House Bill 2100 had a public hearing in the House Finance Committee on Thursday. The bill proposes taxing employers who pay their workers good wages. I was invited to testify.

HB 2100 has 18 Democratic co-sponsors alongside bill sponsor, Rep. Shaun Scott, D-Seattle. It also has a companion bill in the Senate: SB 6093. The bill seeks to impose a 5% payroll tax on medium and large companies for the portion of employee payroll expenses that exceed $125,000 annually per worker. It would apply to companies that employ more than 20 people (subject to change) and have more than $5 million in gross receipts or sales. It would not apply to an employer with total employee wages equal to or less than $7 million for the prior calendar year.

This bill will make Washington state a less attractive state to live and work in, discouraging job creation, encouraging work that can be shifted out of state and potentially bringing workers’ wage caps so employers can avoid the tax penalty. It will make new businesses question whether to set up shop here, and it has companies who are already here wondering if they should leave the state, seeing a continued pattern of business and worker unfriendliness.

The idea for the tax is inspired by a job-killing tax in Seattle known as the JumpStart payroll tax. Tax collection for JumpStart started in 2021, and the results have been concerning. Businesses left Seattle and fewer new businesses started there than at any point in recent history. Sara Nelson, the president of the Seattle City Council, said of the tax, "Instead of 'jump-starting' Seattle's recovery, hundreds of businesses closed or left downtown, taking those jobs elsewhere."

The reason HB 2100 is being pushed, even after seeing what’s happened in Seattle, is because Olympia lawmakers need to find money to deal with their spending problem. Pronto. This tax on payroll above $125,000 could bring in money more quickly than the also-awful proposal to bring an official income tax to the state. That idea will be tied up in court if it passes. (Read more about the proposed income tax here.)

Scott is not convinced his bill will impact those business decisions. And he insists this is a progressive way to deal with federal reforms on the way in the future and that could lower the number of people dependent on other taxpayers for their health care, food or higher education. The bill would create an account called the “Well Washington Fund.”

Funds are sent to the general fund first

Revenue from the tax would go into that newly created account — eventually. First it helps the general fund and the shortfall the state already has because of its overspending problem. And even after the tax has been in place a year, the general fund still receives about half of the money.

The bill reads, “The well Washington fund account is created in the state treasury. Beginning July 1, 2026, all revenues created from the high earners payroll tax on large operating companies in section 4 of this act must be deposited into the state general fund.” Then in July 2027, 51 percent of revenue created by the tax will go to the newly created fund, but the remaining “49 percent, as well as all interest and penalties provided in Title 50C RCW,” is deposited into the general fund.

It’s clear this tax is less about people in need than it is about getting state lawmakers more money for their spending priorities.

Even the money that goes to the Well Washington Fund can be used for this broad list: “Expenditures from the account may be used only for higher education, health care (especially Medicaid), cash assistance programs, and energy and housing programs.”

Dramatic reading

The bill’s text is interesting. It feels a bit like a hate letter, tells a tale of doom and gloom, and it catastrophizes.

Despite the fact President Donald Trump has acknowledged that the Constitution says he is not allowed to run again, the bill says, “The Legislature further finds that it is the apparent intent of President Trump to remain in office after 2028, that the United States supreme court has stripped key provisions from the federal voting rights act, and that ongoing federal austerity budgeting is thus a strong potentiality.”

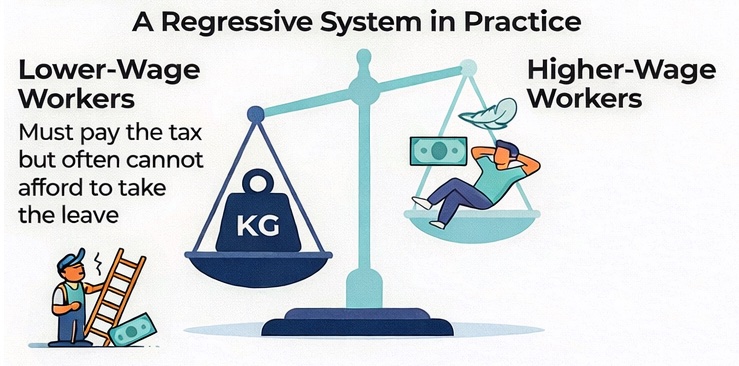

Early on in the bill’s text is this: “H.R. 1 defunds the public sector in order to grant massive tax breaks to American corporations.” It then picks on Microsoft a bit before going on to talk about how regressive the bill author finds our state. (Never mind all the regressive taxes majority-party lawmakers have brought to Washingtonians in recent years. From the gas tax to payroll taxes for WA Cares and the Paid Family and Medical Leave program — both of which harm low-income workers to benefit people with higher incomes and greater resources — state lawmakers could be making an album titled, “Regressive Taxing’s Greatest Hits!”)

Proposed substitute on the way?

When the hearing started on Thursday, it was announced that a proposed substitute would be put forward. I’m watching for it. Thankfully, the bill sponsor said he spoke with many of the “large operating companies” with workers that would trigger the tax and made some changes.

One possible change I am fond of has to do with making health care entities exempt. That’s a must, and it must remain. How can you propose a tax that is supposed to make health care affordable but raises the cost of health care labor?

In the original bill, most hospitals/health systems would be subject to the tax, and health care jobs pay well, especially in Washington state. Labor statistics show we have tens of thousands of health care workers in the state with annual pay well above $125,000.

Hospitals and clinics can’t or won’t absorb a targeted tax on high-skill labor without consequences for consumers of health care. That could mean fewer hires or reduced shifts and less access, slower wage growth, or higher charges and premiums passed on to patients and employers. Calling an account the “Well Washington Fund” doesn’t change the math: Increasing health care operating costs will not make health care more affordable or well.

Affordability is MIA in HB 2100

Even if health care systems and hospitals are protected from this bad idea, this payroll tax on employers will make the state even less affordable. It will bring people who aren’t in need of taxpayer dependency closer to it.

If lawmakers are truly worried about H.R. 1 and want to increase the capacity of already generous safety nets in the state, they should do away with things like concurrent Medicaid payments that help balloon the budget and seek an end to benefits that go to people with no need for taxpayer dependency. That is often the case with long-term-care services provided through Medicaid. Those are two ideas for protecting safety nets that I’ve researched over the past year.

Finally, if legislators are serious about wanting to make health care more affordable for all, including the vulnerable, they should focus on cost transparency and truth in health care. They should seek more competition and an end to certificate-of-need requirements. And we need more informed consumers to help contain health care costs, as well as less administrative burden. We don't need a tax that makes the state more expensive and harms workers and businesses.