"There is no more expensive debt you can have than unfunded pension liability. If the funds are not there to be invested, that's 7 to 8 percent you're losing." Those are the words of State Treasurer Mike Pellicciotti regarding accounting tricks used by the legislature that could add up to $7 billion in public pension costs.

The tricks – changing the expected rate of return on state pensions and stopping pension debt payments – are designed to allow the state to increase spending now, using the pension funds as a credit card.

For years, I was part of what was widely recognized as the best pension reform team in the country. In our travels across dozens of state capitals, we frequently held up Washington as the gold standard, the national example of how to manage a pension system with fiscal discipline and actuarial integrity. That is no longer the case.

By passing ESSB 5357 in 2025, Washington became the first state in two decades to raise its assumed rate of return, a foolish accounting trick that puts long-term pension solvency at risk in order to satisfy short-term political spending.

There are a couple consistently identified games that poorly funded pension plans play and are particularly damaging to long-term solvency.

The first is similar to a mortgage refinance. Just as a homeowner might stretch a 15-year mortgage to 30 years to lower monthly payments, lawmakers extend the period for paying off pension debt. This lowers the immediate bill but explodes the total interest cost, leaving the next generation to pay for today's labor costs.

The second is keeping the assumed rate of return (ARR) on investments artificially high so the state can claim its pension plans are fully funded while paying less in contributions and ignoring market reality. This allows budget writers to divert money that should be going into the fund into new, recurring social programs.

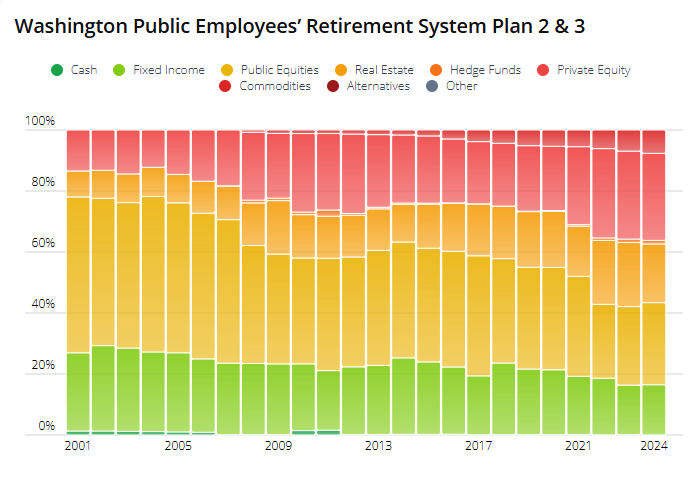

Washington's recent changes used these exact plays. The legislature increased the ARR from 7.0% to 7.25%. This seems minor, but it allowed the state to erase over $5.4 billion in liabilities overnight. I have been unable to find anything that changed in the state's investment strategy to justify this move. By assuming higher returns, the state is choosing to contribute less today, betting that future taxpayers and workers will cover the gap when the market falls short. When combined with the increasingly riskier assets the pension funds are investing in, it creates a very uncertain future.

Reason Foundation's 2025 Pension Solvency and Performance Report. Green (low risk assets) to red (high risk assets).

Lawmakers also took a four-year "holiday" from paying down the debt in two of the state’s legacy pension plans, Public Employees Retirement System (PERS 1) and Teachers Retirement System (TRS 1). These plans have been closed to new workers since 1977, yet they still carry billions in unfunded liabilities. By skipping these payments, the state is taking a high-interest loan from the retirement fund, creating a massive bill that future taxpayers and public employees will eventually have to settle.

These moves were sold by Governor Ferguson’s staff as a necessary “short-term approach,” but underfunding a pension is the most expensive debt a state takes on. If this ARR maneuver is allowed to fester, and investments earn the previously expected 7.0% instead of the new 7.25% target, that $5.4 billion "drop" in liability becomes a real shortfall.

The interest penalty adds up, too. By taking a holiday from paying the Plan 1 unfunded liabilities, the state will avoid roughly $1.1 billion in payments over the next four years. But because that money isn't being invested, and the current unfunded liability continues to grow, it will cost taxpayers an additional $1.07 billion in interest over the next 15 years to make the plans whole. Combined, these maneuvers likely created ~$6.5 to $7 billion in future costs that didn’t exist before the passage of ESSB 5357.

The State Treasurer has been blunt about the math.

The Treasurer's warning in his 2025 Debt and Credit Analysis makes it clear that "healthy reserves, manageable debt costs, and well-funded pensions must continue to be foundational. We must avoid solutions that create higher costs for taxpayers, diminish the state's strong financial position and leave Washington less able to navigate economic disruptions."

State Actuary Matt Smith recently highlighted the danger of the current approach. Today's "savings" are nothing more than tomorrow's lost opportunities. "Actual long-term costs will ultimately be determined by actual plan experience. If actual experience matches assumed experience but funding is based on assumptions that underestimate plan costs, long-term costs will increase, and the plans will forgo investment earnings on the lost prefunding."

When the state underfunds based on optimistic assumptions, they aren't just missing a payment. They’re forgoing earnings - the compounding returns that make the pension system sustainable. Once those investment windows close, the only way to fill the gap is through significantly higher contribution rates from future workers and taxpayers.

Before the legislature considers a single dollar in new programs or expanded spending, they need to reset the ARR to 7.0% or lower to align with actual market expectations and national trends. They need to end the pension holiday and resume the actuarially determined payments for PERS 1 and TRS 1 immediately to stop the compounding interest on debt.

Washington was once the model for the nation. It still can be, if lawmakers stop gambling with the retirement security of public employees and the wallets of future taxpayers.