The Washington Policy Center has written many times about business relocating outside Washington because of its over-regulated and high tax environment. To be fair to the migration naysayers, while many are leaving, there are people and businesses that move to Washington.

However, after you dig into the numbers to really understand what is going on, not all as it seems.

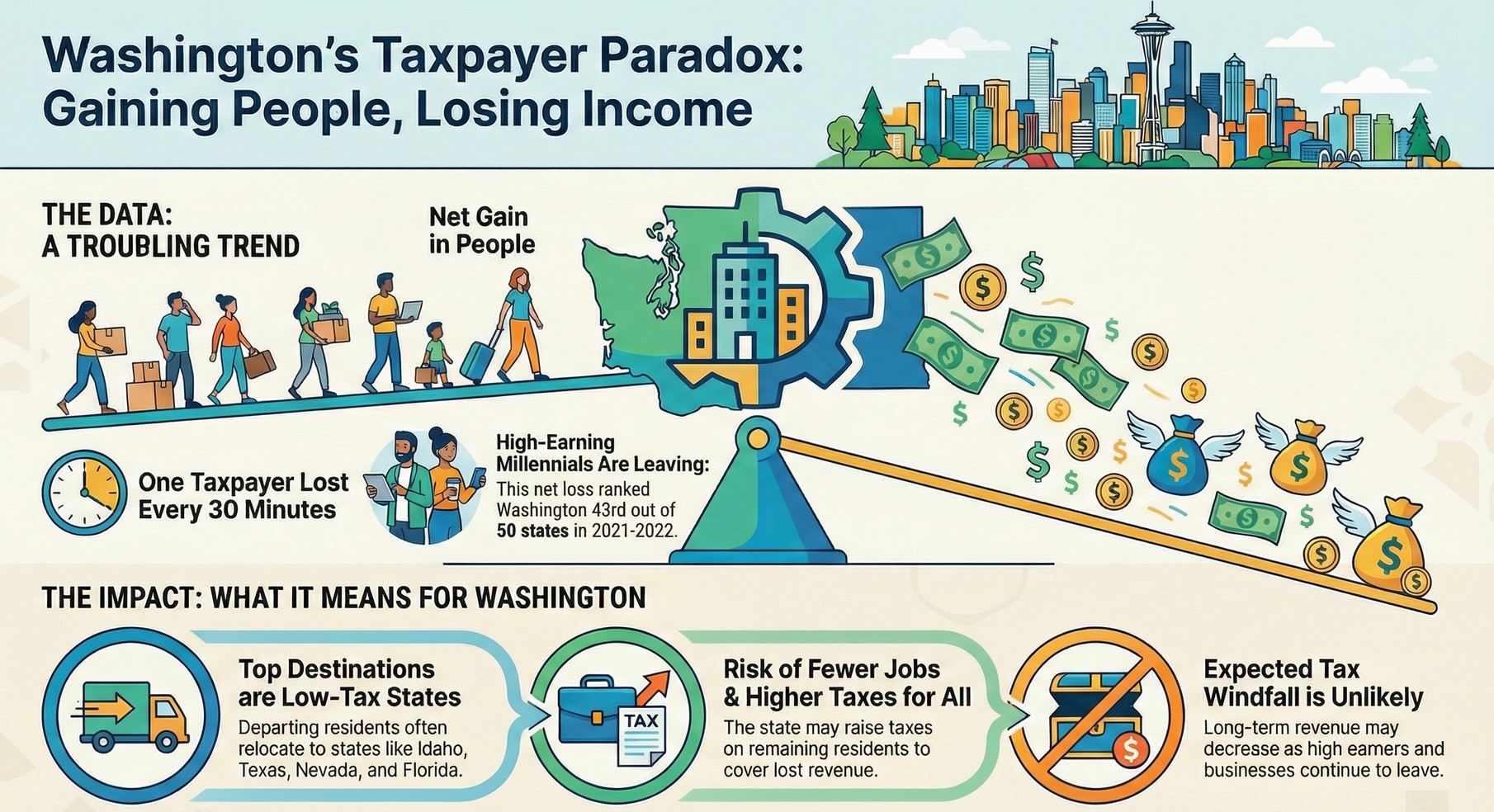

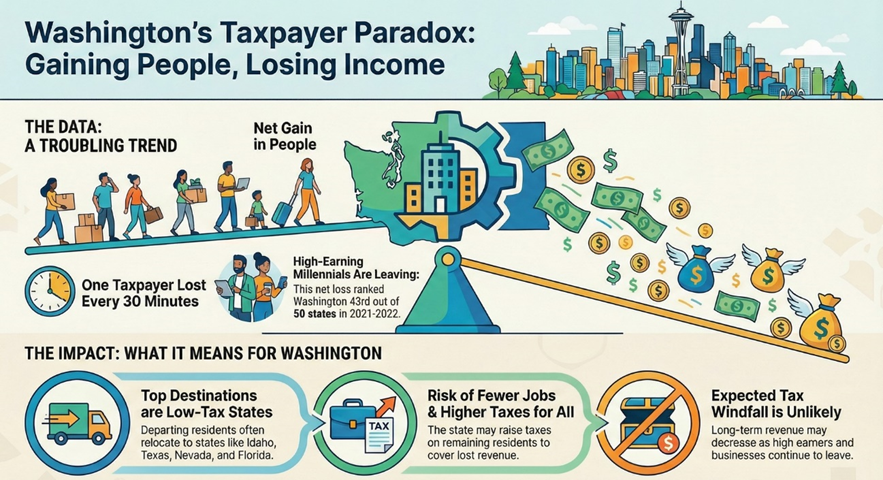

Overall, tax income to the state is declining as the people moving here make less money and pay less taxes than the ones that are leaving. The IRS publishes data every few years (the latest is from 2021-2022 with the next set of data about to be released) that shows the income breakdown of the taxpayers leaving and coming to Washington.

When you see a politician cite a report telling you people can’t wait to move to Washington and it’s a great environment to run a business, take it with a pinch of salt. The real money is still leaving the state.

The IRS data doesn’t paint a pretty picture. In summary, the data shows,

- Washington state experienced a net gain in the number of income tax returns/filers (more people/returns moving in than out).

- However, it saw a net loss in total adjusted gross income (AGI), meaning the people leaving tended to have higher average incomes than those moving in.

- This pattern indicates an outflow of higher-earning taxpayers (e.g., high-income households, business owners and individuals with incomes over $200,000), even as overall filing counts were positive.

- A 2024 SmartAsset study using this IRS data highlighted Washington losing a net 222 high-earning households (incomes >$200k), ranking 8th highest nationwide for such losses.

