“We have to pass the bill so you can find out what’s in it...”

-Speaker Nancy Pelosi, March 9, 2010

Key Findings

- Employers faced with escalating costs and more government regulations will be forced to make an economic decision regarding company-provided health benefits for workers.

- Every employer and employee will be subject to increased government regulation, higher taxes and fewer personal choices in health care.

- The federal government will make decisions for providers and patients based not only on perceived “best practices,” but also on controlling costs.

- Ultimately Medicare and Medicaid patients in Washington State and across the country will have less access to health care, less input into their medical decisions and more dependence upon the government.

- Young adults will have a strong incentive to wait until they are ill or in an accident before buying insurance.

- 19 to 34-year-olds are already facing an unfunded liability burden from Social Security and Medicare of more than $123 trillion. The new federal health care law will continue to add to this liability, and will adversely affect the younger generation’s standard of living and quality of life.

- Decreasing Medicare reimbursements and expanding the number of Medicaid patients while decreasing the number of providers will compound the problem of finding a doctor for patients in these government programs.

Introduction

In March 2010, after 14 months of intense debate and with narrow partisan support and substantial bipartisan opposition in Congress, President Obama signed major health care reform legislation into law. Polls consistently show the Patient Protection and Affordable Care Act continues to be unpopular with the public. At no point in U.S. history has such broad, wide-sweeping social legislation become law by such a slim political margin.

This sweeping law empowers the federal government to manage the health care of all Washingtonians, as well as all other Americans. The national health law will affect every person in Washington, but will have specific consequences for various groups. In separate sections, this Policy Brief examines the new law’s impact on businesses, on Medicare and Medicaid recipients, on young adults and on health care providers in Washington State.

Overview of the Law

The final bill signed by the President is commonly referred to as the Affordable Care Act (ACA) or Obamacare. The non-partisan Congressional Budget Office (CBO) estimated the cost of the law would be $940 billion over the first 10 years from 2010 to 2019. Revenue to pay for the ACA are to come from a $500 billion cut to Medicare and $440 billion in new or expanded taxes. The CBO estimate was based on 10 years of revenue starting in 2010, but only six years of benefit payments starting in 2014. The most recent CBO projection was completed in 2012 and the agency now predicts the ACA will cost $1.76 trillion over the next ten years, with a $716 billion cut to Medicare and over $1 trillion in new taxes.

After removing $50 billion to $60 billion for administrative costs to pay for the 160 new agencies and government organizations, the balance of the $1.76 trillion in spending will essentially be used to fund two programs: a huge expansion of Medicaid, and taxpayer subsidies for people to purchase health insurance in the newly-created state and federally-run health insurance exchanges. Once benefits begin in 2014, estimates for any 10 year period run as high as two to three trillion dollars.

The Individual Mandate

The law is based on an individual mandate that requires every adult in the United States over the age of 17 to have government-approved health insurance or pay a penalty or tax. The tax begins at $95 per year and rises to $700 per year after three years. Individuals who do not have employer-provided or government-provided health insurance will be forced to purchase their own individual insurance policy.

The Employer Mandate

The ACA forces employers with 50 or more employees to provide employee health insurance or pay a tax. There are various formulas, but essentially the tax is set at $2,000 per employee per year. Employers will need to decide whether it is financially better to purchase employee health insurance or simply pay the tax. In July, 2012, President Obama announced that enforcement of the employer mandate would be delayed by one year to January 2015.

New Insurance Regulations

Health insurance companies face many new regulations under Obamacare, but two are critically important to the success of the ACA. The first regulation requires a company to sell insurance to any person regardless of pre-existing health conditions. Essentially this means a person can wait until he becomes sick or injured before purchasing insurance. This concept is called Guaranteed Issue. The second regulation places everyone into a community-rated risk pool. There will be small modifiers for age and smoking, but ultimately the young and healthy will be required to pay more and older, sicker people will pay less for similar health insurance.

State Health Insurance Exchanges

The state and federal exchanges will function as online insurance brokers where individuals and small groups can buy health insurance, often with a federal taxpayer subsidy. To date, only 15 states, including Washington State, have set up exchanges. The federal government has assumed responsibility for the exchanges in the other 35 states. Federal taxpayer subsidies will be provided in the exchanges for people earning between 138 and 400 percent of the federal poverty level (FPL) to help them purchase health insurance. Today, 400 percent of the FPL is $94,200 for a family of four. Approved rates and benefit packages in the various exchange plans are being set by government regulators.

Supreme Court Ruling

On June 28, 2012, the Supreme Court of the United States released its decision on the legality of the ACA. In a surprising two-part ruling, the Court found that the penalty Congress imposed on individuals for not having approved health insurance counted as a “tax” under the Constitution. The Court also found that the federal government could not constitutionally force states to expand their state Medicaid programs. This decision allowed the ACA to stand as passed by Congress with the exception that state legislatures are now free to decide whether or not to expand their state Medicaid programs.

