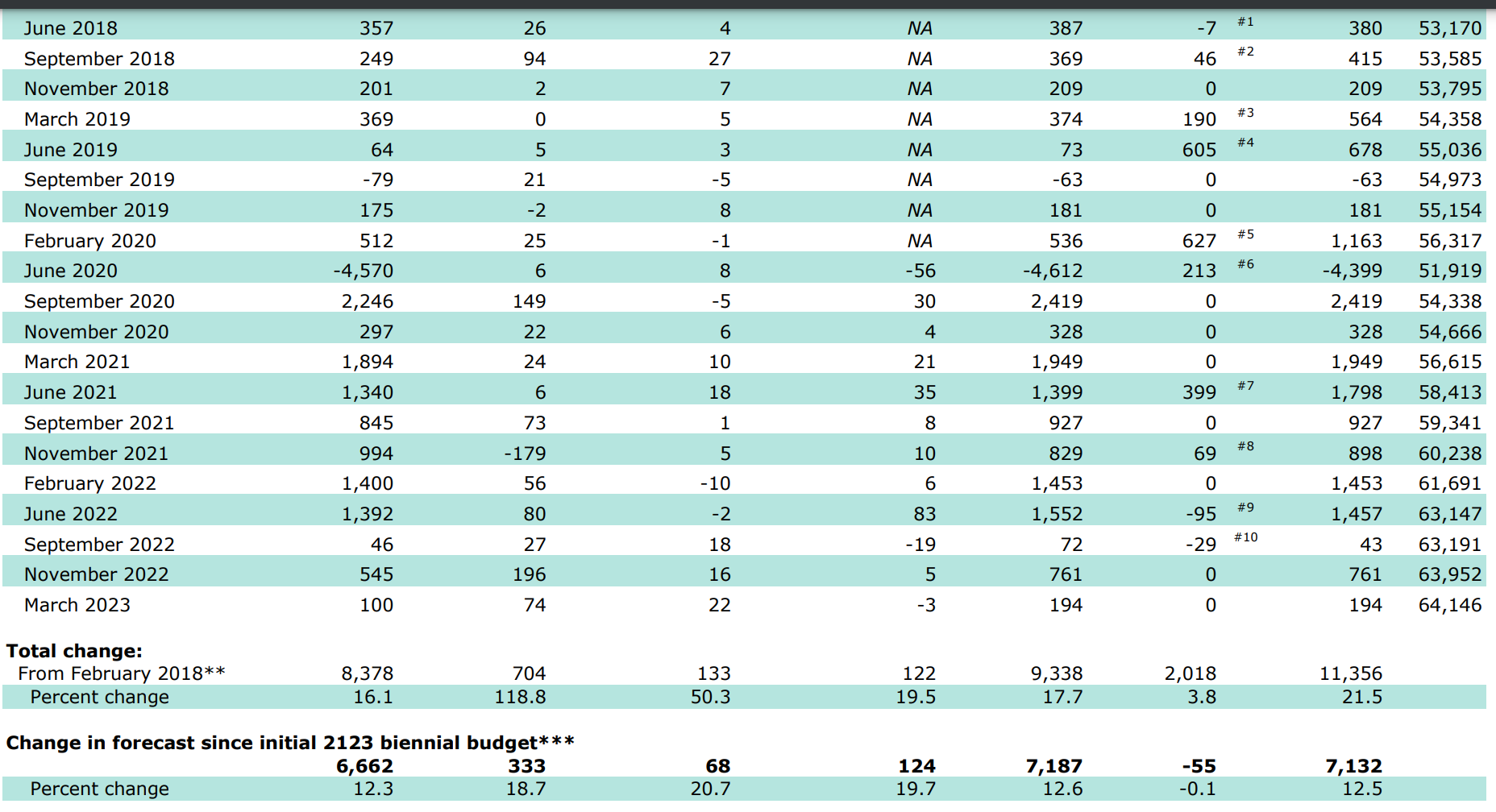

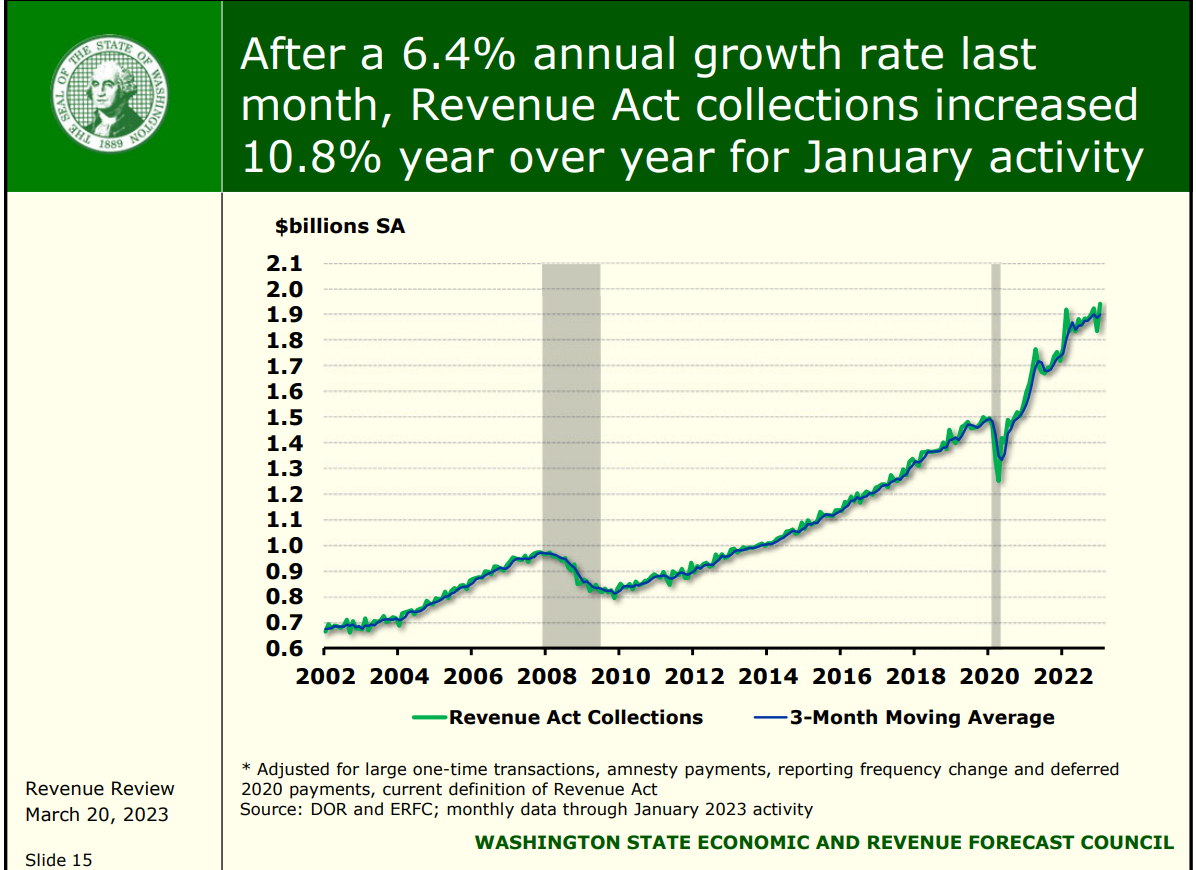

Today’s revenue forecast showed a decrease from prior projections. Also, today’s revenue forecast showed revenue is still increasing biennium over biennium. How can both these be true? Because a slowing of an increase is still an increase. Here’s the bottom line for budget writers:

- "The forecast of funds subject to the budget outlook is increased by $194 million for 2021-23 biennium, decreased by $483 million for the 2023-25 biennium, decreased by $541 million for the 2025-27 biennium"

