Download a PDF of this Legislative Memo with citations here.

Key Findings

- Lawmakers will have around $37.1 billion to spend for the 2015-17 budget. This is a $3 billion increase in revenue from the current budget. Governor Inslee’s budget proposal, however, would spend just under $39 billion.

- The Governor proposes several tax increases including the creation of a seven percent capital gains tax in Washington to collect an estimated $798 million.

- The volatile experience with capital gains tax revenue in other states shows that a capital gains tax is an unreliable source of revenue for funding government services.

- Despite its volatility, the Governor dedicates all the revenue to education spending and prevents the funds from going into state’s constitutionally protected reserve account created by voters.

- State Treasurer Jim McIntire has also raised concerns about the capital gains tax proposal, due to the volatility experienced by other states with this type of tax.

- Due to the proposed rate of seven percent, if enacted the capital gains tax law would certainly face legal challenges for being an unconstitutional tax on income.

- It is noteworthy that none of the states without an income tax have a capital gains tax. This is likely due to the fact capital gains are considered to be income.

- Up until a few weeks ago, the state Department of Commerce highlighted the state’s lack of a capital gains tax as being a “competitive advantage” for Washington.

Introduction

On February 20, 2015, state lawmakers received the most recent state revenue forecast to help them write the Washington’s 2015-17 budget. Though they will receive a slight increase in forecasted revenue, not much has changed from the last revenue forecast. State revenue is projected to increase 8.7 percent over 2013-15, giving lawmakers about $3 billion in extra revenue compared to the last budget.

Lawmakers will have around $37.1 billion to spend in 2015-17. Governor Inslee’s budget proposal, however, would spend just under $39 billion. To make up the difference, the governor wants to enact several small tax increases, spend $537.5 million from the state’s constitutionally-protected emergency reserve, impose a carbon emissions cap and trade system to collect approximately $379 million more for the General Fund and also create a 7 percent capital gains tax in Washington to collect an estimated $798 million.

These tax proposals come despite a campaign promise by the governor not to raise taxes. If enacted, Washington would be the only state without a state income tax to impose a tax on capital gains.

This paper will focus on concerns with the governor’s plan (introduced as House Bill 1484) to impose a highly volatile capital gains tax to pay for his proposed education spending increases.

Volatility of capital gains taxes

When releasing his tax-increase budget plan Governor Inslee said, “We have a very solid, fiscally sound, secure and stable way of financing everything I’ve talked about today.”

The volatile history of capital gains taxes in other states, however, shows this form of taxation does not provide a “very solid, fiscally sound, secure and stable way of financing” ongoing government services. Here are comments of notes from across the country about capital gains taxes:

California’s Legislative Budget Office (LAO) says: “Probably the single most direct way to limit the state’s exposure to the kind of extreme revenue volatility experienced in the past decade would be to reduce its dependence on the source of income that produced the greatest portion of this revenue volatility—namely, capital gains and perhaps stock options.”

More from the LAO: “California’s tax revenues have numerous volatile elements, but among the more significant sources of revenue volatility are the state’s tax levies on net capital gains through the personal income tax. Every budget outlook must make assumptions about Californians’ capital gains realizations, either explicitly or implicitly.”

Standard & Poor’s said in a national report, “State tax revenue trends have also become more volatile as progressive tax states have come to rely more heavily on capital gains from top earners.”

Standard and Poor’s also recently reviewed Governor Inslee’s proposal: “In particular, the governor’s proposal to impose an excise tax on capital gains could run into political opposition; therefore, it represents a source of risk to the budget since it accounts for over half of the revenue proposals.

Although they would only weigh in on the matter indirectly through their elected legislators, voters in Washington have previously rejected initiatives to levy an income tax. This included a proposal to target the state’s highest income earners, as the capital gains tax proposal would do . . . while the governor’s proposal to tax certain capital gains income would likely offset some of the revenue slide (relative to personal income), it could cause the state’s revenues to be more volatile. We have observed that capital gains-related tax revenues are among the most cyclical and difficult to forecast revenues in numerous other states.”

The Pew Charitable Trusts recently said, “The problem for states trying to predict revenues is that stock market fluctuations and other cyclical events have a larger impact on incomes at the top, causing revenues from income taxes and capital gains taxes to vary widely from year to year . . . The report said the growth in forecasting errors is mostly attributable to tax revenue volatility, which is driven by increased reliance on capital gains income taxes, and on corporate income taxes, personal income taxes and sales taxes, besides volatility in corporate income taxes. Lesser errors are attributable to fluctuations in sales taxes . . .