Other legal challenges to specific parts of the law are currently working their way through the court system. One question is whether the law allows people who seek qualified health care coverage through the federal exchanges, rather than a state exchange, to receive a subsidy to help pay their monthly insurance premiums. A court ruling on this question is expected in the next year.

Impact on Business

Washington State has about 226,700 small businesses, each with fewer than 50 employees, and about 8,600 larger firms, each with 50 or more employees. Although the Affordable Care Act (ACA) is affecting various groups of workers differently, it does impose some common regulations on all employers. The law is being phased in and is scheduled to be fully implemented by 2018.

Effective since 2010, all employer-sponsored group plans have had have to cover employees’ adult children up to age 26. Employer plans may not exclude children up to age 19 for pre-existing medical conditions and they must cover preventive care. Small businesses with fewer than 25 employees may qualify for federal subsidy grants if they offer a wellness program.

Small businesses with less than 25 employees may qualify for tax credits if they pay at least 50 percent of the total health insurance premium cost for employees and the average wage of their employees is below $50,000. The tax credit a small business may receive is determined by the number of employees and by average wages. Basically, the smaller a business is, the larger the tax credit it could receive.

Phase I of the employer tax credit began in 2010. Eligible employers may qualify for a tax credit of up to 35 percent of their contribution toward employees’ insurance premiums. Phase II of the employer tax credit begins in 2014. Eligible employers may receive a credit of up to 50 percent of their portion of premium costs. However, these employers must purchase coverage through the state-based health exchange to qualify for the credit, and the credit is only good for two consecutive tax years.

The ACA imposes a 10 percent annual excise tax on tanning services. The tax started in 2010. Tanning salons collect the tax from customers and send it to the U.S. Treasury, so the tax functions like a federal sales tax.

In 2011, the ACA began requiring all employers to report the value of employee health benefits on workers’ yearly individual W-2 forms. The IRS will maintain a record of every American’s health insurance coverage. For individuals, failure to maintain government-acceptable health coverage will be a violation of federal law.

In 2011, the health care law imposed a new excise tax on insurance companies. Although these taxes can be passed on to consumers, the magnitude of the tax and the companies’ ability to remain competitive will require insurers to absorb the majority of this tax.

Starting in 2012, pharmaceutical manufacturers were required to begin paying a new excise tax. This industry is not large in Washington State, although the tax may affect the prices Washington residents pay for prescription drugs.

New Medicare taxes began in 2013. The Medicare tax on income went up 0.9 percent a year on wages over $200,000 for individuals and $250,000 for married couples. Taxpayers at these income levels are also required to pay a new 3.8 percent tax on “unearned” income, marking the first time a payroll tax has been applied to non-wage income.

Unearned income includes dividends, capital gains, rental income and, in certain cases, profits from home sales. Many business owners in Washington State are in this income bracket and are subject to the new taxes. The earning thresholds are not indexed for inflation, so the number of individuals and families hit by this tax will increase each year, as has happened in recent years with the federal Alternative Minimum Tax (AMT).

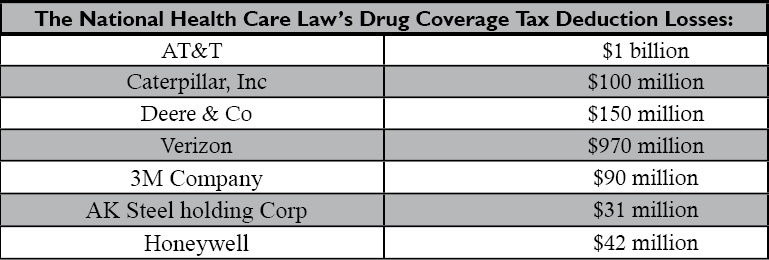

In 2013, the ACA ended the tax deduction employers receive for Medicare Part D retiree drug subsidy payments. Federal accounting rules require that businesses immediately write-down the cost of ending this deduction, resulting in significant losses in company value. In 2010, The Boeing Company announced a $150 million charge. Other large companies announced similar losses early on (see chart below) and many other companies have since been forced to follow suit.

About one-third of large U.S. companies, including many in Washington, offer the prescription drug benefit to their employees and retirees. Nationwide, an estimated 6.3 million retirees receive drug benefits from their former employers and they are reportedly at risk of losing coverage because of this tax change. The average subsidy amounts to about $665 per plan member.

If employers choose to stop offering the drug benefit in order to reduce costs imposed by the ACA, estimates show 1.5 to 2 million retirees will lose their employer-sponsored coverage and be forced into Medicare, an outcome that violates President Obama’s promise that no one who wanted to keep their health coverage would lose it under his plan.

Starting in 2013, medical device manufacturers had to start paying an excise tax of 2.9 percent on the value of their products. This new tax is being passed on to consumers or is being deducted from company research and development budgets. Massachusetts, home to many medical device makers, is particularly hard hit, and Minnesota-based Medtronic company reports the tax on medical devices could cost the company up to 1,000 jobs.