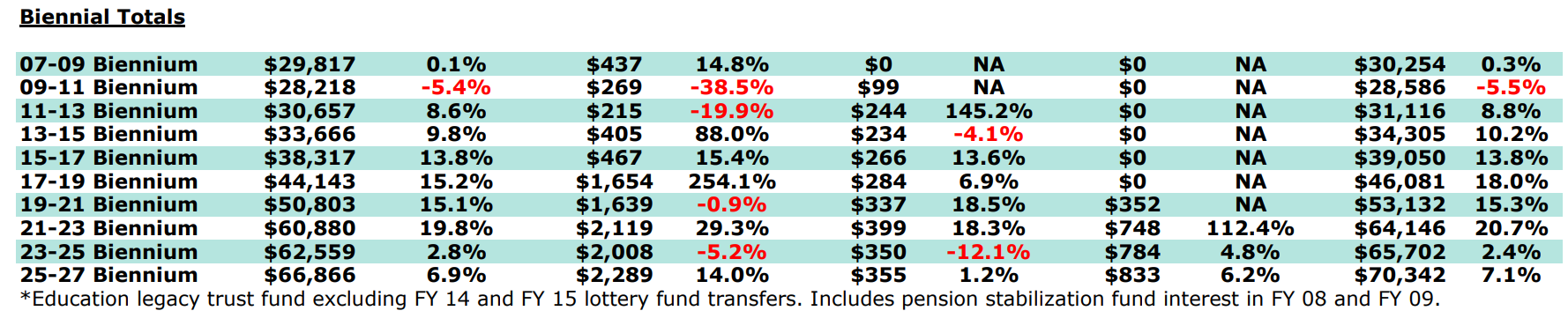

- "Total state revenues are expected to grow 20.7% between the 2019-21 and 2021-23 biennia and 2.4% between the 2021-23 and 2023-25 biennia"

- “The forecasted total of GF-S, ELTA, OPA and WEIA revenue for the 2021-23 biennium is $64.146 billion, an increase of 20.7% over 2019-21 biennial revenue, and forecasted total revenue for the 2023-25 biennium is $65.702 billion, an increase of 2.4% over expected 2021-23 biennial revenue. Forecasted total revenue for the 2025-27 biennium is $70.342 billion, an increase of 7.1% over expected 2023-25 biennial revenue.”

Catch all that? The projected revenue increase has slowed but budget writers will have more to spend in 2023-25 than they did in 2021-23.

Here are some of the comments from budget writers today:

- Sen. Christine Rolfes: “While today’s revenue forecast reflects a slowdown in our state’s economic activity, I’m confident that the Senate remains in a strong position to deliver a balanced state budget with significant new investments for the foundational services people rely on. We are focused on supporting our students and teachers, addressing the housing crisis, strengthening our behavioral health system, improving public safety, and taking historic steps to protect our environment. Washington is the only state in the nation with a requirement to balance its budget over four years and that strong fiscal governance has made our state more resilient as we face today’s economic uncertainty and stubborn inflationary pressure.”

- Sen. Lynda Wilson: “On the plus side, state government is still in a sound budget position. Between our robust rainy-day fund and other money in reserve, there is more than enough to cover all of state government’s required expenses. The surplus should still be around $4.5 billion even after factoring in the higher costs of maintaining state services and programs for the next two years. There is zero justification for new taxes of any kind, and I am heartened by that, especially since other tax increases approved in past years are still looming.”

The Senate will release its operating budget this Thursday with a public hearing already scheduled for Friday. The House is expected to release its operating budget next Monday. One mystery to be solved by the budget balance sheets, will lawmakers plan to spend revenue from the capital gains income tax that was previously ruled unconstitutional?

Should justices agree that it is an unconstitutional income tax, refunds and interest will need to be paid back to taxpayers. A decision by the state Supreme Court on the capital gains income tax is not expected before the session ends.