After raising taxes by $9 billion in a single year and somehow still facing a $2.3 billion deficit, you’d think state lawmakers would pause before lecturing anyone about not paying enough. But that's not how things work in Olympia.

Earlier this week on TVW's The Impact 2026 Opening Day Special Edition, House Speaker Laurie Jinkins argued that the wealthy need to pay their "fair share," a common refrain from the majority party to justify Washington’s ever-growing tax burden. Speaker Jinkins went further, claiming that (at the 2:35 mark) "the poorest people in this state are carrying the rest of the state on their backs in terms of taxation."

The claim that low-income taxpayers are "carrying" the state is demonstrably false. It's likely used to divide Washingtonians by class to build support for further tax increases.

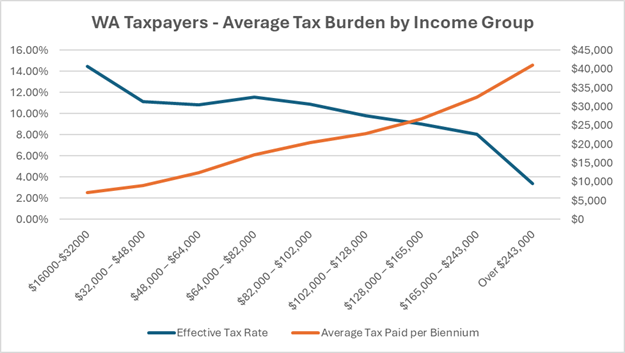

According to the Department of Revenue (DOR), taxpayers earning over $243,000 pay approximately $41,020 in state and local taxes per biennium. Those in the lowest bracket ($16,000-$32,000) pay an average of $7,206.

Low-income families do pay a higher share of their income in taxes. But when you look at total dollars collected, higher earners contribute the overwhelming majority of tax revenue. When the tax averages are applied to the state's approximately 2.75 million households in these income ranges, the data shows that the top income groups contribute vastly more in total tax dollars than lower-earning brackets.

Total state and local taxes paid by Washington households by income bracket over a two-year budget cycle (biennium). Source: Washington Department of Revenue Tax Alternative Model; U.S. Census Bureau ACS 2019-2023 5-Year Estimates, Table B19001.

Notably, the state's current $2.3 billion shortfall is larger than the total tax payments from all households in the lowest income bracket. If record-breaking contributions from high and middle earners are not enough to prevent a deficit, the problem is one of spending, not a lack of "fair share" revenue.

The truth is that both low-earners and high-earners are overtaxed. Low-income earners shouldn’t be paying over 14% of their salary in taxes. But the wealthy are already contributing tens of thousands of dollars more per year than anyone else. Higher taxes are producing higher deficits.

And there's another critical risk with targeting high earners: revenue volatility. As I've written previously, income and capital gains taxes crash when the economy dips, putting education and public safety funding at risk. It also leaves the legislature with relatively few options to close the deficit besides perpetual tax increases.

The "tax the rich" crowd offers a false choice: either high earners pay more, or low-income families suffer under regressive taxes. But there's a third option, and other states prove it works.

Colorado's Taxpayer Bill of Rights (TABOR) requires the state to refund excess revenue to taxpayers when collections exceed constitutional limits. In 2024, Colorado returned $1.7 billion to taxpayers. Florida has delivered over $6.7 billion in tax cuts since 2019 while maintaining budget surpluses. Even Oregon gives a tax rebate when the state collects income taxes above constitutional limits.

These states recognize a simple principle: when government collects more than it needs, that money belongs to taxpayers—not to new spending programs.

Washington could do the same. Instead of turning Washingtonians against each other to justify more taxes, lawmakers should cut spending and lower taxes for everyone, including the regressive sales tax that hits low-income families hardest.

The data is clear: high-income earners already contribute the lion's share of household tax payments. Squeezing them harder won't fix Washington's bloated budget. It will simply fund more spending and higher deficits, while leaving ordinary taxpayers to deal with regressive taxes lawmakers remain unwilling to reduce. If you could tax your way to prosperity on the backs of high earners, California would be budget nirvana.