‘Certainly when there are capital gains there is roller coaster revenue coming in when people sell (stocks) and pay the capital gains tax. If you budget that way for the next year and it doesn’t happen, you have a deficit,’ Connecticut Democratic state Rep. Patricia Widlitz said.”

The state Department of Revenue (DOR) analyzed an earlier capital gains tax bill (House Bill 2563 in 2012), and found:

“Capital gains are extremely volatile from year to year. Revenue from this proposal will depend entirely on fluctuations in the financial markets and can be expected to vary greatly from the amounts presented here.”

DOR analysts do not include this warning in the fiscal note for this year’s House Bill 1484, explaining that the volatility of a capital gains tax is already well understood:

“When staff prepare the fiscal notes, they may or may not look at prior years’ notes as their starting point. In this case, staff said the volatility issue is understood and discussed by folks on the hill.”

Volatility of capital gains earnings in Washington

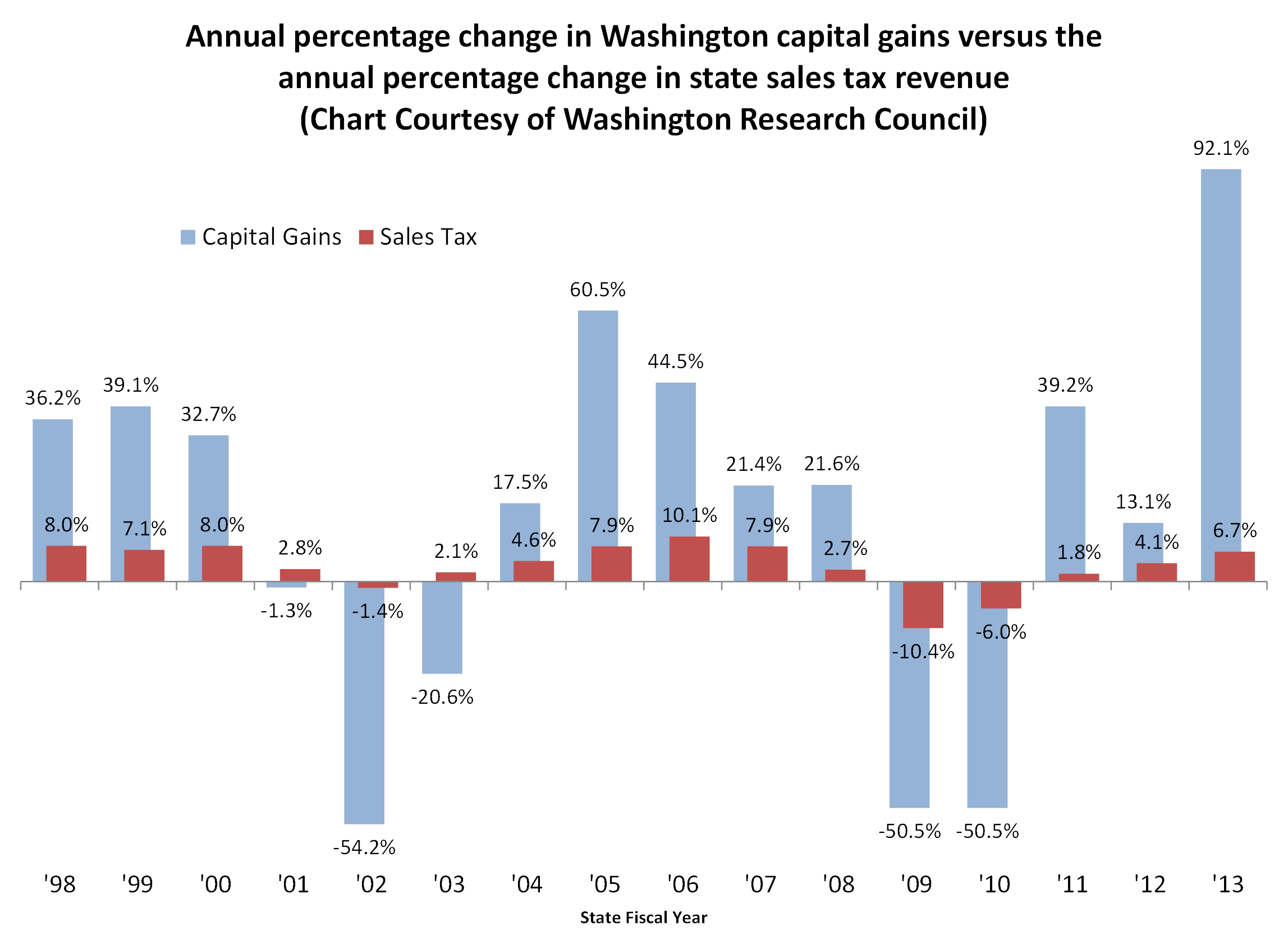

Also consider the recent history of capital gains volatility in Washington. According to a recent study by the Washington Research Council:

“In percentage terms, the swings in capital gains are much bigger than the swings in state sales tax revenue. Moreover, the two series are highly correlated: in each of the three instances where sales tax revenues were lower than in the preceding year, capital gains decreased by more than 50 percent.”

