The Washington Tax Structure Work Group (TSWG) met yesterday to vote on what tax options should receive further consideration and review before being reported back to the full legislature to act on. In a positive sign that state officials may finally be listening to voters, the TSWG voted to remove any further discussion around income taxes from the table. The meeting was a little disjointed, however, due to the decision to vote anonymously using software instead of taking a public roll call. TSWG member Rep. Jesse Young objected to the anonymous vote process by highlighting the public's frustration with how the redistricting commission conducted business.

Here are the tax options the Tax Structure Work Group yesterday removed from future discussion by a majority vote:

- Value Added Tax (VAT);

- Employer compensation tax;

- Flat or progressive corporate income tax; and

- Flat or progressive personal income tax.

Still on the table for additional research and debate by the TSWG are:

- Wealth tax (would need to conform with 1% and uniformity requirement to be constitutional);

- Replacing the B&O with a margins tax (this is a WPC recommendation);

- Adjusting the property tax growth factors;

- Adding new property tax exemptions; and

- Enhancing the working family tax credit.

Last December the Tax Structure Work Group received an update from its consultant on the community meetings and outreach that occurred during 2021. From the consultant’s report:

- "... overall participants had more concerns than support for a wealth tax. Participants expressed concerns that a wealth tax would not be a stable tax base given how easily billionaires can leave the state."

- "Most participants did not express support for a VAT and employer compensation tax combination ... They also expressed concerns that the employer compensation tax might hinder economic growth."

- "Participants expressed support for a margins tax..."

- "There were more comments expressing concerns about a flat personal income tax and corporate income tax than comments in support."

- "There were more comments expressing concerns about a progressive personal income tax and progressive corporate income tax than comments in support of these taxes."

- "Participants expressed concerns about property taxes continuing to increase over time."

During yesterday’s meeting the TSWG consultant provided these additional details on its community tax surveys:

- “People of color have a strong preference for the sales tax relative to their white counterparts.”

- “People of color responded more favorably to flat taxes over progressive taxes.”

- “Business owners responded more favorably to flat taxes over progressive taxes.”

- “Overall, respondents did not feel that taxing income would be fairer than solely taxing retail spending and home value. Responses are relatively similar with respect to age, income, and geographic region.”

- “People of color respondents more felt that this Scenario (income tax) would not be fairer compared to their white respondents.”

- “People of color respondents do not think progressive income taxation is a fairer approach.”

- “Concerns over the constitutionality of an income tax in Washington State.”

On that last point, Washington’s courts have repeatedly ruled for nearly 100 years that the state constitution needs to be amended in order to impose a graduated income tax. The most recent ruling came on March 1 when the capital gains income tax (ESSB 5096) was ruled unconstitutional by an Inslee appointed judge. The judge said:

“ESSB 5096 is declared unconstitutional and invalid and, therefore, is void and inoperable as a matter of law.”

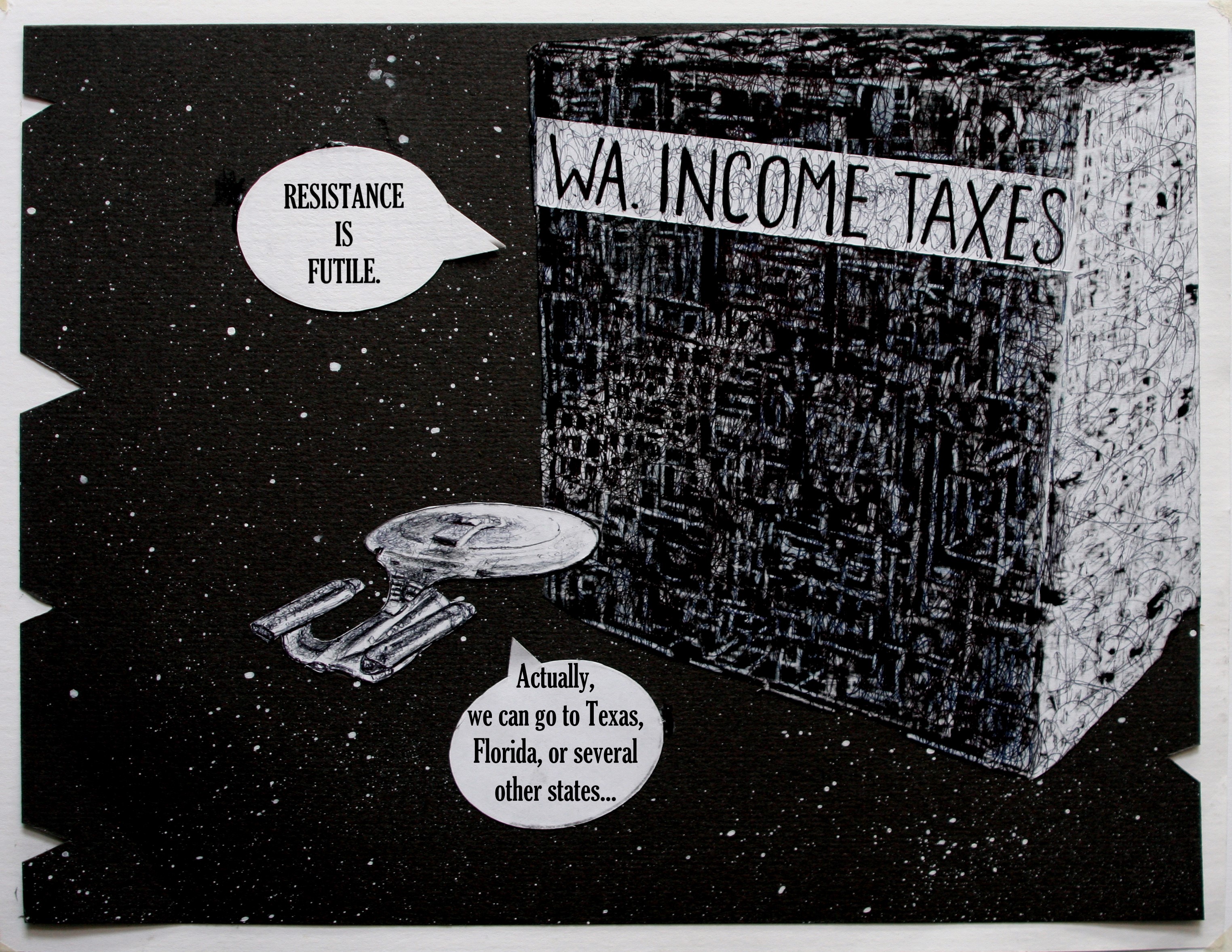

At least 28 local governments in Washington have acted in the last few years to adopt an income tax ban. Washington voters have also rejected 10 straight ballot measures to impose an income tax (including six constitutional amendments). Based on the decision yesterday by the Tax Structure Work Group to remove income taxes from further consideration, voters’ clear and consistent message opposing income taxes may finally be sinking in.

Additional Information

No surprise, Tax Structure Work Group process finds voters still don’t want income tax

Washington Policy On the Go: Insider Update with Washington State Tax Structure Workgroup

House Finance Committee Tax Structure Work Session

Replacing the Business and Occupation Tax with a Single Business Tax

Washington Research Council: Getting the Tax Structure Right - It’s Complicated

Tax reform doesn’t mean tax increases