The Opportunity for All Coalition filed a lawsuit today to overturn the new income tax on capital gains (SB 5096). This is the second lawsuit to be filed against the tax. The plaintiffs are April Clayton (Red Apple Orchards), Kevin and Renee Bouchey (former owners S.K.D. Farms, Inc), Joanna Cable, Matthew Sonderen (Sonderen Packaging), Rosella and Burr Mosby (Mosby Farms), Christopher and Catherine Senske (Senske Services), and Washington State Farm Bureau. All of the plaintiffs are Washington Policy Center members.

It is no surprise to see so many farmers suing after lawmakers failed to address their concerns expressed before adopting the illegal income tax. A recent legislative public record said that farmers can afford to pay the income tax on capital gains since they work “less than half time.”

Discussing the lawsuit, former Attorney General Rob McKenna said earlier this week:

“Our complaint, which will be filed by a group of small business owners and farmers, will argue that the capital gains tax is not an excise tax, it’s an unconstitutional income tax. Even if found to be an excise tax, however, the capital gains tax is illegal because the tax is imposed on the basis of the taxpayer’s residence, not on where the taxable event occurs. It attempts to reach taxable events outside Washington, which the State’s excise taxes may not do . . .

There is no legal argument that your income is not your property, just a policy argument. Washington’s constitution defines property as everything, whether tangible or intangible, that is subject to ownership. Income is certainly part of ‘everything,’ and it is an intangible form of property that is owned by the people who earn it. To suggest otherwise is to say that you don’t own your income; but if I don’t own my income, how can I be liable for paying tax on it?”

Washington’s state Supreme Court has consistently ruled that income is property (meaning you own it). This is why a graduated income tax has been prohibited without a constitutional amendment and a tax on income must conform with the constitutional restrictions on property taxes.

Every state in the country, the Congressional Budget Office and the Internal Revenue Service (IRS) all unequivocally say a capital gains tax is an income tax. According to the IRS:

“This is in response to your inquiry regarding the tax treatment of capital gains. You ask whether tax on capital gains is considered an excise tax or an income tax? It is an income tax. More specifically, capital gains are treated as income under the tax code and taxed as such."

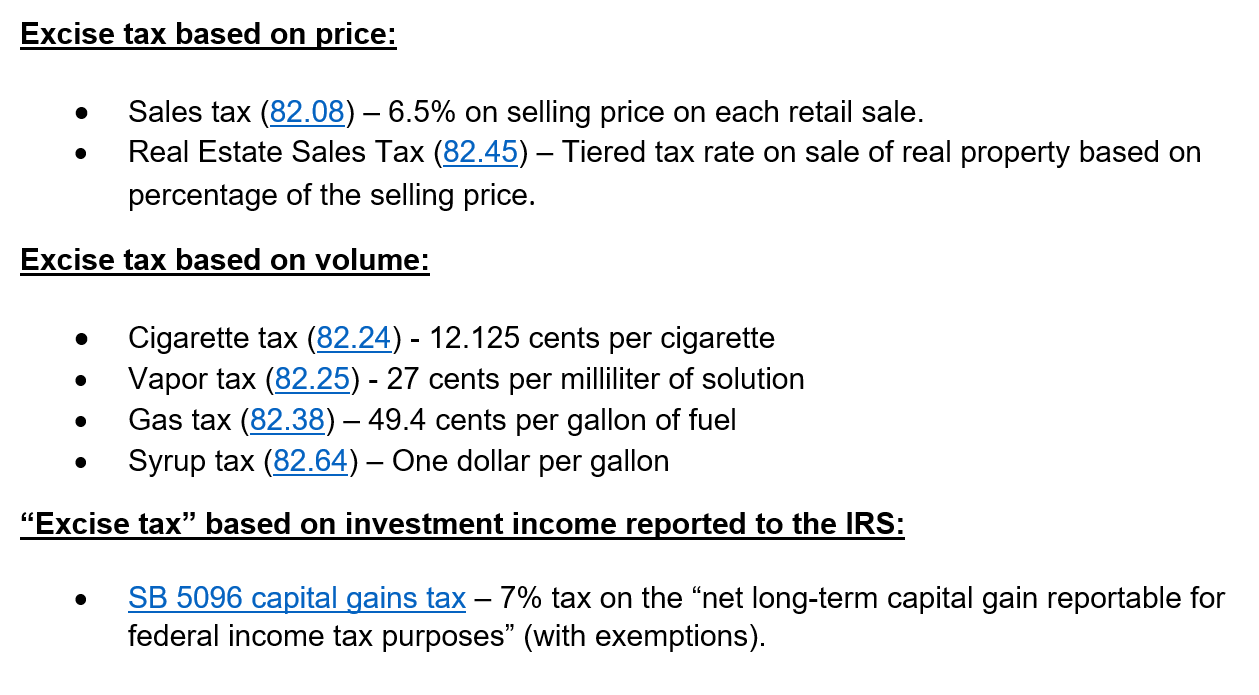

Excise taxes are applied at point of sale on price or volume. Here are examples of Washington's excise taxes and how imposed:

The fact that a capital gains tax is an income tax is not in dispute anywhere outside of Washington state. So why was this tax adopted? These emails from Sen. Pedersen discuss the goal for the new capital gains income tax:

- April 30, 2018: “But the more important benefit of passing a capital gains tax is on the legal side, from my perspective. The other side will challenge it as an unconstitutional property tax. This will give the Supreme Court the opportunity to revisit its bad decisions from 1934 and 1951 that income is property and will make it possible, if we succeed, to enact a progressive income tax with a simple majority vote.” (emphasis added)

- December 15, 2018: “I personally believe that adopting a capital gains tax is one of the best things we could do to help advance the possibility of an income tax in our state, because it could help resolve the legal uncertainty about whether an income tax is a ‘property tax’ subject to constitutional limitations. Until that happens, it would take 2/3 majorities in the legislature (and a vote of the people) to adopt an income tax, which makes it very unlikely to happen." (emphasis added)

- May 11, 2021: “I feel hopeful that this case will open the door to a more significant overhaul of our tax structure, which many consider to be the most regressive in the United States. I note that there is some irony in the position that you are taking. Five men in 1934 decided that income is property and therefore that major changes to our tax system could not be made by simple majority vote: instead the stars would have to align for 2/3 majorities in both chambers of the legislature and a majority vote of the electorate. That is profoundly anti-democratic, in my view.” (emphasis added)

About that legal “uncertainty,” here is what the state Supreme Court said in 1960:

"The argument is again pressed upon us that these cases were wrongly decided. The court is unwilling, however, to recede from the position announced in its repeated decisions. Among other things, the attorney general urges that the result should now be different because the state is confronted with a financial crisis. If so, the constitution may be amended by vote of the people. Such a constitutional amendment was rejected by popular vote in 1934."

Not liking the clear message from the courts does not make the legal facts uncertain.

I feel confident that with the consistent history of the multiple court rulings invalidating a graduated income tax, the plain language of the 14th amendment defining property to include everything subject to ownership, and the fact voters have already rejected 6 constitutional amendments to overturn the graduated income tax restriction that this illegal income tax on capital gains will also be struck down.

Additional Information

OFAC income tax on capital gains lawsuit

IRS: Capital gains tax "is an income tax"

State Revenue Departments Describe Capital Gains Income Taxes

Lawmaker’s emails confirm goal for capital gains proposal is broad income tax

Public records reveal WA DOR’s thoughts on capital gains income taxes