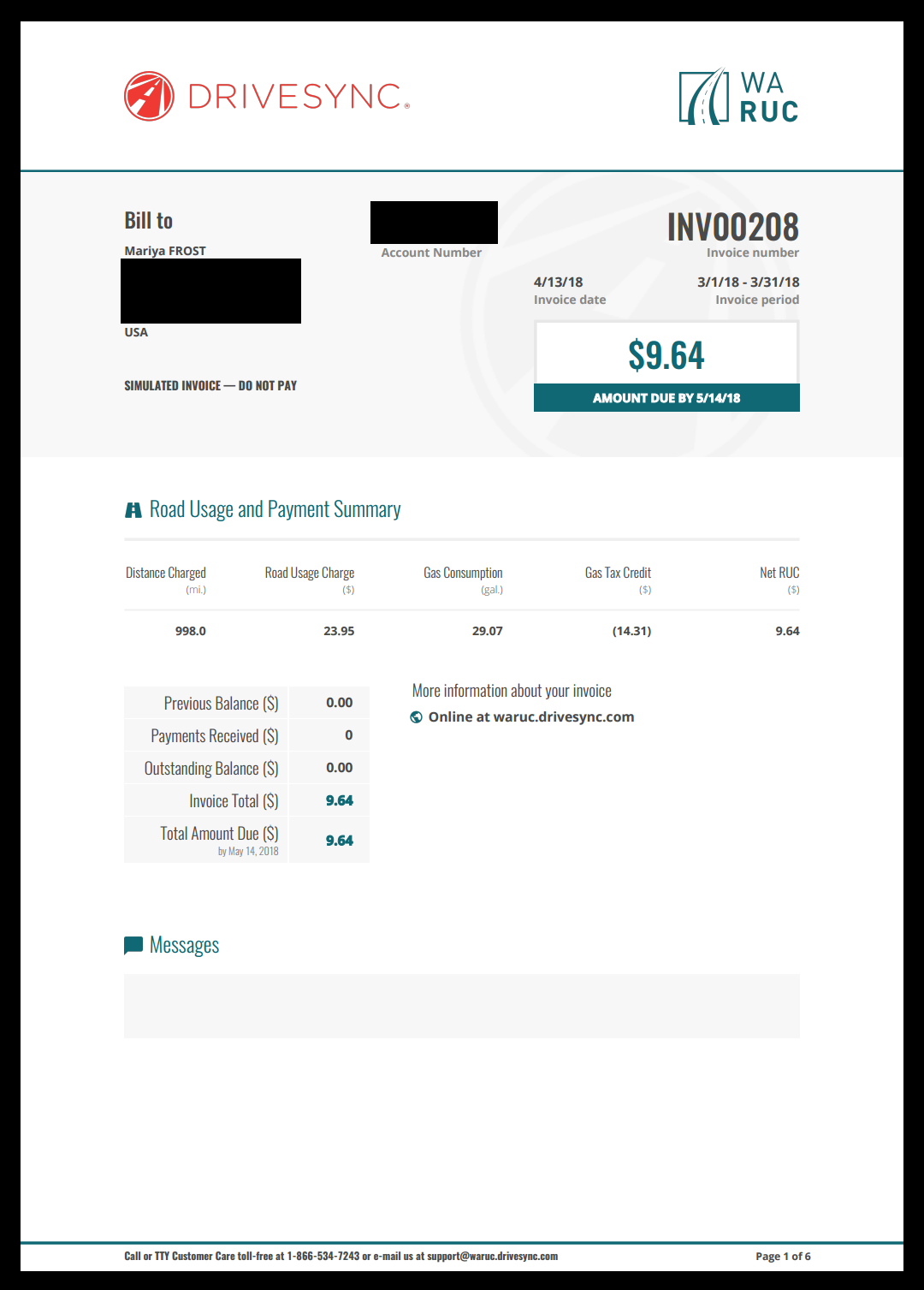

Last week, I received my first simulated monthly invoice (pictures below) from DriveSync, which contracts with the Washington State Transportation Commission in the Road Usage Charge Pilot Project.

