slice of a pie they are actively shrinking.

Imagine a situation where every Washington resident had housing, plenty to eat, uncongested roads and faced no crime. By the logic of Senate Democrats, the state should still take the same percentage of income even if they didn’t need to provide services.

The document asserts we can balance the state budget without cuts by asking the "wealthy to step up." This is semantic manipulation that deliberately misses the fundamental problem: the state spends too much. Higher taxes are just the tool being used to fund that spending.

Every dollar government spends must eventually be extracted from the private economy, whether through direct taxation, borrowing (future taxation), or inflation (hidden taxation). When politicians celebrate avoiding an "all-cuts austerity budget," they celebrate preserving a burden on the private sector that continues growing faster than the economy supporting it. They admit revenue has increased while claiming it is not enough because they feel entitled to spending a larger percentage of your income.

This document also dismisses capital flight as a myth, arguing that "businesses operate where people want to be." Higher taxes will not drive them out because they need our "great schools" and infrastructure. This assumes you can drastically change one variable (taxes) while all other variables (business location, investment decisions) remain constant and have no impact. The labor market doesn't operate that way, as the situation in Seattle has clearly shown.

Later in the document, Senate Democrats claim lawmakers want to ensure corporations "pay what they owe," but this relies on a deliberate misunderstanding of the Business & Occupation (B&O) tax. B&O is a gross receipts tax, not an income tax. It charges a business for every dollar of sales, regardless of whether that business made a profit. Businesses face higher rate tiers and surcharges simply for growing revenue. This doesn't target "excess wealth" or profit; it punishes scale. A high-volume, low-margin company can actually lose money each year and still be hit with a massive tax bill. The document calls this "fairness," but a tax code that drives businesses into insolvency regardless of their profitability isn't fair—it's predatory.

The “total personal income” chart shown above isn't evidence of a revenue problem. It's evidence of a private sector that has thrived despite government. The argument that the state must reclaim its historical "share" of your income reveals that some progressive politicians view your prosperity primarily as a taxable event. The only question is how much of your success can be extracted before you notice or leave.