Federally-mandated, state-based insurance exchanges began October 1, 2013. Washington is one of only 15 states to establish a state health insurance exchange while 35 other states plan to use the federal exchange. The exchanges are intended to act as an insurance broker, connecting consumers with affordable health coverage. They do not function as open markets, however, because prices and benefit levels are fixed by the federal government.

Individuals and families earning up to 400 percent of the federal poverty level ($94,200 for a family of four in 2013 and $96,000 for that same family in 2016) can receive federal subsidies for the purchase of health insurance in the state-based exchanges. Employers with fewer than 100 workers were supposed to be allowed to purchase health insurance through the exchanges, but this feature of the ACA has been delayed.

Phase II of the employer mandate begins in 2014. Companies with more than 50 employees must provide full-time employees (defined as 30 hours per week) with health insurance or face a fine. For larger companies with more than 200 workers, if health coverage is offered, then all full-time employees must be automatically enrolled in one of the employer’s health plans every year. Workers may individually opt out of the employer plan, but it is up to the employer to provide adequate notice of the automatic enrollment and opt-out options.

This insurance must cover 60 percent of the individual employees’ premiums and must be “affordable,” which the ACA defines as premium costs that do not exceed 9.5 percent of a workers’ household income. If the premiums an employee must pay exceed this, they may receive a subsidy to purchase insurance through the exchange and the employer may face a penalty.

If the coverage offered by employers with 50 or more employees does not meet the ACA’s affordability standard, the employer will pay a fine of $3,000 for every full-time worker who receives a government subsidy. If the employer does not offer a health insurance plan, the fine is $2,000 for every full-time worker, not counting the first 30 full-time employees. Enforcement of the penalties will begin in 2015.

By January 2014, all health plans must comply with a federally-mandated benefits package. Federal officials have chosen 10 benefit mandates that every health insurance policy must cover. These mandates include pre-natal care, maternity and pediatric dental care. Obviously not everyone needs this coverage; a single, 60-year-old man has little need of maternity insurance, yet everyone will be forced to pay for this “basic” insurance coverage whether they want it or not.

More taxes will be imposed on drug manufacturers ($3.5 billion) and on private insurance companies ($13.9 billion) starting in 2017. These taxes will be followed by a $4.2 billion tax on pharmaceutical companies and a $14.3 billion tax on insurers starting in 2018. Drug companies will have an additional tax of $2.8 billion imposed in 2019.

Starting in 2018, a 40 percent excise tax will be placed on high-value health insurance plans, so-called Cadillac plans. The value levels at which the tax starts are $10,200 for individuals and $27,500 for families.

Policy Analysis of Business Impacts

Businesses and employment in Washington State will likely suffer as a result of the Affordable Care Act. Employers of all sizes are experiencing a significantly greater regulatory burden, more government-mandated paper work, fewer choices in health plans for their employees and no mechanism to control costs. These provisions will have a severely negative impact on employment. Researchers at Suffolk University’s Beacon Hill Institute found that the ACA would nationally “destroy a total of 120,000 to 700,000 jobs by 2019.”

Employers now offer health benefits as a recruitment tool to attract the best workers, or because of a moral commitment based on 65 years of traditional employer-sponsored health care in this country.

The national landscape has changed dramatically with the passage of the ACA, however. Employers faced with escalating costs and more government regulations will be forced to make an economic decision regarding company-provided health benefits for workers.

In many cases, paying the fine (or tax) for not offering health insurance will cost employers considerably less than paying for employee health coverage. Employers are already deciding to pay the lesser amount in taxation and to force their employees into the government-managed insurance exchange plans. Other companies are canceling coverage for part-time workers.

Still, others are ending coverage for the employed spouses of their workers, pointing out that working spouses must be offered coverage by their own employers under the new law. As a result, many workers are losing their current health coverage, despite President Obama’s repeated promise that no one would be forced into another health plan or to change doctors.

Other employers have begun reducing employee’s work hours to avoid the 30 hour per week threshold set by the ACA.

New rules mandating community rating and guaranteed issue of insurance are greatly impacting the private insurance industry. Carriers in Washington State, as well as throughout the country, will become dependent on government revenue, mandated benefit plans and government subsidies for their customers. Given the extensive web of regulations, penalties, taxes and oversight imposed once the ACA is fully implemented, private insurance companies will operate essentially like publicly-regulated utilities.

The ACA will dramatically change health care in Washington State. Every employer and employee will be subject to increased government regulation, higher taxes and fewer personal choices in health care.

Impact on Medicare and Medicaid

Medicare and Medicaid were enacted in 1965 with broad support by both political parties and with broad acceptance by the American public. Since then, Medicare and Medicaid have grown into two of the largest taxpayer-funded programs in the United States.

Medicare for the elderly has about 1,030,000 enrollees in Washington State with over 286,000 enrollees choosing to join Medicare Part C, also called the Medicare Advantage program. In addition, 357,000 people are enrolled in the government TRICARE program (which provides health coverage for military families) and pays providers at Medicare rates. Aging baby boomers will bring significant increases in Medicare enrollment in the next 30 to 40 years, as members of this generation reach age 65.

