Imposing a low-carbon fuel standard (LCFS), as proposed by a bill in Olympia, will increase gas prices about 10 cents a gallon. Who says so? The state of Oregon does, where they have an LCFS. The state of California does, where they imposed an LCFS a decade ago. And, Stu Clark, the policy advisor at the Department of Ecology who represented Governor Inslee at last week’s hearing on the LCFS.

Of course, he did not say that in the hearing.

To the contrary, he claimed an LCFS would not increase gas prices, which sharply contradicts data from every other jurisdiction and the data presented at a seminar Clark himself organized a just few years ago regarding the impacts of an LCFS.

That data, from the Washington State Office of Financial Management, as well as from the states of California and Oregon, show the LCFS has and will significantly increase gas prices. The only place this fact is disputed is in a legislative hearing.

On January 14th, legislators held the first hearing on HB 1091, which would require a reduction in the carbon-intensity of transportation fuels using biofuels and other methods, similar to policies already adopted in California and Oregon.

The claim that the LCFS has not increased the price of gasoline was a key talking point for advocates of the new requirements. This is a particularly strange claim since both California and Oregon officials openly admit that the LCFS has increased prices, and advocates admit they want the mandate to raise prices for consumers, to drive down fuel use and CO2 emissions with them.

It should be noted that increasing the price of fuel would likely reduces CO2 emissions. This is basic, free-market economics. That is why when advocates of an LCFS claim it will reduce prices it isn’t that they are mistaken. It is that they are being dishonest.

For example, Clark claimed that in California there have been, “No price spikes, no fuel disruptions, or any unintended consequences.” He went on to say that biofuels are “substantially cheaper than what they replace, not more expensive.”

This is intentionally misleading.

For example, the State of Oregon has an entire web page, titled “Annual Cost of the Clean Fuels Program,” dedicated to the cost increases imposed by the LCFS. They do not hide the fact that an LCFS increases prices. It is not even controversial.

Oregon officials report that in 2019, when their LCFS policy was only 15 percent of the way to imposing the full requirement, the “average cost of the Clean Fuels Program per gallon of E10 [gasoline] for 2019” was 2.57 cents. For B5 (diesel) it was 2.94 cents per gallon more.

The cost in California is even higher. For comparison, the cost of credits in Oregon per metric ton of CO2 in 2019 was $147.95. In California, it was $191 – 30 percent higher. In a 2018 report, California’s Legislative Analyst Office noted that at $150, which is lower than the current price, the LCFS adds “several cents” per gallon. They prevaricate a bit, saying that government subsidies help reduce that price, but that is just taking money from taxpayers’ one pocket and putting it in the other.

Clark also made a strange claim that an LCFS would actually lower the cost of fuel. He does not believe this. If biofuel cost less, there would be no need to require people to buy it. Clark knows it costs more, which is why he supports using political force.

Clark also made a strange claim that an LCFS would actually lower the cost of fuel. He does not believe this. If biofuel cost less, there would be no need to require people to buy it. Clark knows it costs more, which is why he supports using political force.