- Reports from late 2025 (e.g., National Taxpayers Union Foundation) calculated Washington losing one taxpayer on net every ~30 minutes based on 2021–2022 flows, ranking it among the top states for frequent net taxpayer losses (No. 43 out of 50, where lower is worse).

Common destinations for outflows include lower-tax states like Idaho, Texas, Nevada, and Florida. Inflows often come from high-tax states like California (which can offset raw numbers but not always income levels).

With the threat of the 9.9 income tax on high earner incomes, this situation is likely to get worse. Business owners and high-income individuals have the ability to relocate to other states and will do so with both their personal and business incomes. California is proof. A recent wealth tax proposal (and it was just a proposal not a passed law) and the state lost an estimated $1 trillion in 30 days.

What does this mean for Washington residents with lower incomes? Less jobs, less hours and higher taxes. Once higher income residents leave, the state will turn to everyone left behind to make up for the difference in lost tax revenue. Cutting costs to balance the budget will be furthest from the politician’s minds.

Even the Democrats admit that it won’t remain a tax on high income individuals. The tax has to be on everyone in order for there to be enough tax to pay for the bloated bureaucracy.

Long term, the tax windfall Washington politicians are expecting is unlikely to materialize. Short term there will be a bump in tax revenue but in the long term, as business owners relocate either themselves or the business income to more tax friendly locations, the state will see less tax revenue.

Olympia has some easy choices to make this year. Politicians must cut costs, discard the income and related tax proposals, reduce regulations and incentivize business before it’s too late.