Lawmakers are again considering a proposal that would change how the payroll tax rate is calculated for Washington state’s Paid Family and Medical Leave (PFML) program. Most W-2 employees pay into PFML, but not everyone qualifies for benefits, and some workers who qualify still can’t realistically use them.

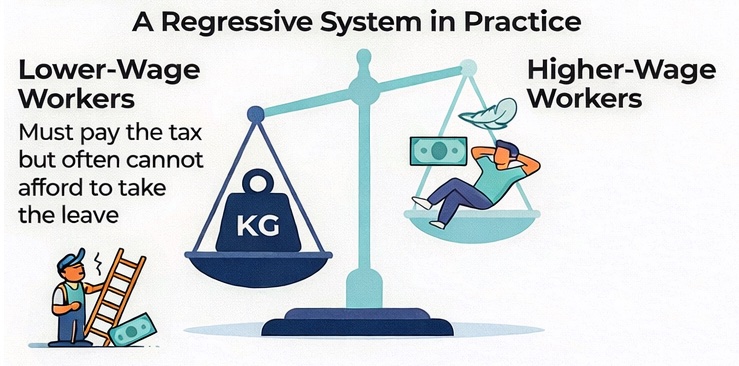

It should not be a surprise that low-wage workers use PFML least. Paid leave isn’t designed to replace a worker’s full paycheck. And many low-wage workers don’t meet the program’s eligibility requirements tied to work history. The result is that PFML functions less like a safety net and more like a worker-paid benefit that is most accessible to middle- and higher-wage earners.

Program payouts have increased alongside tax rate increases, outpacing projections. That should have been expected: When workers are forced to pay into a benefit, they will predictably look for ways to use it. PFML’s tax rate has grown from 0.4% of wages when the program began in 2019 to 1.13% as of Jan. 1, 2026. (Individual workers can estimate how much they’ll pay to PFML in 2026 here.)

Despite taking more and more money from workers, the program faces short-term deficits tied to high utilization. Fund managers believe they can reduce those swings by shifting to a more forward-looking approach to setting the tax rate. That’s reasonable — and it’s what Senate Bill 5292 would do.

The bill would not, however, solve long-term solvency concerns. That’s why lawmakers have previously discussed raising or removing the statutory rate cap (currently 1.2%), combining it with this rate-structuring bill. Some lawmakers have floated a cap as high as 2%, even though that may still not be enough to fulfill PFML’s promises. A 2% cap would mean $2 of every $100 in wages could be taken to fund paid leave benefits for others.

I testified in the Senate Labor and Commerce Committee Friday, concerned SB 5292 would once again become a vehicle for that bad idea. (See my testimony below.)

The committee chairwoman seems confident the proposal can move through the session without a drastic tax-rate-cap increase being attached to it. I hope she’s right. And before lawmakers consider higher taxes, they should first consider benefit-side reforms. Lawmakers could start by limiting repeat usage, which happens frequently. They could also reduce the maximum duration of leave. Right now, a beneficiary can receive up to 18 weeks of paid leave.

Sen. Curtis King, R-Yakima, just filed four bills aimed at solvency protections without increasing the rate cap: SB 6140, SB 6141, SB 6142 and SB 6143. Workers should hope these bills receive hearings and can be considered sooner rather than later. Many lawmakers remain committed to the program as designed, but workers — including low-wage workers who are least able to absorb payroll deductions — need paycheck protection.

Lawmakers should stabilize the PFML fund by passing an unaltered SB 5292 and, at the same time, better protect workers’ paychecks with Sen. King’s solvency bills.

—————

My testimony on SB 5292:

"Chairwoman and members of the committee — thank you for the opportunity to testify. I’m Elizabeth New, a director and policy analyst with Washington Policy Center.

Last session when this bill was considered, the House amended it to add an incremental increase to the rate cap until it reached 2%, and even 2% was considered insufficient for solvency.

As you heard this morning, the current rate cap is 1.2%, and we are already close to that amount at 1.13%. When this payroll tax began in 2019, the rate was .4%.

The tax and the payouts have seen considerable increases in this program’s short lifetime. It is unsustainable and harmful to the majority of Washington workers who are forced to pay in.

I registered as “other” for this testimony, concerned that SB 5292 will again become a vehicle for changing the rate cap, allowing this payroll tax to take even more wages from workers, including low-income ones whose wages should be available for their own life needs. Often, some of low-income workers’ earnings are given over to people with higher incomes and no need for taxpayer dependency. PFML is progressive in rhetoric but regressive in reality.

In fiscal year 2025, people making $61 dollars or more an hour used PFML more than twice as much as the lowest-wage workers — with many of them having more than one claim. And usage among the bottom wage quintile was just 8% of all claims in FY 2025. Participation among top earners keeps climbing.

PFML is not a safety net. PFML is also easily misused because of loose qualifications for the benefit.

I urge you to reconsider this program that mandates paid leave for some workers at other workers’ expense, especially as it has proven to be a state-mandated benefit for middle- and upper-wage earners.

At the least, to help address affordability in the state, it makes sense to make adjustments to the overly generous benefit before increasing the tax rate even higher. I see Sen. King has introduced four bills that would help control program costs.

Thank you for your time.