California’s budget has been particularly hard hit by the volatility of the state’s capital gains taxes. So much so that in November 2014, voters there approved a constitutional amendment to require the state to put a specific percentage of its capital gains tax revenue into a protected savings account so it could not be spent and exacerbate future budget shortfalls. Explaining the purpose of the voter-approved constitutional amendment the LAO said:

“This constitutional amendment separates state spending from the rollercoaster of revenue volatility. This measure takes capital gains revenues that make up more than 8 percent of the General Fund - the average for the last 10 years - off the table rather than being used for unsustainable permanent tax cuts or ongoing programs.

The spiking revenues (along with 1.5 percent of overall General Fund revenues) will be used for debt payments and deposited into the BSA [protected savings account], to be withdrawn during economic downturns to avoid program cuts and middle class tax increases.”

California’s volatile experience with its capital gains tax revenue and the voters’ effort to prevent the legislature from spending it too fast shows that a state capital gains tax is an unreliable source of revenue for funding ongoing government services.

Governor’s volatile capital gains taxes dedicated to education spending

According to Section 113 of HB 1484 (governor’s proposal), all of the revenue raised from a capital gains tax “must be deposited in the education legacy trust account created.” This would serve two purposes. First, the governor would dedicate the new money to education spending and second, by putting the money into this account and not the general fund, the governor would avoid triggering the constitutional requirement passed by voters in 2011, “to ensure extraordinary and unsustainable [revenue] growth is saved, rather than spent.”

This second fact was illustrated by the conversation at the January 15, 2015 meeting of the state Budget Outlook Meeting. As noted by the handouts for that meeting:

“Extraordinary Revenue. The Office of Financial Management submitted a correction to the budget the Governor submitted in December. Without correction, the calculation of extraordinary revenue growth under current law would result in additional revenues being transferred to the Budget Stabilization Account, which was not the intent of the Governor’s proposal. The correction dedicates new law revenues proposed in the budget to the Education Legacy Trust Account, rather than the general fund.”

This means that the governor has structured his capital gains tax proposal to avoid money from this volatile tax from going to the constitutionally-protected reserve account, while also dedicating it to pay for current education spending.

Despite this maneuvering, the state’s Office of Financial Management (OFM) acknowledges that capital gains taxes are volatile and that “careful budgeting” will be needed. According to OFM:

“After exemptions to remove any capital gains tax on retirement accounts, homes, farms and forestry, the proposal will raise an estimated $798 million in fiscal year 2017. This estimate is an average based on 10 years of data; the actual amount collected from this tax would be expected to vary from year to year depending on fluctuations in the financial markets.

The state can manage these fluctuations through careful budgeting. For example, Governor Inslee’s budget projects the state would have about $2 billion in total reserves by the end of the 2017–19 biennium.”

According to the state’s most recent four-year budget outlook, that $2 billion would include $619 million in unrestricted reserves (or 1.5 percent of estimated spending) and $1.4 billion in the constitutionally protected reserves. This means under the best case scenario, only $619 million of the estimated $2 billion would be available to weather the volatility of the capital gains taxes without relying on the funds in the constitutional reserve account.

State Treasurer McIntire has also expressed concerns about the governor’s capital gains tax proposal saying, “. . . capital gains is probably the most volatile revenue source for most state governments. That is a concern.”

Constitutional considerations

Governor Inslee calls his 7 percent capital gains tax proposal an “excise tax” for the “privilege of selling or exchanging long-term capital assets,” but it may not be constitutional in Washington as an income tax. None of the states that do not have an income tax have a capital gains tax. This is likely due to the fact capital gains are considered income.

Under the state constitution, property cannot be taxed at a rate greater than 1 percent and the taxes must be uniform. The state supreme court has repeatedly ruled that “income” is property and that taxes on income must conform to the 1 percent limit.

The fiscal note for House Bill 1484 assumes that litigation against the proposal will occur. According to the fiscal note:

“We assume that because the capital gains tax is a new tax actions challenging its constitutionality will be filed in Superior Court . . . We assume up to five Superior Court actions will be filed challenging the constitutionality of the capital gains tax and that such court challenges will be filed after the effective date of the capital gains tax, which is January 1, 2016.”