I "owe" $9.64 in mileage tax – or, as public officials will surely someday declare – just two lattes a month!

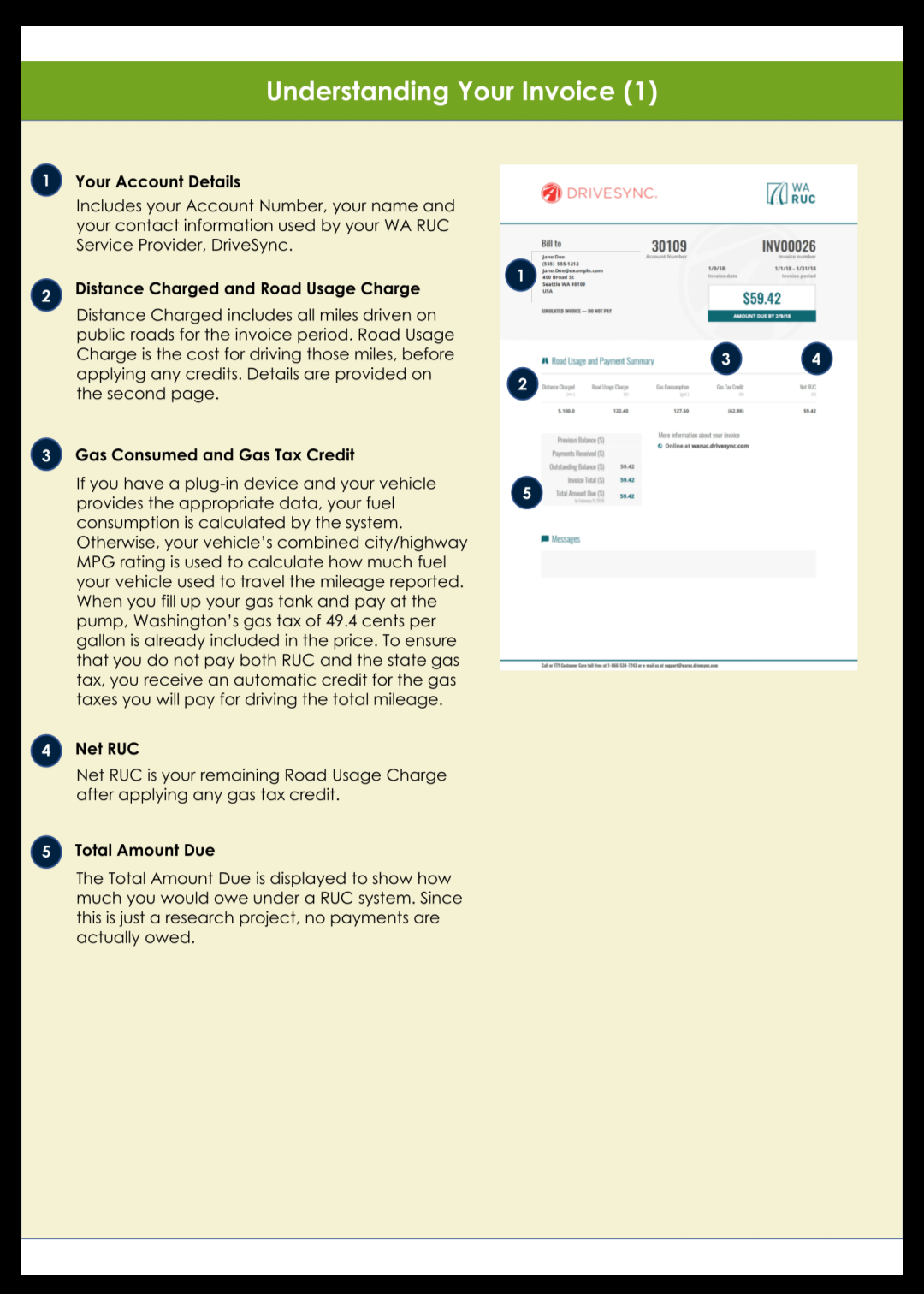

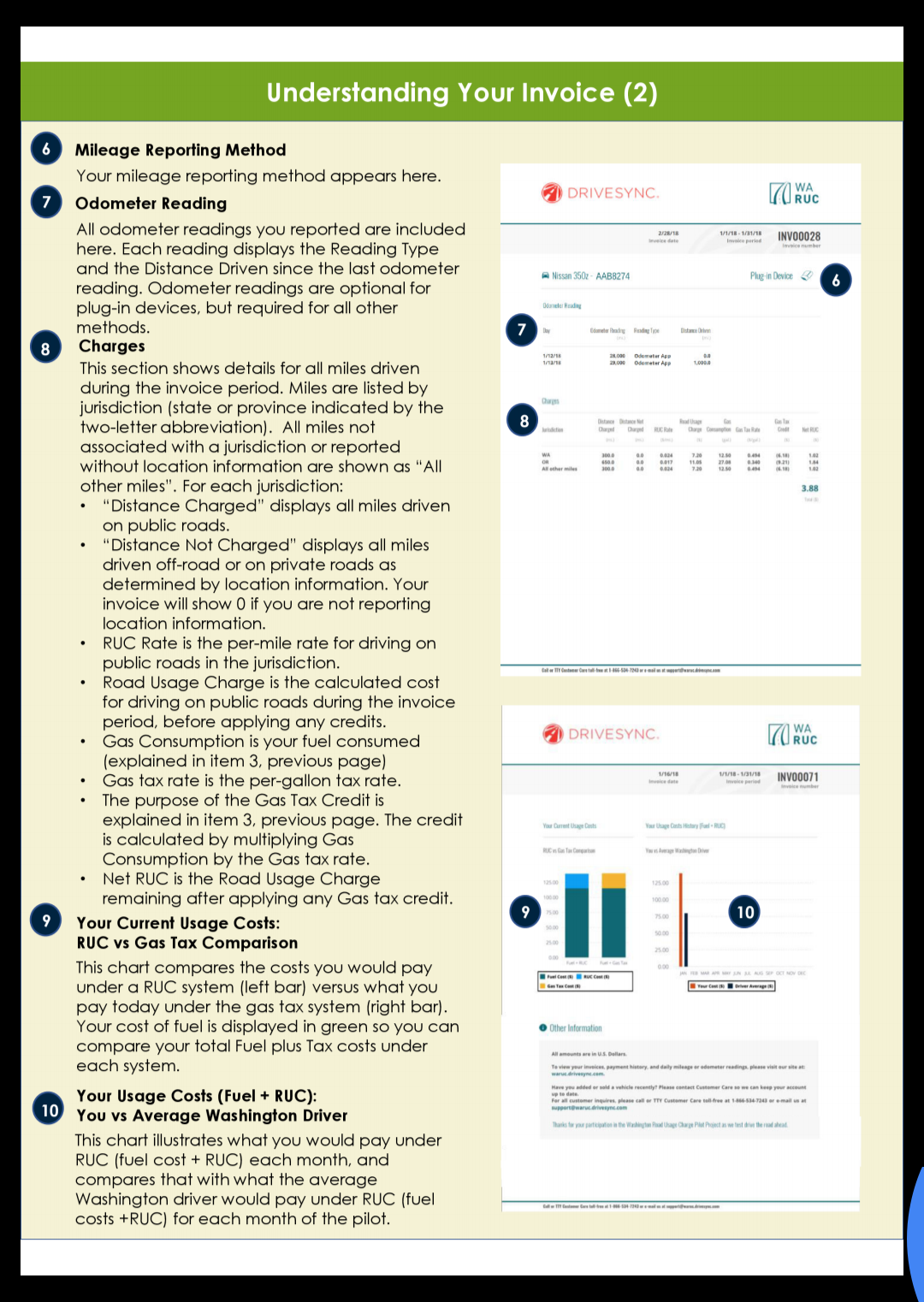

The way this amount was calculated is by taking the miles I drove on public roads (998 miles) and multiplying by a per-mile rate of 0.024 (2.4 cents). This amounts to $23.95 owed in mileage tax.