One-half of the funding for the new national health care reform law will come from almost $716 billion in cuts in the Medicare program over the next 10 years. These cuts are taken from payments to physicians and hospitals. Cuts to Medicare Part C have been delayed for two years until 2015, but most observers believe they will eventually occur. Once implemented, Medicare Part C cuts are expected to virtually eliminate the Medicare Advantage program.

The Medicaid entitlement program for low-income families has approximately 1.35 million recipients in Washington State. Under the requirements of the ACA, an estimated 320,000 to 400,000 more people will be added to Washington’s state Medicaid program. Federal taxpayers will pay for these added Medicaid patients for the first six years of the expansion. State taxpayers will then be required to pay 10 percent of the new costs. Of course, state taxpayers and federal taxpayers are the same people, so taxpayers in Washington will be helping to pay all the costs of the expanded program.

Starting in 2010, the federal government prohibited new doctor-owned hospitals from participating in Medicare and limited expansion of existing physician-owned facilities. Also starting in 2010, Medicare Part D, the prescription drug program, expanded so that by 2020 all drug benefits will be funded by the program.

Medicare started cutting payments to inpatient psychiatric hospitals in 2010. The federal government also established a new agency, the Federal Coordinated Health Care Office, with the intention of improving care for people receiving both Medicare and Medicaid.

The government increased the mandatory Medicaid drug rebate from 15.1 percent to 23.1 percent in 2010. That means drug manufactures are now paying an additional eight percent to the states for drugs sold through the Medicaid program. The federal government will also increase the funding and the role of the Medicaid Payment and Access Commission to help manage care for Medicaid enrollees.

The Center for Medicare and Medicaid Services (CMS) started choosing winners and losers among hospitals in 2011. Hospitals in defined “low-cost areas” receive higher reimbursements while primary care doctors in designated “shortage areas,” along with general surgeons, receive an annual 10 percent bonus payment for five years. Government officials have decided that hospitals and doctors outside these approved areas will receive no additional payments.

Cuts in Medicare started affecting many health services and facilities starting in 2011. General hospitals, nursing homes, inpatient rehabilitation units and long-term care facilities all experienced a reduction in compensation. Home health care workers, physicians, diagnostic laboratories, ambulance services and durable medical equipment suppliers also saw cuts in their reimbursement payments. Government cuts in reimbursement rates often result in reduced access to health care for patients.

In 2011, CMS established an Innovation Center to experiment with creative payment ideas and froze Medicare Part B means testing at 2010 levels.

Also in 2011, Medicaid prohibited payment to providers for services related to health-acquired conditions. In other words, Medicaid will not pay for treating medical complications that arise during treatment.

Under the ACA, Medicaid officials began an effort to change the way health care is administered. CMS, through Medicaid, will provide funds to establish mandatory medical homes for patients, which are the latest variation of health maintenance organizations (HMOs). Long-term care in non-institutionalized settings and community-based support for people with disabilities now receive more money.

Medicare began funding Accountable Care Organizations (ACOs) in 2012. These function as a doctor-hospital partnership so that decreased spending can occur by way of a single check. Doctors will either be employed by hospitals or will enter into a form of health maintenance organization (HMO) relationship with the hospital.

Along with ACOs, Medicare established “value-based” purchasing programs in 2012 that must determine reimbursements for hospitals, home health agencies and ambulatory surgery centers. In 2012, Medicaid began “bundled” payments with a single-capitated reimbursement to doctors and the hospital for an enrollee’s specific care. Mental hospitals received increase in payments for the acute care of Medicaid patients.

Ironically, Medicare cut reimbursements to psychiatric hospitals in 2013. Cuts are also scheduled for payment of hospital re-admissions and for hospice care in the Medicare program. Taxpayer subsidies for the purchase of drugs under Medicare Part D increased in 2013.

A new Medicare tax on the “rich” began in 2013. Single taxpayers earning more than $200,000 per year and couples earning more than $250,000 received a mandatory 0.9 percent increase in their Medicare payroll taxes. This increases the total Medicare payroll tax for these individuals to 3.8 percent. Also, these same taxpayers are now required to pay a new 3.8 percent Medicare tax on “unearned” income, that is earnings from capital investments, dividends, rental income and, in some cases, the sale of real property. The definition of “rich” is fixed and does not increase with inflation or the cost of living. Consequently, as wages increase over time, more Americans will find themselves being defined as “rich” by the government and will be forced to pay these new taxes.

State Medicaid programs increased payments for primary care in 2013. This increase is funded exclusively by money collected from federal taxpayers.

In 2014, Medicare is scheduled to establish a non-elected Independent Payment Advisory Board (IPAB) which will make recommendations to reduce the spending growth rate. Medical spending cuts ordered by the Board will go into effect unless blocked by Congress. Further cuts to Medicare Part C and to home health care payments will occur the same year.