Although the governor hopes to prevail against these legal challenges by describing his capital gains tax as an “excise tax,” it is arguably an income tax. As described by former Supreme Court Justice Phil Talmadge in his legal analysis of 2010’s Income Tax Initiative 1098 (legal citations omitted):

“Washington law is unambiguous. Income is property. Beginning in Aberdeen Savings and Loan Association v. Chase, and continuing through a series of cases, the Washington Supreme Court has held that income is property. As such, this tax is subject to the provisions of the so-called uniformity clause, article 7, section 1 of the Washington Constitution, which provides that all taxes ‘shall be uniform upon the same class of property within the territorial limits of the authority levying the tax...’

“Moreover, article 7, section 2 of the Washington Constitution establishes the upper limit upon ad valorem property taxes. That constitutional restriction essentially limits any property tax to no more than one percent of the value of the property.”

On the issue of the legislature trying to call an income tax an “excise tax” to pass constitutional muster, Justice Talmadge highlighted the decision in Jensen v. Henneford:

“The Legislature attempted to describe the income tax as an excise tax on the ‘privilege of receiving income’ in the State of Washington. The Supreme Court was unmoved. The Jensen court stated that the 1935 Legislature’s effort to rename the tax did not make it an excise tax . . . Subsequently, in Power, Inc v. Huntley, the Legislature enacted what it described as a corporate excise tax, which was actually a graduated new income tax on corporations. Again, the Supreme Court indicated that legislative labels for a tax are not controlling.”

Governor Inslee describes his proposal as an “excise tax” for the “privilege of selling or exchanging long-term capital assets” and not an income tax. Litigation is certain, however, if it is enacted. It is likely the fact that no other state without an income tax has a capital gains tax will be used to justify the position of those who believe a capital gains tax is a tax on income.

State Department of Commerce called lack of capital gains tax “competitive advantage”

To help market the State of Washington to potential businesses, the state’s Department of Commerce runs a website called “Choose Washington.” Under the tab “Why Washington” you can select “Our Strengths.” Under that tab you will find a page called “Pro-Business.”

Up until at least February 8, 2015, that “Pro-Business” page read (emphasis added)

“We offer businesses some competitive advantages found in few other states. These include no taxes on capital gains or personal or corporate income. We also offer industry-specific tax breaks to spur innovation and growth whenever possible.”

That highlighted text advertising no state capital gains tax has since been removed from the “Choose Washington” page. When asked why this decision was made the Department of Commerce said:

“Currently there are multiple revenue proposals and tax preferences in play in the Legislature, including capital gains and R&D incentives, for example. You see a normal refresh of online marketing content to reflect that. We think it would be disingenuous not to adjust our marketing messages about tax policy and preferences accordingly.”

Based on archived versions of the “Pro-Business” page, the reference to no capital gains taxes as being a “competitive advantage” for businesses in Washington had been on that page from at least 2012 until February 8, 2015.

Conclusion

Governor Inslee described his tax plans to pay for his proposed 15 percent increase in spending (exceeding the projected $3 billion in revenue growth the state is already receiving) as “fiscally sound, secure and stable.” Experience shows, however, that capital gains tax revenue is highly volatile.

The volatility of capital gains taxes in California has wreaked havoc on that state’s budget. This is why voters there recently approved a constitutional amendment to require the state put a specific percentage of its capital gains tax revenue into protected savings, so it couldn’t be spent and make future budget shortfalls worse.

Despite this move away from basing budgets on volatile capital gains taxes, Governor Inslee takes the opposite approach, by dedicating all the revenue to education spending and preventing the funds from going into state’s constitutionally protected reserve account created by voters. State Treasurer McIntire also has also raised concerns about the governor’s capital gains tax proposal, due to the volatility experienced by other states with this type of tax.

Because it proposes a rate of 7 percent, if enacted the capital gains tax law would certainly face legal challenges for being an unconstitutional tax on income. It is noteworthy that none of the states without an income tax have a capital gains tax. This is likely due to the fact capital gains are considered to be income. Also, up until a few weeks ago, the state Department of Commerce highlighted the lack of a capital gains tax as being a “competitive advantage” for Washington.

Lawmakers will have an extra $3 billion to use for increases in state spending for 2015-17. If they decide to ask taxpayers for even more money, those efforts should focus on tax sources that will actually improve budget stability and not give Washingtonians a front seat on an even more volatile budget rollercoaster, like the reliance on capital gains taxes has created in other states.