Planners in Seattle are counting on the public to pay billions more in taxes, primarily to fund local transit.

The staff of the Puget Sound Regional Council (PSRC) – the federally mandated metropolitan planning organization – has released a draft financial strategy for the 2050 regional transportation plan (RTP). That strategy includes new ways to get more money from the public to fund politicians’ transportation priorities – including:

“indexing existing taxes; new taxes such as a carbon tax, motor vehicle excise tax and street utility tax; paid parking surcharges; impact fees; increases to transit and ferry fares; increases to sales taxes and various registration and license fees; as well as transportation facility tolls and a road usage charge in the future.”

About half of the new revenue would fund public transit, and only 13% would fund state highways in the region.

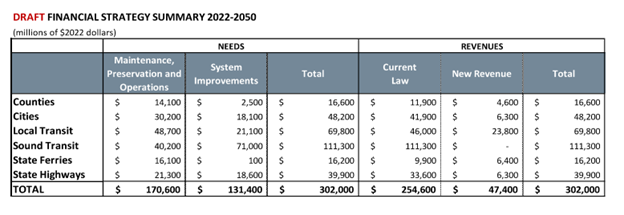

(Notably, the financial strategy reveals Sound Transit for the first time as a $111 billion dollar system – an increase reflecting the massive cost overruns the agency recently forecast.)

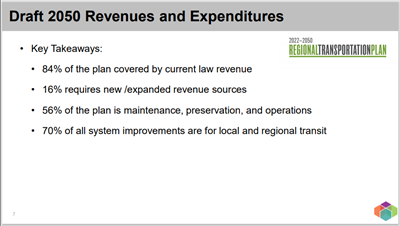

Looking at both current (84%) and new revenue (16%) that funds the PSRC’s plan – the PSRC indicated 70% of all improvements are for local and regional transit.

The major takeaway from the PSRC’s new revenue assumptions is specific to one new revenue source: the road usage charge (RUC) – a tax on every mile you drive rather than for every gallon of gas purchased at the pump. While the Washington State Transportation Commission (WSTC) that has been studying the implementation of the RUC recommends protecting this source of revenue for highway spending only – PSRC planners simply ignore the Commission’s bipartisan recommendation in their plan. Instead, they take on the policy assumption “that revenues are available for all investment types.”

This isn’t surprising, given that the PSRC made a similar assumption in a 2018 version of their multi-decade draft plan, which anticipated 70% of all new revenue to come from a RUC, primarily to fund public transit.

The PSRC is a member of the RUC steering committee, which is examining the potential transition from a gas tax to a RUC, so their feedback is heard and valued.

Their assumption that RUC revenue would fund public transit is significant because it would divert public resources away from roads that most of the region depends on for mobility, and which must be kept in a state of good repair. This unelected planning staff’s preferred dilution of RUC revenue would result in less money going toward roads - and would ultimately undermine policymakers’ efforts in replacing the gas tax in any true sense. Effectively, their plan would move the state away from a reliable and fair user fee funding model (like the gas tax) to one where drivers pay more and more money for systems they do not use or benefit from.

Current travel trends and projections all point to a need for more – not less – spending on our highway system. Policymakers should ensure that any gas tax replacement is protected for road maintenance and upgrades only and is not used to achieve social or political objectives. If the RUC is developed as a general tax, as the PSRC staff hopes and advocates, it should be rejected by the people and their legislators.