In 2014 a huge expansion of state Medicaid programs will occur, as all adults, 18 and older, earning less than 138 percent of the federal poverty level become eligible for coverage. Medicaid in Washington State already covers people who earn up to 250 percent of the FPL. Initially federal taxpayers will fund this expansion, but after six years, state taxpayers must pay 10 percent of these new costs. At the same time, Medicaid is scheduled to reduce payments to hospitals that take care of a disproportionate share of Medicaid patients.

In 2015, Medicare will make further cuts to home health services and will decrease hospital reimbursements for hospital-acquired infections.

Starting in 2018, the IPAB must give recommendations for cutting costs in Medicare to Congress, if Medicare per capita spending is greater than the gross domestic product per capita plus 1 percent. Presumably these cost-cutting recommendations will then become law.

Policy Analysis of Medicare and Medicaid Impacts

Medicare currently reimburses providers at about 70 percent of what private insurers pay. Medicaid reimburses roughly 60 percent of what Medicare pays. Because of these low payments, fewer providers are willing to see new patients covered by these two government programs. Consequently, Medicare and Medicaid patients have a difficult time finding health care services today. Slashing Medicare reimbursements and greatly expanding Medicaid will only compound this access problem.

Restricting doctor-owned hospitals limit patient choices in health care, especially when these facilities have been shown to hold costs down.

According to the last report of the Medicare Trustees, the program already has a $42 trillion unfunded liability, provided the cuts to Medicare in the ACA occur. If these cuts don’t take place, the unfunded liability increases dramatically to $90 trillion. Clearly financial reforms are necessary, but the random cuts mandated by the President’s national health care law are not a long term solution and they are not in the best interests of the patients.

Instead of allowing patients more control over their health care dollars and treatment decisions, the ACA gives the federal government unprecedented control over patients’ health care. The federal IPAB will make decisions for providers and patients based not only on perceived “best practices,” but also on controlling costs.

The Board may find that a 70-year-old woman is “best treated” by giving her pain medicine rather than a joint replacement procedure. Perhaps heart surgery for anyone over the age of 70 will be prohibited, so medical care can be redirected to younger people. This is exactly the kind of top-down rationing that countries with government-managed medicine, like Great Britain, are now doing through their nationalized health programs. Often the result of national health policy is increased suffering and a lower quality of life for citizens.

From a public policy standpoint, the new Medicare tax on “unearned” income is a huge shift in funding for the program. Currently Medicare, like Social Security, is funded by a payroll tax as a social insurance program. This new 3.8 percent tax decouples Medicare funding from workers’ payroll and makes Medicare a regular welfare program, in which some taxpayers will be forced to pay for another individual’s care.

The new costs created by the huge Medicaid expansion are essentially unknown. At current rates, Washington State taxpayers will pay an additional $680 million to $8.7 billion over the first 10 years of the expansion. The second 10 years of the expansion will cost closer to the $8.7 billion number if state and federal taxes are combined.

The tragedy is that having Medicaid health insurance is not better than being uninsured. A recent study from Oregon reported in the New England Journal of Medicine, confirmed that in a randomized, controlled study, Medicaid patients had no better health outcomes, nor did they live longer than a similar group of people without health insurance.

The real unknown is the impact of the individual and employer mandates to purchase health insurance required by the new health care law. Employers will be required to choose between paying for employee health benefits or paying a fine. No one knows how many employers will drop their employee benefits and force workers into the Medicaid program because they find paying the fine is cheaper.

Inconsistencies run throughout the new health reform law. Although Medicare and Medicaid are both government-run programs, under the new law Medicare will be cut in such areas as home health and inpatient psychiatric care, whereas Medicaid receives more funding in these areas. The ultimate control of health care funding, however, will be given to federal regulators who will have no knowledge or interaction with individual patients and their providers. If their decisions increase the suffering of patients, it is unlikely the regulators will know about it.

Throughout the implementation of the new health care law, drug companies and medical device manufacturers will face significant tax increases. The cost of these taxes will either be passed on to health care consumers or will be deducted from research and development budgets. The cost of new taxes cannot be passed on to Medicare and Medicaid patients because of government-mandated fixed reimbursements.

The resulting decrease in research and development funding will mean fewer new drugs and devices will be developed, which in turn will have an adverse effect on the medical treatment of Medicare and Medicaid patients. After a century of progress, the ACA will begin to reduce the ability of American medicine to conquer historically crippling diseases, like cancer, AIDS, Multiple Sclerosis and diabetes.

Ultimately Medicare and Medicaid patients in Washington State and across the country will have less access to health care, less input into their medical decisions and more dependence upon the government.

Impact on Young Adults

In 2012, Washington State had approximately 1.4 million people ages 19 to 34. This group represents about 21 percent of the state’s population.

These 19 to 34-year-olds are the healthiest of all age groups and have the least need for medical care. Many of them still live at home, are in school or are just starting out in the workforce in low paying, entry-level jobs. At this stage of their lives, paying for health insurance is a low priority for them.

