If you think Olympia’s thirst for taxes couldn’t get any worse, get ready. Democrats in Olympia are discussing a 9.9% tax on income above $1 million dollars which along with high earning individuals, affects the vast majority of small businesses in Washington. The tax calculation is purportedly based on Adjusted Gross Income (AGI), which means any small business (depending on the business tax structure) that makes over $1 million will be taxed, even if business expenses are close to or exceed the threshold.

It will effectively give every business owner a choice, increase prices to cover the tax, or cut expenses. For a small business, since most of the cost is labor, there will be reduced hours, reduced wages and layoffs as a result.

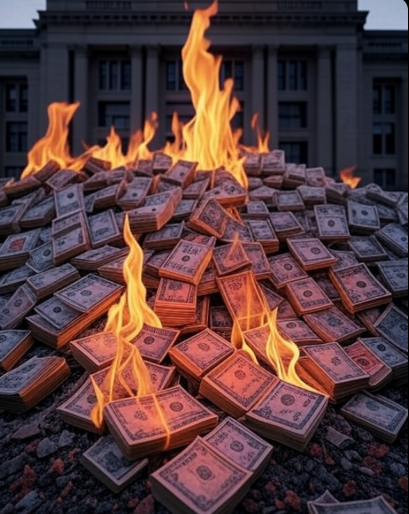

A business owner is not going to operate a business at a loss because of Olympia’s greed and mismanagement of our tax dollars.

The proposal comes on the heels of the largest tax increase in Washington history earlier this year. Senate Bill 5814 (SB 5814) went in to effect in October, was designed to plug a self-inflicted budget black hole at the expense of hardworking entrepreneurs.

From freelance IT consultants to mom-and-pop temp agencies, the ripple effects of this 6.5% (plus local add-ons up to 10.5%) tax increase on previously untaxed services like advertising, security, and software development is already proving catastrophic. Over 90,000 businesses must now scramble to comply, but it's the little guys, those with razor-thin margins and no army of accountants, who will bear the brunt.

Now Olympia wants another bite at the remnants of the pie.

Don’t forget that Washington voters have rejected on income tax ten times.

Fundamentally, the fact an income tax on AGI is being considered shows a basic misunderstanding of how tax law and business work. Similar to Washington's Business and Occupations tax (B&O), which is assessed on gross business income, an AGI income tax on a $2 million dollar small business (which is not that large in business parlance) would result in another $100,000 in taxes.

The final tax impact may come down to what the definition of Adjusted Gross Income is. The legislators that are proposing this income tax have not defined the deductions that will be applied. If the tax is applied per the Internal Revenue Service (IRS) definition, then the 9.9% tax will destroy those businesses with razer thin margins and force other businesses to relocate out of Washington.

The income tax proposal is short-sighted and will destroy the small business environment in Washington. The short-term bump in tax collections the state will see will be offset almost immediately by the loss of long-term tax income when businesses shut down, cut staff and even leave the state.

An income tax is a non-starter for small businesses in Washington and should be for legislators in Olympia too.