The budgets are coming, the budgets are coming! That's the cry that will soon be heard in Olympia after today's revenue forecast. So what did we learn from the forecast? Revenue for the current 2015-17 budget is projected to grow to $39 billion and increase in 17-19 to $41.6 billion, a $2.6 billion increase (or 6.8%). With the exception of during the peak of the great recession in 09-11, this means state biennial revenue will have increased each budget going back at least through 1997 (revenue forecast chart runs back to 1997 - see page 30 of forecast).

Here are some of the highlights from today's revenue forecast:

- "The GF-S revenue forecast has been increased by $247 million for the 2015-17 biennium and increased by $303 million for the 2017-19 biennium."

- "GF-S revenues are expected to grow 13.5% between the 2013-15 and 2015-17 biennia and 6.8% between the 2015-17 and 2017-19 biennia."

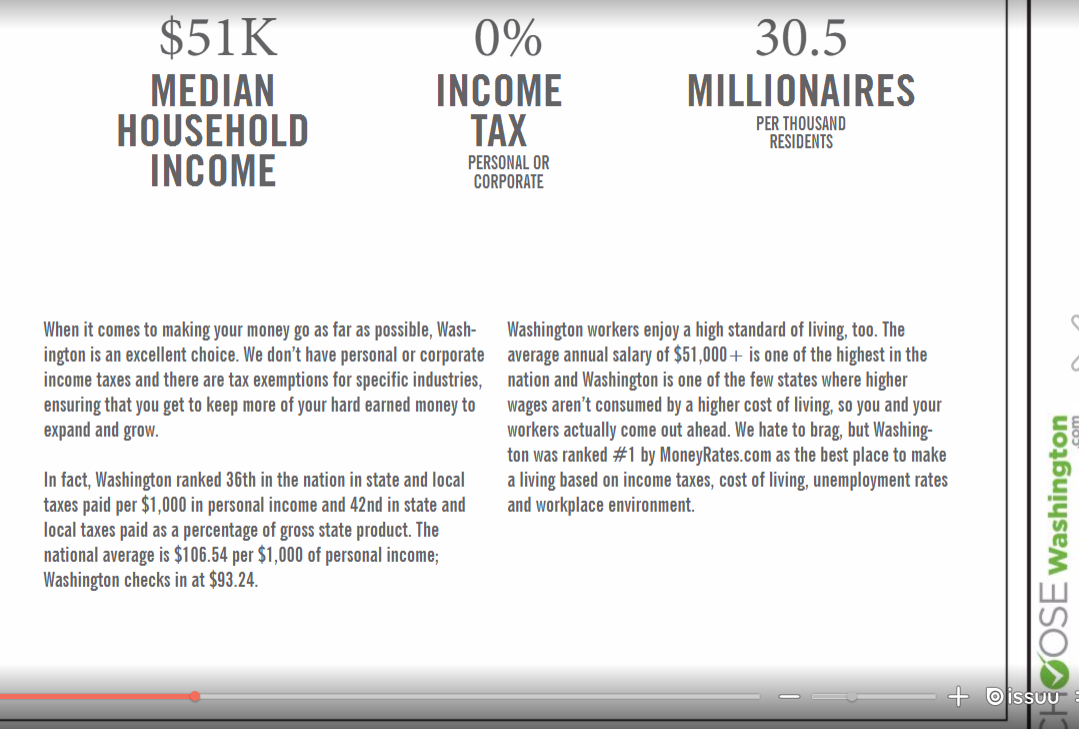

As boasted by the Washington Department of Commerce during its current trade show in Paris, this revenue growth is happening without a state income tax:

An op-ed in the Seattle Times today by WPC board member Matt McIlwain reiterated this point:

"Our state has a tax system that favors growth, investment and opportunity. We have no income tax on personal income, employee stock ownership or capital gains. Compared to other states, our smarter approach favors forward-looking innovation and investment that creates more job opportunities for people in our state. It also enables personal-income growth that encourages consumer consumption and fuels sales-tax revenue increases to fund state services, local governments and schools . . .

As we reflect on the magnitude of the increased state tax revenues, we should be thankful for the choices Washingtonians have made in the past around defeating an income tax. With our state’s balanced tax system, state revenues have increased almost every year. History shows that our smart growth and consumption-orientated tax system, when combined with intelligent prioritization by legislators, keep Washington at the forefront of bold business initiatives, technical innovation and job creation. The result is not only rising revenues for the state, public schools and local governments, but the fostering of new ideas and opportunities that make the world a better place for everyone."

Now we'll see how lawmakers plan to use this revenue growth for their budget proposals. Rumors are the Senate will release its budget as soon as next Tuesday with the House following the next week.

Additional Information

"Choose Washington" - no capital gains taxes

Tax Foundation warns against imposing capital gains income tax