The new health care legislation redefines “child” as anyone under the age of 26. Starting in 2010, all family insurance plans have had to cover everyone up to age 26, and no one under the age of 19 could be denied coverage for pre-existing conditions.

Health savings accounts (HSAs) and flexible savings accounts (FSAs) with high-deductible insurance plans are excellent choices for the young and healthy.Unfortunately, under a provision of the new health care law, starting in 2011, funds from these personal medical accounts cannot be used to purchase over-the-counter medications.

New taxes on drug manufacturers began in 2011. New taxes on medical devices started in 2013 and, like all of the taxes in the new federal health care law, they will be passed on to all consumers regardless of age.

Many of the key features of the federal health care reform begin in 2014. The individual mandate starts in 2014 and will force every adult over the age of 17 to buy health insurance or pay a fine or tax of either $695 or 2.5 percent of income per year, whichever is larger.

State-based insurance exchanges, including Washington’s, begin in 2014. Although states will be responsible for their administration, the federal government must first approve all prices and benefit packages offered by the exchanges. People who earn up to 400 percent of the federal poverty level ($46,000 for a single person and $94,200 for a family of four) will be eligible for federal taxpayer subsidies if they buy insurance through an exchange. The law does allow state exchanges to offer catastrophic coverage for people up to age 30.

The new Medicaid program begins in 2014 and will provide taxpayer-funded health insurance for any adult who makes less than 138 percent of the federal poverty level ($15,900 for a single and $32,500 for a family of four).

Two new insurance regulations start in 2014. Insurance companies must use community rating, where everyone regardless of age and health status pays roughly the same amount for comparable insurance coverage. Insurance companies are also bound by guaranteed issue rules, which means no matter how sick a person is, an insurance company cannot deny that person health insurance. Private insurance plans must also pay for government-approved “essential benefits,” making many health insurance policies that are legal today illegal after January 1, 2014.

Taxes on private insurance premiums begin in 2014 and will undoubtedly be passed to consumers. Employees will be able to receive a 30 to 50 percent rebate on the cost of insurance, if their employer offers a wellness program approved by the government.

An excise tax of 40 percent on high-end private health insurance plans begins in 2018.

Policy Analysis of Young Adult Impacts

As a group, young adults are the least likely to need health care services. They have survived childhood illnesses and are generally not old enough to suffer age-related diseases such as cancer, arthritis or heart disease.

They represent a high percentage (up to 60 percent) of the uninsured population largely because they are young and healthy and have financial priorities other than buying insurance.

The new federal health care legislation will force all 19 to 34-year-olds who are not covered by a family plan to purchase health insurance or pay a yearly tax. Because of the community rating rule, insurance premiums for young adults will be artificially high to help pay for older, sicker people in the insurance pool. Young adults will make an economic decision and decide whether it is cheaper to buy insurance or to pay the tax.

The financial success of the ACA is dependent upon on young, healthy adults paying for insurance they don’t need and won’t use. If only older, sicker people sign up for health insurance, the cost of the ACA will escalate dramatically.

Young adults will also consider the fact that insurance companies must sell them policies regardless of pre-existing conditions. Young adults will have a strong incentive to wait until they are ill or in an accident before buying insurance, often described as signing up for insurance on the way to the emergency room.

The new health care law allows catastrophic insurance policies for people under the age of 30. Under normal market conditions, a low-cost, high-deductible, catastrophic plan coupled with a tax-free HSA would provide ideal coverage for most 19 to 34-year-olds, and this is one workable solution to the exploding cost of health care. The Washington State exchange does offer one catastrophic plan for young adults.

Many young adults will start their work careers in low-paying jobs, earning less than 138 percent of the federal poverty level. They will then be forced into the Medicaid program and tragically, can expect no better health care outcomes than if they had no insurance.

People earning 138 percent to 400 percent of the federal poverty level will qualify for taxpayer subsidies in the insurance exchange. The Urban Institute estimates that 80 percent to 90 percent of 19 to 34-year-olds will qualify for these subsidies. Of course, as these young adults grow older and enter their high-earning years, they will potentially lose that subsidy.

All health care users, including young adults, will pay more because of the new taxes on drug manufacturers, medical devices and insurance companies. These taxes will be passed on to consumers in the form of higher drug, device and premiums prices.

The biggest impact on the younger generation is the high level of deficit spending by the federal government. Deficits simply pass the government’s current cost from the older generation to the younger. The 19 to 34-year-olds are already facing an unfunded liability burden from Social Security and Medicare of more than $123 trillion. The new federal health care law will continue to add to this liability and will adversely affect the younger generation’s standard of living and quality of life.

Impact on Providers

Washington State has 98 community hospitals, including 92 acute care facilities. Approximately 12,050 physicians, of whom about 6,000 are in primary care, practice medicine in Washington. Almost 20 percent of these primary care doctors plan to retire within the next five years. Even before passage of the health care law, it was estimated that Washington State will need at least 900 more primary care doctors by 2020.

