When the Washington state Legislature meets, as it is doing now, you can count on health care costs to increase. This year, two cost-increasing bills moving through the legislative process seek “affordability” by making the purchase of health coverage more expensive.

House Bill 2626 has a hearing Feb. 3 at 8 a.m. in the House Committee on Finance. It proposes increasing an insurance premium tax that is applied to health insurance providers, adding a new tax on other providers and removing an exemption on yet others. The takeaway? The state proposes to increase the tax on the sale of health coverage and related services. It shouldn't be a surprise when health care costs rise even higher.

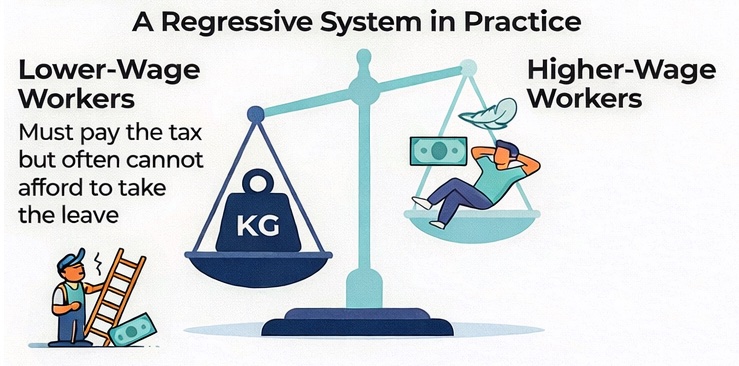

Another bill, House Bill 2073, takes a different, damaging approach. This proposal requires nonprofit health carriers to report their annual surplus and directs the Office of the Insurance Commissioner to decide whether the carrier’s surplus is “excessive.” If it deems that it is, the carrier must pay 3% of the excess to the commissioner’s office. The money won't go back to those who purchased insurance but to a state subsidy account.

What? Why is the remedy a state sweep into a program for other people? If the Legislature believes a nonprofit carrier is charging and then holding “too much” money, the excess should go back to the people who funded the excess — premium payers — through lower future rates, premium credits or rebates. Lawmakers shouldn’t be treating “excess surplus” like a public revenue source.

If the state wants health care to cost less, lawmakers should reduce regulations that block competition, transparency and innovation. They could strengthen rate reviews and focus on consumer relief, not state skims. Several cost-saving measures exist, including better protecting taxpayer-provided safety nets, not widening them.

Lawmakers shouldn’t be treating insurance like an ATM in the name of affordability. Health care doesn’t become more affordable for all by making its purchase more expensive.