In a Seattle Times' recent column, "Another ‘millionaires tax’ finds Seattle is far richer than anyone knew," celebrates a $115 million haul from the city's 5% tax on compensation over $1 million, far exceeding the cities projections of $50 million to $65.8 million.

Mayor Katie Wilson's blunt assessment suggests progressive taxes on high earners are sustainable and lucrative. While highlighting revenue surprises, Seattle Times reporter, Danny Westneat’s article rests on flawed assumptions that conflate business income with individual high earners, downplays migration risks, and ignores the delayed nature of behavioral responses to taxation.

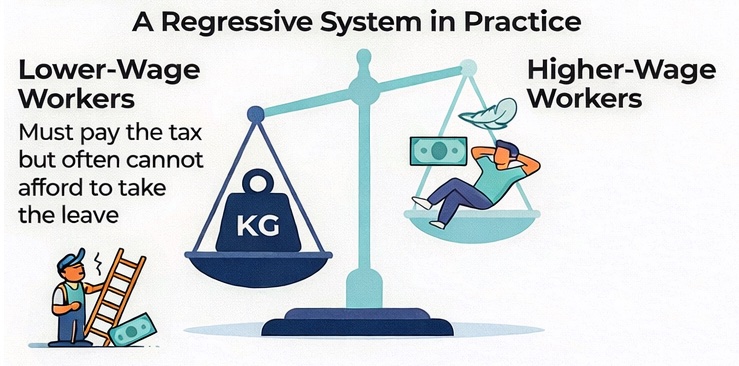

First, the article repeatedly blurs the line between businesses and high earners. It notes the tax is paid by 170 Seattle companies, not individuals directly, and suggests that since companies haven't fled en masse, the policy works. But this payroll-style levy burdens employers who must absorb or pass on costs, higher compensation taxes reduce net take-home for executives, discourage talent attraction, and squeeze profit margins for pass-through entities and small-to-mid-sized firms that dominate Washington's economy. When a new tax is introduced, inevitably it takes several years to stabilize and for those who planning on leaving, a few years before the relocation is complete.

High earners aren't faceless plutocrats. Many are entrepreneurs, tech innovators, and small business owners whose compensation includes stock grants or bonuses. Treating corporate payment as proof of resilience ignores how these taxes erode the incentives that drive job creation and investment. The real hit falls on the broader ecosystem, not just "the rich."

Second, the article understates the delay in high earners leaving Seattle and Washington. Behavioral changes like relocation take time, establishing domicile elsewhere involves legal, family, and professional hurdles. Office leases tie a business to a location for several years and the true impact won’t be seen until those businesses are free to leave.

Anecdotal evidence already points to state outflows. Hedge fund manager Brian Heywood testified to knowing dozens of couples, including prominent figures, shifting residences to no-income-tax states like Florida, Texas, or Nevada. Reports from 2025 show net losses of high-income households (over $200,000) to lower-tax jurisdictions, with Las Vegas seeing a surge in Seattle transplants buying multimillion-dollar homes.

Perhaps if Washingtons Department of Revenue published timely data on business creation and business failure, the evidence wouldn’t be quite so anecdotal.

This author receives multiple calls and emails a week from former and soon to be former business owners who are leaving Washington because of the threat and instability of the tax environment in Washington.

The tax's first-year over performance reflects wealth already here, tied to volatile stock-based pay amid a strong market, not proof that people won't leave once cumulative burdens (Seattle's JumpStart taxes, state capital gains levy, and proposed 9.9% income tax via Senate Bill 6346 compound). Migration often lags policy by years, as seen in California and New York, where high earners quietly decamp after thresholds are crossed.

The column's core assumption, that wildly exceeding projections validates endless taxation, is dangerously optimistic. Past "millionaires taxes" (JumpStart, capital gains) also beat forecasts initially due to underestimated wealth concentration and market booms, yet they introduce volatility and long-term risks. Projections routinely low ball because experts can't predict human behavior under new incentives. Claiming "larger variance cannot be ruled out" as evidence of inexhaustible riches dismisses warnings from economists about capital flight, reduced investment, and job losses when top combined rates approach or exceed 18% in Seattle.

Policymakers should heed these realities rather than celebrate short-term windfalls. Washington's no-income-tax advantage has fueled growth, eroding it risks turning "filthy rich" into "formerly rich." Sustainable revenue comes from expanding opportunity, not chasing high earners who can, and eventually will, vote with their feet.