Depending on the comparison, Washington’s gas prices have increased between 35 and 52 cents more than neighboring states since the state launched a tax on CO2 emissions at the beginning of the year. Despite the clear data, state politicians and agency staff refuse to acknowledge the cost of the increases and aren’t helping residents deal with the impact of the costs.

This amount is in line with the results of the $48.50 per metric ton (MT) of CO2 price set at the state’s auction of emission allowances at the end of February. For gasoline with a 10% ethanol mix, $48.50 per MT CO2 amounts to 39 cents per gallon. As we noted previously, some fuel suppliers are charging more than that after they undercharged in January and February, before the actual price of CO2 allowances was set at auction.

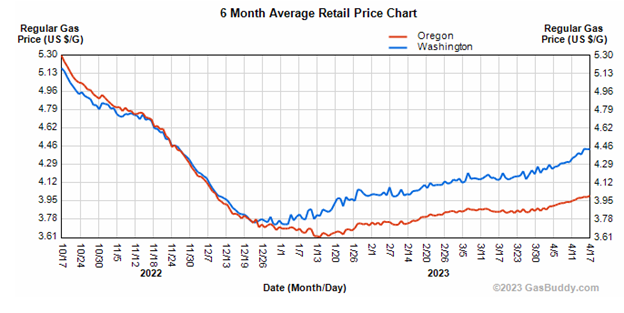

There are several ways to calculate the change in prices since January. Perhaps the most straightforward is to use GasBuddy to compare the average prices of Regular gas in Washington and Oregon. As the graph shows, prices in the two states were very similar last year. In January the prices began to diverge suddenly. The difference went from about 3 cents per gallon at the end of the year to about 49 cents per gallon on April 17 – an increase of 46 cents per gallon. Comparing Washington to the average of Oregon and Idaho yields a similar result, an increase of about 52 cents per gallon in the difference since the beginning of the year.

There are several ways to calculate the change in prices since January. Perhaps the most straightforward is to use GasBuddy to compare the average prices of Regular gas in Washington and Oregon. As the graph shows, prices in the two states were very similar last year. In January the prices began to diverge suddenly. The difference went from about 3 cents per gallon at the end of the year to about 49 cents per gallon on April 17 – an increase of 46 cents per gallon. Comparing Washington to the average of Oregon and Idaho yields a similar result, an increase of about 52 cents per gallon in the difference since the beginning of the year.

We can compare that to AAA data. Since the beginning of the year, the difference between Washington’s gas prices and the average of Oregon and Idaho increased by about 44 cents per gallon.

We can also use the AAA data to compare Washington to other West Coast states, including California, Idaho, Nevada, and Oregon. Using that comparison, the gap between Washington’s gas prices and the West Coast has increased by about 35 cents per gallon since the beginning of the year.

Coming up with a perfect estimate of the impact of the tax on CO2 emissions is difficult because there are several factors impacting gas prices and prices in other states. Previously, we used the Energy Information Administration’s data to estimate the difference between Washington and other West Coast states minus California. That data set, however, has been heavily impacted by prices in Arizona which have skyrocketed since the beginning of the year, jumping by nearly $1.20 per gallon. No other state has seen anything close to that increase. It is unclear what is causing that increase, but the EIA dataset does not include gas prices for Arizona, making it impossible to adjust for this outlying trend.

Using AAA price data for the states in the EIA comparison – Alaska, California, Hawaii, Nevada, and Oregon – minus Arizona, yields a difference of 46 cents per gallon in Washington since the beginning of the year. Within the range of the others.

This real-world data are sharply at odds with the claims of staff at the Washington State Department of Ecology which continues to claim on the agency’s web page that “the potential impact on gas prices is expected to remain low – about 1% to 3% in 2023,” which would amount to between 4 and 12 cents per gallon. Apparently responding to our previous analysis, the same site also addresses the question, “Will the new climate policies result in a 46-cent-per-gallon increase in the gas tax starting in 2023,” answering with a direct “no.” The real-world data show, in fact, that is almost exactly where they are now.

Our projection of 46 cents per gallon was based on Ecology’s own analysis showing the cost of CO2 allowances would be $58.31 per MT of CO2 and using California’s methodology of applying that cost to the price of gasoline. Although the actual price of CO2 allowances in the first auction is below Ecology’s estimates, some fuel suppliers are now adding about that amount to compensate for only adding the equivalent of about $31 per MT of CO2 in January and February.

It is strange that the Department of Ecology continues to deny the evidence which includes real-world prices, actual invoices from fuel suppliers, and agreement by other states (including California and Oregon) that these policies increase gas prices. It is even more ridiculous when the express purpose of CO2 taxes is to increase gas prices and provide an incentive to use less gasoline and other CO2-emitting fuels.

And yet, the governor and staff at the Department of Ecology still blame everyone but themselves for rising gas prices.

This denial doesn’t stop families and businesses from dealing with the impacts of rising gas and energy prices. It does mean families can’t look to state government for help in addressing those prices.