The ACA will have a tremendous effect on doctors and other health care providers. Although there will be some rebalance of Medicare doctor reimbursements across the country, physicians face on average a 25 percent decrease in pay for all Medicare patients. The federal government started reducing funds for inpatient psychiatric hospitals, long-term care and rehabilitation facilities in 2010.

Under the new health care law, the federal government will establish a Work Advisory Committee to try to determine health manpower needs. More student scholarships and loans will be available (although the dollar amounts are not specified) and more Medicare funding will go toward training primary care doctors. Declining government reimbursement payments, however, will encourage many talented and ambitious students to choose professions where their chances for career success are less limited by artificial government rules.

A new Patient-Centered Outcome Research Institute (one of some 159 new government agencies included in the legislation) will undertake comparative effectiveness medical research.

On December 31, 2010, the government banned new physician-owned hospitals and placed sharp limits on the growth of existing private doctors’ hospitals. Washington State lawmakers imposed a similar prohibition in 2000, but under the health care law the ban on new physician-owned hospitals will be extended nationwide. The ban on business investments for doctors will further discourage young people from entering the profession.

People working in long-term care facilities, home health programs, ambulance services, diagnostic labs and durable medical equipment manufacturing all experienced reductions in government reimbursements starting in 2011.

Federal payments to states for Medicaid services related to “health care acquired conditions” stopped in 2011. In other words, if the federal government determines that Medicaid patients have complications because of their care and not from their original diseases, the providers will not be reimbursed for treating these new conditions.

Also in 2011, the Center for Medicare and Medicaid Services (CMS) established the Center for Medicare and Medicaid Innovation (CMI). This new agency will create payment incentives for delivery models that attempt to improve the quality of care and lower costs. Another new agency will attempt to strengthen emergency room and trauma care services.

Some winners emerged in 2011. Primary care doctors and general surgeons received a 10 percent pay bonus for treating Medicaid patients -- good for only five years. Community health centers received an additional $11 billion over five years. Doctors in so-called frontier states, North Dakota, Montana, Wyoming, South Dakota and Utah – will receive higher (how much higher is yet to be determined) Medicare reimbursements. Five year “demonstration programs” for tort reform began in 2011. Beyond this vague description, no specific or meaningful tort reform program was included in the new law. In 2012 the health care law imposed additional Medicare pay cuts to hospitals, nursing homes, inpatient rehabilitation facilities and dialysis programs.

In 2013, Medicare started to evaluate “bundled payments” to doctors and hospitals. This means the government will write one check for all the care an individual patient receives. Hospitals and doctors will then be forced to determine how that check is divided, resulting in increased conflict and tension within the medical profession. The Medicare program will continue provider cuts to hospices and to hospitals with high patient re-admission rates.

Also in 2013, a mandatory program began that will impose a pay-for-quality policy in federal reimbursements. Under the program the definition of “quality” will be decided by government regulators, not by health care consumers. The criteria are still under review, but will probably include such things as infection rates and the incidence of in-hospital heart attacks. The fewer of these complications a hospital has, the larger the amount of federal money it will receive.

Financial relationship disclosures between hospitals, doctors, pharmacists and drug manufacturers also began in 2013.

The Medicare payroll tax increased 0.9 percent on income greater than $200,000 for individuals and $250,000 for married couples in 2013. This brings the total Medicare payroll tax on the “rich” to 3.8 percent. A new 3.8 percent tax will also be added to “unearned income” for these same taxpayers. Many doctors and hospital administrators are in these income brackets, so in addition to receiving less pay from Medicare, they will be forced to pay more in Medicare taxes.

Starting in 2014, the new health care law tremendously expands the government’s day-to-day involvement in health care. Medicaid expands and will include any adult earning up to 138 percent of the federal poverty level (FPL). States must establish insurance exchanges that will function as government-run insurance brokers. Washington is one of 15 states that has set up an exchange. The other states have elected to use the federal exchange.

The individual mandate requiring every person in the country to buy government-approved health insurance starts in 2014. Federal subsidies will be given to people earning up to 400 percent of the FPL ($94,200 for a family of four today and $96,000 for that same family in 2016) if they purchase approved health insurance through a state or federally-managed exchange.

A Medicare Commission will be established in 2014 with the intention of reducing the per capita rate of growth in the program. Hospitals in general will see further pay cuts for patients with hospital acquired infections, and hospitals with a high percentage of Medicaid patients will experience further reductions in government funds.

The employer mandate to purchase health insurance for employees begins in 2015. Doctors in private practice and all hospitals will be subject to this mandate.

In 2015, physicians will receive a reimbursement differential based on quality of care compared to cost. Government agencies, not patients, will define the meaning of “quality of care.” Hospitals with a higher rate of re-admissions (as determined by the government) will see decrease pay from Medicare. Home health programs will experience more Medicare cuts.

