The recent increase from 7% to 9.9% in the Capital Gains Tax (Senate Bill 5813) may not produce the increased revenue the state is projecting, and the state may see a decrease in tax revenues as business leaves the state.

The new higher rate is going to give businesses and investors pause for thought about where they declare residency, so as not to pay the 10% tax.

Famously, the state lost $610 million in taxes that would have been paid by Jeff Bezos, of Amazon fame, when Mr. Bezos’ moved to Florida avoiding Washington state’s punitive capital gains tax. At the time of the move, the tax rate was 7%.

To put that in perspective, in 2023 Washington state collected $416.6 million in capital gains tax.

There is more impact to Washingtons tax bottom line than loss of unrealized capital gains tax. When business and investors leave the state, the state sees a reduction in Business and Occupation (B&O) taxes, sales taxes, license fees, property taxes, fuel taxes, vehicle taxes/fees, excise taxes, RTA taxes, recording fees and estate taxes to name just a few. On top of the direct business spending, employees that are laid off as a result of a business leaving the state, lose income and further reduce the taxes the state collects.

It’s a vicious cycle. Once investors and business owners reach the tipping point where the tax demands of the state exceed the benefit of staying, higher net worth individuals will leave, or at least move residency, and the state will collect less tax. To compensate for the lost taxes the historical response from Washington legislators has been to raise taxes on those residents that remain, and the cycle continues.

The simplest way to fix this is to make Washington a more attractive place to live and do business by having a competitive business climate with lower taxes and less unnecessary regulations.

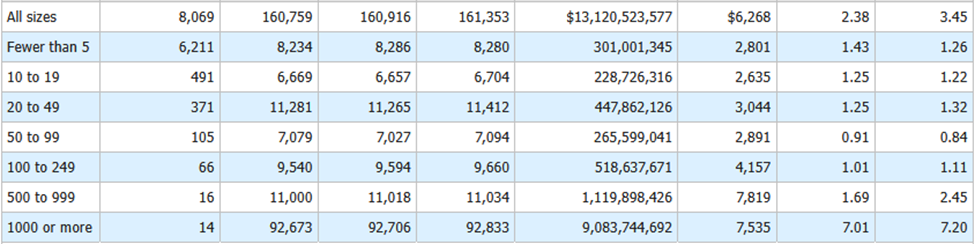

According to data from the US Bureau of Labor Statistics, in 2024 Q3, there were 241,058 businesses in Washington in all industry sectors. There are 8,069 businesses in the information section, the sector the capital gains tax is primarily targeted at.

Information sector companies have some of the highest paying jobs in Washington. Those 8,069 jobs generate $13 billion in wages per quarter based on the latest data available, Q1 2024. Projecting the remaining quarters for 2024 (the data isn’t available yet), then the total wage spent in the information industry will be approximately $52 billion for the year. According to the data there were 161k employees employed in the information job sector in 2024. Simple math shows that the average income per employee was $323,000.

The state of Washington assumes that only high net worth business owners and individuals will leave the state but should a company like Microsoft or Amazon decide to relocate a significant number of employees to a more tax friendly state, the tax impact to the state will be significant. If just 25% of the high earning individuals, about 40,000 employees who would be subject to the capital gains tax left through relocation, you would see an estimated $16 billion less wages in the state, and a resulting reduction in taxes collected.

Even at a conservative combined 10% tax rate, that would represent a loss of $1.6 billion in tax revenue from various tax sources; sales tax, B&O tax, capital gains, estate taxes, for Washington. Realistically, the reduction in taxes collected would be much higher as economic activity would be reduced and other dependent industries would generate less taxes.

For those that say the big corporations would never leave, Microsoft recently announced breaking ground on a second data center in North Carolina.

And that’s just one job sector. Washington could be looking at catastrophic loss of tax revenue if you extend this to all job sectors. The refusal of the 2025 legislature to reduce or just keep tax revenue flat will haunt future legislatures who will be facing a huge deficit. Within a few weeks of passing the largest tax increase in state history, Governor Ferguson is telling state agencies to tighten their fiscal belts even more.

Washington wages in the Information Sector Q1 2024

Bureau of Labor Statistics, accessed on 6/18/2025, at https://data.bls.gov/cew/apps/table_maker/v4/table_maker.htm#type=16&year=2024&st=53&hlind=1022&supp=0

Small businesses, that gross over $1,000,000 per year, currently are exempt from the capital gains tax if they are owned by an individual, but with legislators unbridled appetite for new tax revenue, that can change in one legislative session. Small business owners, whose retirement is tied up in the sale or annuity revenue from a business, may find themselves looking at several hundred thousand dollars in additional taxes if they stay in Washington prior to retirement. Owners will choose to move somewhere else to avoid paying the state capital gain taxes.

Washington legislators need to think hard before creating new taxes on business. Already the writing is on the wall for some businesses, and they are leaving. There will come a point where even the most dedicated corporations will throw in the towel. By then it will be too late. Now is the time to act, cut state spending and pass legislation that will reduce the taxes on business and get Washington back from 5th worst state to do business, to the 6th best.