The GPS-enabled transponder calculated that I used a little over 29 gallons of fuel, which is multiplied by 0.494 (49.4 cents in state gas tax per gallon). I am credited for the fuel tax I supposedly paid, so the remaining amount of mileage tax owed is $9.64.

The reason I do not owe $0, according the state, is because my vehicle is more fuel efficient than the average vehicle that gets 20.5 miles per gallon. Therefore, I owe more money to the state.

Assuming my driving patterns don't drastically change, $9.64 per month is a little over $115 annually in additional tax.

With people in the Puget Sound region already paying hundreds of dollars more each year in motor vehicle excise tax overcharges and property taxes that benefit Sound Transit, those two lattes a month are deceptively expensive. They could become even more expensive if public officials later choose to increase the 2.4-cent rate used in the pilot. The state gas tax has increased 115% just in the last 20 years.

To make matters worse, the money may not benefit the drivers who pay. While fuel taxes are protected by the 18th amendment for highway purposes only, public officials and agencies have suggested that a mileage tax may not be protected. This is no surprise, as even the Washington State Department of Transportation has given up on congestion relief and seems to increasingly operate as a transit agency.

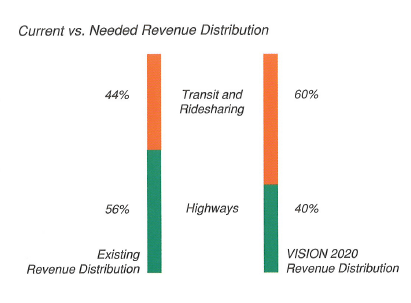

This trend in diverting more money from drivers to mass transit is also in line with Vision 2020, a regional transportation plan required by federal law, written in 1990 by regional planners (now the Puget Sound Regional Council). Thirty years ago, urban planners established a goal to decrease the amount of revenue that goes toward highways by 16%, and funnel those dollars instead to mass transit, despite public demand. The planners stated that new revenue should prioritize transit, and that “existing dedicated sources must be expanded in their potential use to allow more flexibility” in spending.

The PSRC’s mission hasn’t changed. In their recent update to Transportation 2040, planners assume nearly $40 billion in new taxes, fees and tolls. A whopping 70% is assumed to come from the Road Usage Charge. They would like to see more than half of public dollars go to transit, leaving 17% for highways.

While drivers might be willing to pay more each year to fix potholes, maintain bridges, and expand roads, it seems unconscionable to add on yet another tax that would likely be used pay for mass transit projects. Transit is not underfunded. Sound Transit by itself expects to collect over $60 billion just in tax revenue between 2017 and 2041.

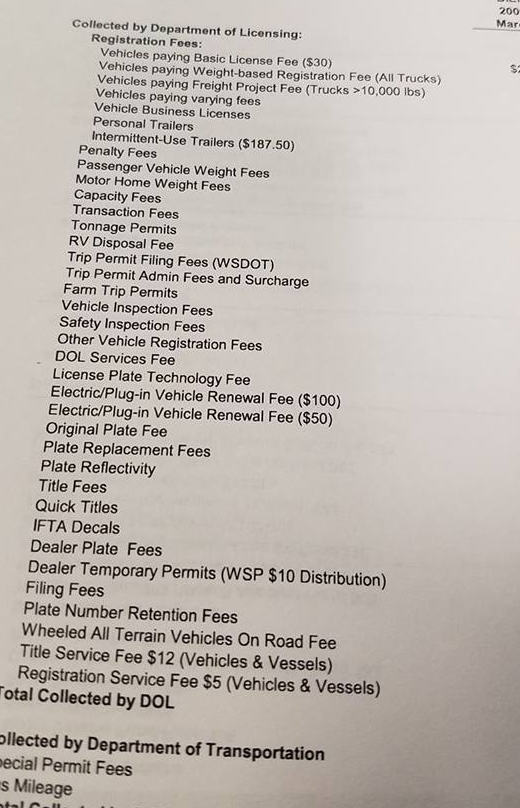

In case people need a reminder of how much drivers already pay for roads and mass transit, in addition to taxes and tolls, here is a list of registration fees collected by the state Department of Licensing:

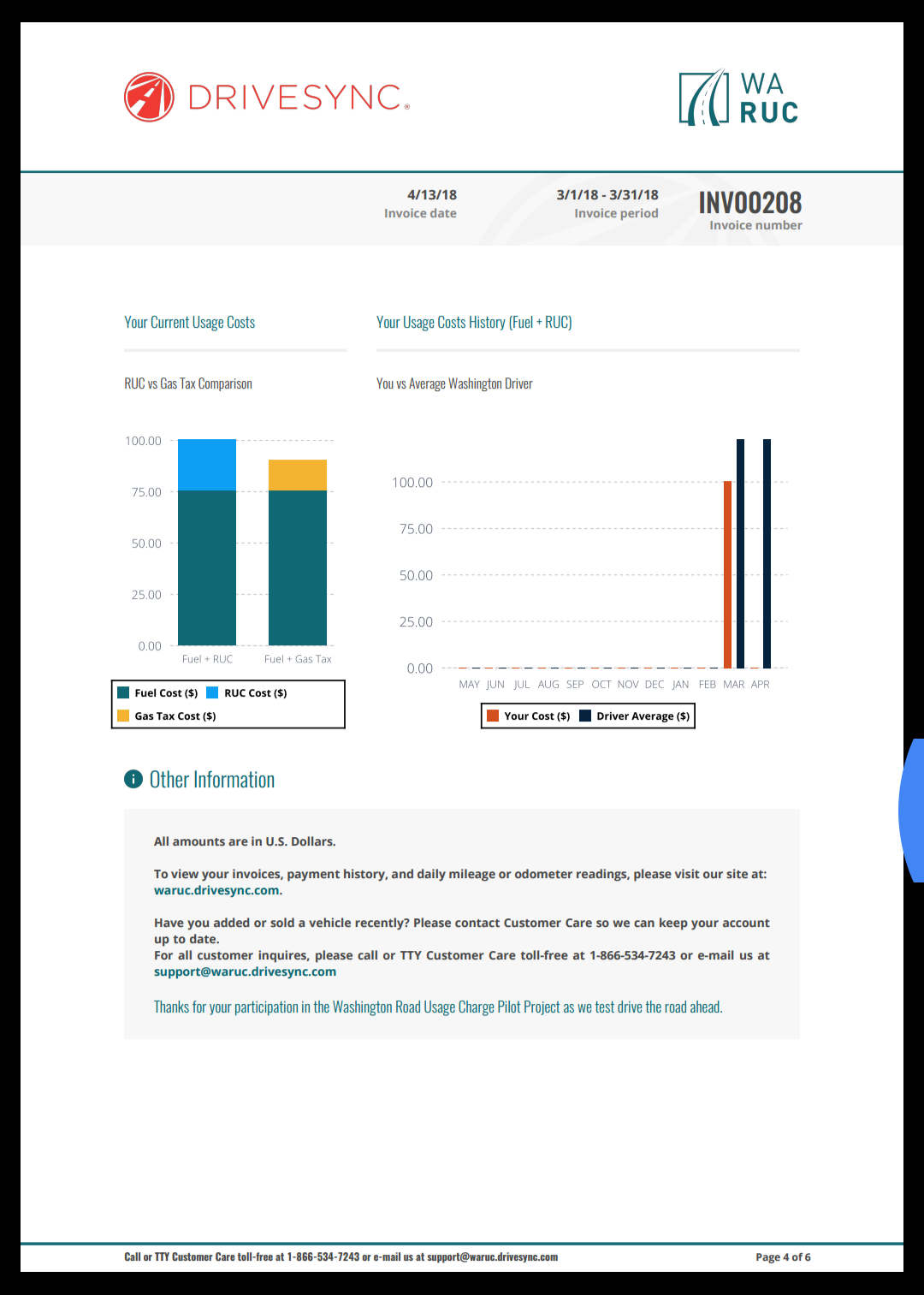

Below are a few pages of the invoice I received from DriveSync.