By 2016, the bundling reimbursement programs will be implemented, depending on the judgment of the Secretary of the Department of Health and Human Services. The new Medicaid program will revert back to a shared cost basis with states (90 percent federal dollars and 10 percent state dollars, although federal and state taxpayers are the same people).

In 2017, all doctors will be subject to the required pay-for-quality program. Physicians will be reimbursed by complying with government-mandated treatments and by not having patient complications.

Policy Analysis of Provider Impacts

The Congressional Budget Office estimated the minimum cost of President Obama’s health care law to be $1.76 trillion over the first 10 years. A large part of the funding will come from $716 billion in cuts to the Medicare program. Included in this $716 billion are significant cuts in payments to hospitals and to doctors.

Medicare currently reimburses physicians at 70 percent to 80 percent of private insurance. Hospital reimbursements are even lower at 65 percent to 70 percent of what private insurance pays. Medicaid, in general, reimburses about 60 percent of what Medicare pays or about 40 percent of what private insurers pay. Many doctors are now losing money whenever they see a Medicare patient, let alone a Medicaid patient, and at least 40 percent of Washington State physicians have stopped seeing new Medicare participants.

Consequently, access to health care services, not access to health insurance, has become a more significant problem for these government-sponsored patient groups. Decreasing Medicare reimbursements and expanding the number of Medicaid patients while decreasing the number of providers will compound the problem of finding a doctor for these patients.

Many smaller hospitals, especially in rural areas, will have trouble staying open as the government cuts back on Medicare and Medicaid reimbursements. Even larger hospitals will struggle financially. Demand for care will increase as Baby-Boomers reach Medicare age and as the enrollment in Medicaid, as required under the ACA, increases dramatically. At the same time, reimbursement payments for these two government programs will go down. Hospitals will need to become very efficient and major facility consolidation will undoubtedly occur, leaving fewer choices for patients.

Physician-owned hospitals have in many cases proved to be more cost efficient while providing a better patient experience. Outlawing these innovative facilities only decreases competition and restricts patient choices.

In addition to the severe decrease in provider reimbursement, the bundling of pay into a single check will dramatically change our health care delivery system. For simplicity and expediency, this bundling will force doctors into financial arrangements with hospitals. It is very likely that most doctors in the future will either be employed by hospitals, rather than maintaining independent practices, or will at least enter into a financial partnership with hospitals.

The ACA does not solve the escalating cost of malpractice insurance for providers. It is estimated that between 10 percent to 20 percent of overall health care costs are due to the legal system, specifically due to the fact that providers practice defensive medicine by ordering additional tests and procedures. Although the new law allows for pilot programs, it does not establish meaningful legal reform.

Massachusetts passed a state universal health care law in 2006. It is essentially the template for the national health care law signed by President Obama, including individual and employer mandates, a government-run insurance exchange with state subsidies, community rating and guaranteed issue of insurance.

After passage of the state plan, Massachusetts’ uninsured rate dropped from around 10% to 3%, but the unintended consequences have been dramatic. Demand for health care exploded, costs exceeded the budget by over $1 billion and access to providers dropped precipitously. Residents in Massachusetts have some of the longest wait times in the country to see a primary care doctor. There is every indication that across the country similar problems with patients gaining access to providers will develop under the ACA.

A fundamental problem with the American health care system is one of increasing cost. This rise in cost is driven by the fact that almost 90% of health care in the United States is paid for by a third party – either an employer or a government agency. Patients are therefore disconnected from the true cost of their care and have little or no interest in seeking the most cost-effective treatments. The new health care law magnifies this problem by further disconnecting patients from the cost of the care they receive.

Under the ACA, the only way for the government to hold down costs will be to force more regulations and price controls on the health care delivery system. Instead of allowing the free market and consumer choices to stimulate innovation and best practices, President Obama’s health care law creates dozens of powerful new government agencies, like The Patient Centered Outcome Research Institute, the Independent Payment Advisory Board and The Center for Medicare and Medicaid Innovation, to make health care decisions for patients and providers.

As demand continues to rise, rationing of health care by the government will likely occur. Patients will experience increased suffering, longer wait times to see physicians and fewer physicians to choose from. Overall, the ACA requires that people’s major health care decisions be made by government program managers, not by their doctors, as is already happening in Massachusetts.

Conclusion

The Patient Protection and Affordable Care Act allows the government to take over one sixth of the U. S. economy and dictate a top-down, one-size-fits-all health care system to the entire country. In spite of claims made during the debate, the ACA:

- Does not provide universal health insurance coverage.

- Is not allowing people to keep their existing health insurance plans.

- Is not eliminating waste, fraud and abuse.

- Will not control costs unless health care is severely rationed.

- Violates people’s fundamental rights by mandating they purchase a costly private product defined by the government.

This country was founded on individual choice, personal responsibility and the rights of states over the federal government. Already, implementation of the ACA has resulted in the loss of existing health coverage for 290,000 Washingtonians. As implementation continues, the ACA will continue to adversely impact and severely restrict choices for virtually everyone in Washington State.

Download a PDF of this Policy Brief here.