In their recent update to the regional transportation plan, planners at the Puget Sound Regional Council (PSRC) are making big assumptions about how much money they could get from taxpayers between 2018-2040.

The metropolitan planning organization is somewhat obscure, but powerful. It “produces regional growth and transportation plans [that] strongly influence policy in King, Pierce, Kitsap and Snohomish counties.”

Their updated draft transportation plan depends on nearly $40 billion in new taxes, fees and tolls.

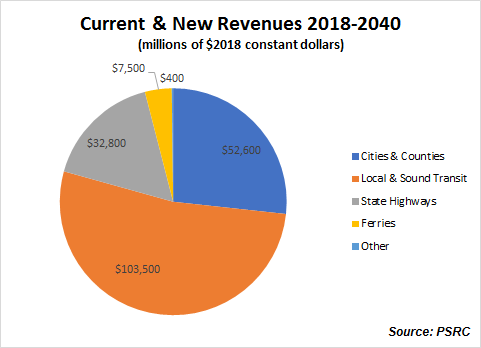

Combined with current revenues, that’s $196.8 billion over roughly two decades. Of this amount:

- 52.6% is for local and Sound Transit

- 26.7% is for cities and counties

- 16.7% is for highways

- 3.8% is for ferries

Like the Washington State Department of Transportation (WSDOT), regional planners believe strongly in managing - not relieving - congestion. This is clearly stated in the draft plan and reflected in the above allocations.

In the pie chart, transit receives more than half of current and projected new revenues, despite transit serving less than 4% of daily person trip demand.

How the PSRC plans to get $40 billion for their desired projects is even more striking, because their plan requires passage of a long list of new taxes, fees, and tolls. These include:

- Indexed fuel tax ($260 million)

- Carbon tax on fuel ($5.2 billion)

- New motor vehicle excise taxes ($5 billion)

- Employee tax per employee per month ($500 million)

- Vehicle license and registration fee increases ($570 million)

- Vehicle weight fee increase ($620 million)

- Facility tolls ($400 million)

And…

- Road Usage Charge ($27.6 billion)

The Road Usage Charge makes up nearly 70% of assumed new revenue. In other words, regional planners are very hopeful it will pass. However, the Road Usage Charge pilot project is just starting this year and is already controversial, so the PSRC’s assumption about its passage and how the money would be spent is highly presumptuous.

If a Road Usage Charge is implemented – the PSRC notes they would like “a broader consideration of possible uses" (they want the charge to not be protected by the 18th amendment like the state gas tax is). This would allow officials to spend the money on what they feel is best for us rather than on actual public demand, a concern we have highlighted repeatedly. If the PSRC gets what they want, the charge will not be a true user fee but a tax, and less money could go to roads.

Although the PSRC has laid out its plan, the public comment period is still open until January 31st. Comments can be submitted on the PSRC website.