IBM’s Institute for Business Value conducted a survey of more than 25,000 consumers in the US about personal preferences related to mobility, shopping, work attendance, and more. Their findings show people are planning to “make significant changes in the way they go about their lives and work in the wake of the virus.”

Here are some notable results from the survey regarding mobility and telecommuting:

- More than 20% of survey respondents who normally take transit said they no longer would, while 28% said they will take transit less frequently.

- More than 50% of survey respondents said they would use ridesharing services less frequently or not at all.

- More than 17% of people said they will drive more because of the pandemic, and 25% said they would exclusively use their personal vehicle moving forward.

- About one-third of respondents said that they will take the impact of COVID-19 on the economy into consideration before they buy a vehicle. About 25% said they will wait for six months before making a purchase.

- Nearly 40% of respondents said “they feel strongly that their employer should provide employee opt-in remote work options when returning to normal operations.”

- More than 75% of people said they want to continue to telecommute “at least occasionally,” and 54% said they want telecommuting to “be their primary way of working.”

The survey results regarding increased willingness to telecommute are striking. It will be interesting to see changes among telecommuters over the coming years, and whether a small percentage increase in telecomuting yields meaningful traffic relief for those who are in the freight industry or who cannot work from home.

The survey responses regarding travel choices are also revealing. The shift to driving among previous transit riders suggest that we should expect some of the negative impact of COVID-19 on transit and rideshare use to not be recoverable.

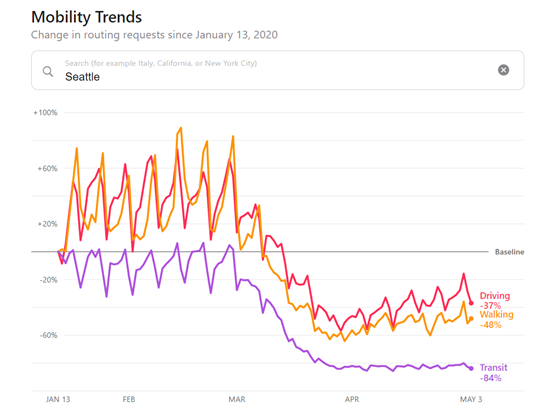

Apple’s Mobility Trends tell a similar story, as shown below for Seattle. While driving and walking are starting to slowly recover, transit use remains mostly flat. As of May 3, driving is -37% below baseline volumes on January 13th, walking is at -48%, and transit is at -84%. Similar trends can be seen in Los Angeles, New York, Boston, Philadelphia, and many other cities in the US.

IBM’s survey data results and current travel trends indicate that transit agencies and rideshare companies will have to think of creative, new ways to move people safely and flexibly in the post-COVID future.

Transit agencies in particular will need to re-evaluate their traditional mass transit model and adapt services to people’s evolving, diverse preferences. This may mean we see more micro-transit options and less rail. It could also mean that transit agencies contract out more of their services to the private sector and function as mobility operators, overseeing and coordinating service rather than operating it.

As Baruch Feigenbaum of Reason Foundation put it so well:

“Transit agencies are an integral part of the new mobility universe, but they are only one part of it. Providing mobility is not about expanding the agency; it is about serving the customer.”

If transit agencies and rideshare companies are able to adapt, they may yet remain viable when society adjusts to its new normal.