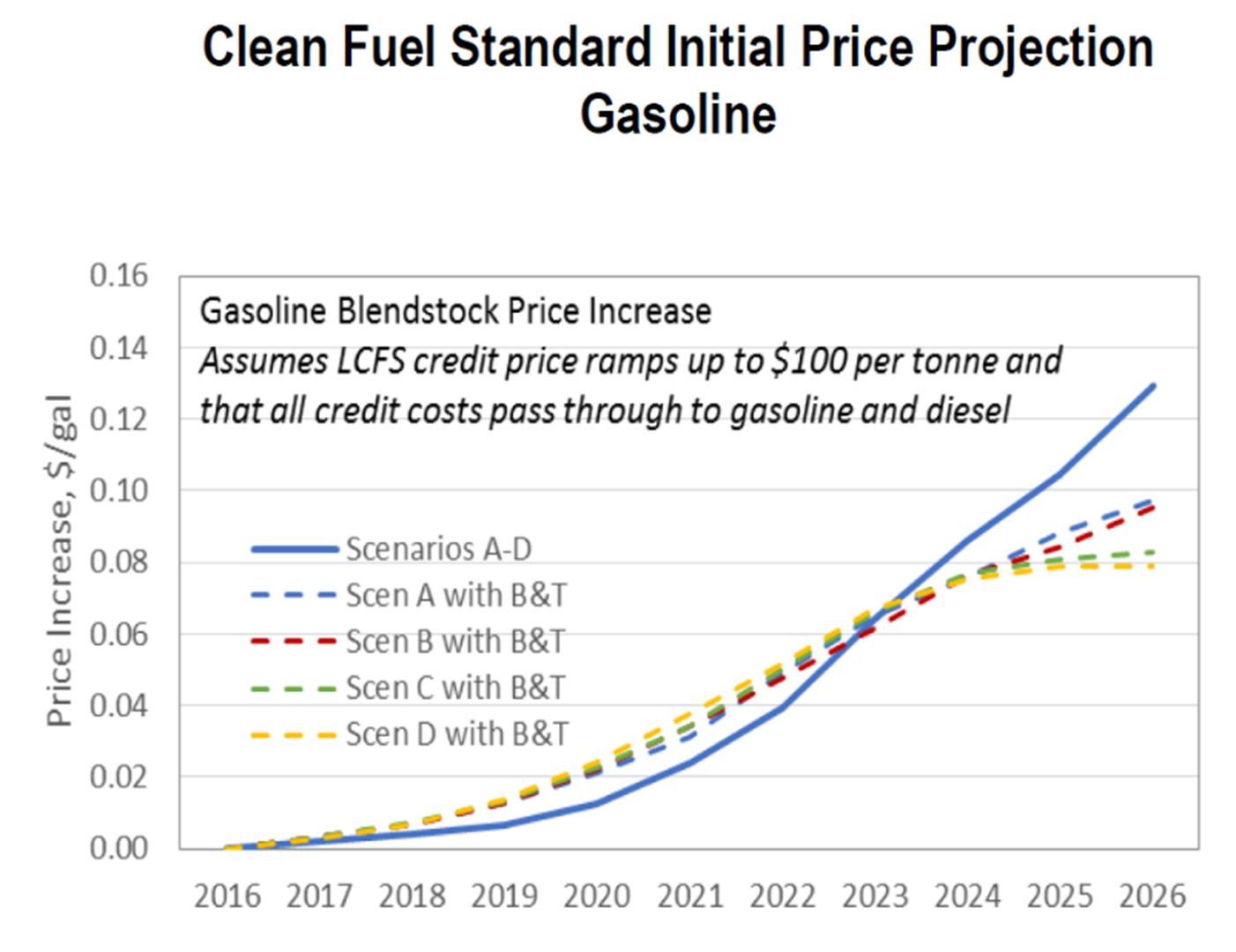

Further, in the past, Clark organized presentations that admitted an LCFS increases gas prices. In 2015, Clark helped organize a seminar with Jim Cahill of the Washington State Office of Financial Management (OFM) regarding the LCFS that was being proposed. In their presentation, OFM estimated that at a credit price of $100 per metric ton of CO2, the price increase per gallon of gasoline would be between 8 to 10 cents per gallon using four different scenarios. The price in California is currently twice that.

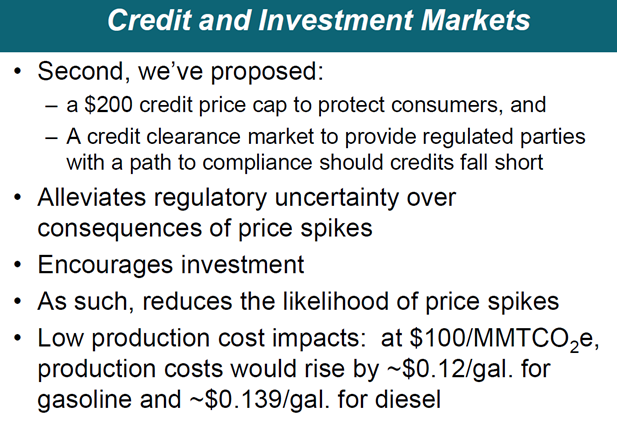

That same seminar included a presentation from Wes Ingram of the California Air Resources Board. Ingram notes that at $100 per metric ton, gasoline production costs “would rise by ~$0.12/gal.” Twelve cents per gallon. Again, the current price of the LCFS in California is twice that.

That same seminar included a presentation from Wes Ingram of the California Air Resources Board. Ingram notes that at $100 per metric ton, gasoline production costs “would rise by ~$0.12/gal.” Twelve cents per gallon. Again, the current price of the LCFS in California is twice that.

Ironically, in Clark’s testimony, he claimed that projections of higher gas prices were based on “a series of extreme assumptions and flawed analysis.” This is a remarkable statement since the models presented at the seminar he organized arrived at these same conclusions. In fact, the models were conservative because they projected prices that are lower than the current credit price in both Oregon and California.

Those projections have been borne out by real-world data. Oregon’s LCFS credit price averaged $147.95 and agency staff estimate the additional cost was 2.5 cents per gallon when the LCFS was 15 percent of the way toward the goal. This would extrapolate out to about 17 cents per gallon when fully implemented. That fits the model almost perfectly because a credit price 50 percent higher than the model used has resulted in a price at the pump 50 percent higher than the model predicted.

Those projections have been borne out by real-world data. Oregon’s LCFS credit price averaged $147.95 and agency staff estimate the additional cost was 2.5 cents per gallon when the LCFS was 15 percent of the way toward the goal. This would extrapolate out to about 17 cents per gallon when fully implemented. That fits the model almost perfectly because a credit price 50 percent higher than the model used has resulted in a price at the pump 50 percent higher than the model predicted.

This is not surprising. Calculating the additional cost of gasoline is just math. Oregon has the formula on its web page. If you can multiply, you can get the answer for yourself. Unfortunately, politics outweigh science and math, so advocates of the LCFS deny the science and ignore their own projections from just a few years ago.

There is one additional talking point about higher prices that is worth addressing. Clark and others note that the price of gasoline is lower today than when California’s and Oregon’s LCFS began. This is a talking point advocates know is misleading but hope the public is not paying enough attention to spot it.

The reason gas prices have declined is that the world supply of oil has increased, in part due to increased oil production in the United States. That drove the price of oil down even as an LCFS mandate was increasing prices in some states. By the logic of Clark and others who make this argument, if we increased gas taxes by 10 cents a gallon but gas prices declined by 20 cents due to increased oil supply, gas taxes do not increase gas prices! They know this reasoning is absurd. They hope others don’t.

Dishonesty in politics is not new or surprising. The fact that advocates of the LCFS are contradicting their own statements from a few years ago while denying data from the states they want to emulate is, however, pretty brazen.