With a gas tax that starts at 20 cents per gallon, Governor Inslee released his $1.5 billion carbon tax increase today. Unlike Initiative 732, which was revenue neutral (or even a tax cut), the Governor’s proposal would amount to a significant tax increase.

Here are some basic details and concerns.

· The tax would start at 20 cents per gallon and increase about six percent per year (3.5% plus inflation). In 2029, the tax would be about 36 cents per gallon.

· The Governor’s briefing claims, “A carbon tax would spur unprecedented public and private investment in clean energy measures that will generate long-term economic growth and jobs.” Contrary to this claim, states with a carbon tax harmed their manufacturing base, with the NE states seeing significant losses in the past five years, despite the economic recovery.

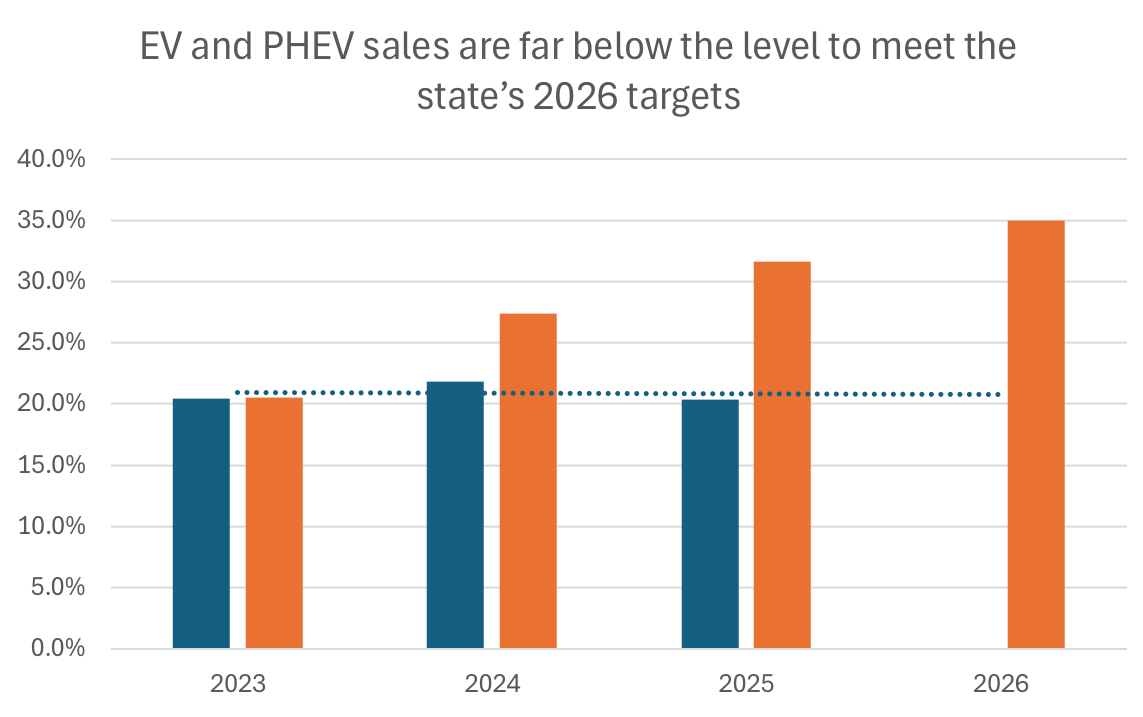

· Rather the cutting taxes elsewhere to offset the increase, the revenue will be used to subsidize politically popular programs. The briefing says, “more than three-quarters of the revenue will be directly invested in emission-reducing programs that help put more electric vehicles on the road…” State data show the majority of those who own electric vehicles and solar panels are in the top 10 percent of earners. This would tax working families to subsidize the wealthy.

· Subsidizing electric vehicles, solar and wind energy are extremely expensive ways to cut carbon emissions. We are nearing the point where additional wind and solar simply replace other carbon-free sources of energy like hydro and nuclear. Each dollar spent to swap solar for hydro is a dollar entirely wasted. Electric vehicle owners are typically wealthy, meaning they are not price sensitive. Subsidizing something people would have purchased anyway is a waste of resources.

· Under the plan, the burden of reducing carbon emissions falls primarily on individuals, not business. The taxes hit gasoline, natural gas for home heating, and electricity. Many energy-intensive businesses, on the other hand, are exempt. In some ways, this is understandable, because high energy costs risk driving manufacturing out of Washington, which is bad for the economy and the environment. The result, however, is that the bill narrows the range of people who must shoulder the burden of cutting CO2 emissions.

We will provide a more complete analysis in the near future.

As we have stated repeatedly, efforts to improve energy efficiency, reduce our reliance on oil from Russia and Venezuela, and reduce environmental impact have merit. This bill, however, makes many of the typical mistakes of such proposals – choosing politically guided expenditures on trendy technologies (like electric cars) over simple and transparent approaches that put personal incentives and technology first. The result is likely to be a high cost for low carbon reduction.