Key findings

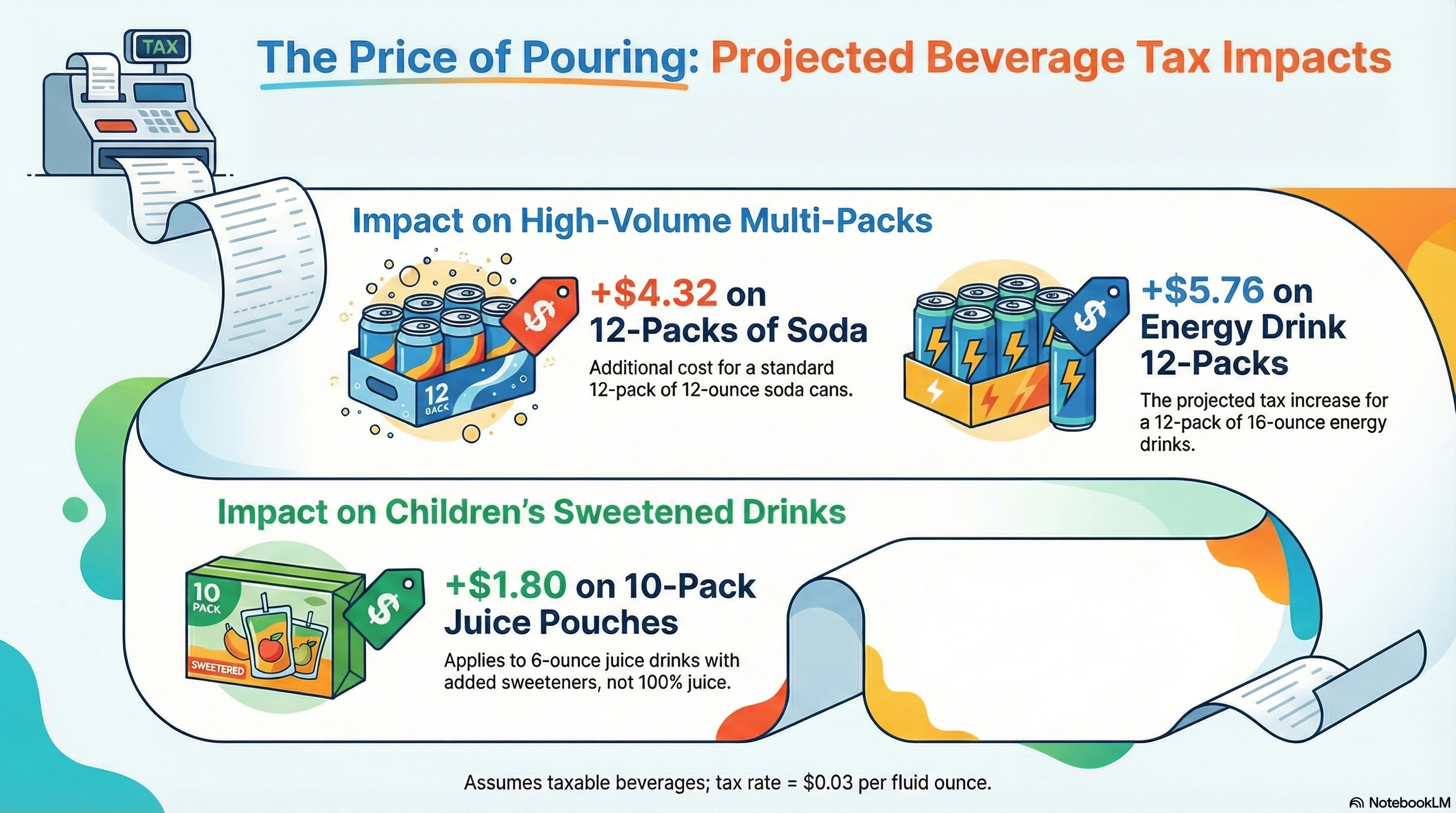

1. In 2018, Seattle imposed a soda tax on residents, sharply increasing the cost of all soda drinks sold in the city.

2. While consumer prices and city tax revenue increased, the tax did not deliver the public health benefits that tax-increase supporters promised.

3. A soda tax is unpopular. In 2018 voters passed a statewide ballot initiative that bans local soda taxes.

4. A state bill, SB 5371, would evade the local ban by imposing a Seattle-style soda tax on communities statewide.

5. Studies of Oakland’s soda tax and findings by Cornell University researchers show that a soda tax does not result in improved health outcomes.

6. SB 5371 sets the Legislature up for failure. It would increase revenue to the state and increase costs to consumers but is unlikely to provide health benefits to the public.

Introduction

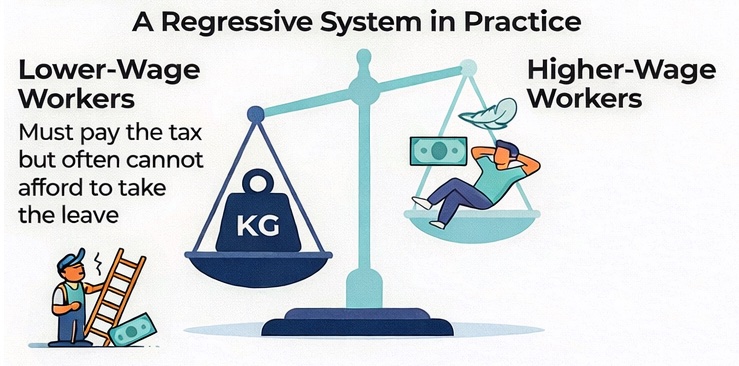

In 2018 the city council and mayor of Seattle imposed a special tax on “sweetened beverages,” sharply increasing the consumer cost of all soda drinks sold in the city. The tax is imposed on the distributor, but it is paid by consumers in the form of higher retail prices. The tax falls hardest on convenience stores and other small retailers, especially those located in low-income neighborhoods.

At the same time, city officials claimed the tax would discourage the consumption of sweetened drinks and would deliver a number of public health benefits. In the years since the tax was imposed, however, none of the health benefits promised by Seattle officials have been realized.

There is now an effort to enact a soda tax statewide. This Legislative Memo analyzes SB 5371, legislation to impose the Seattle-style soda tax on all communities in Washington State.

Read the full Legislative Memo here.