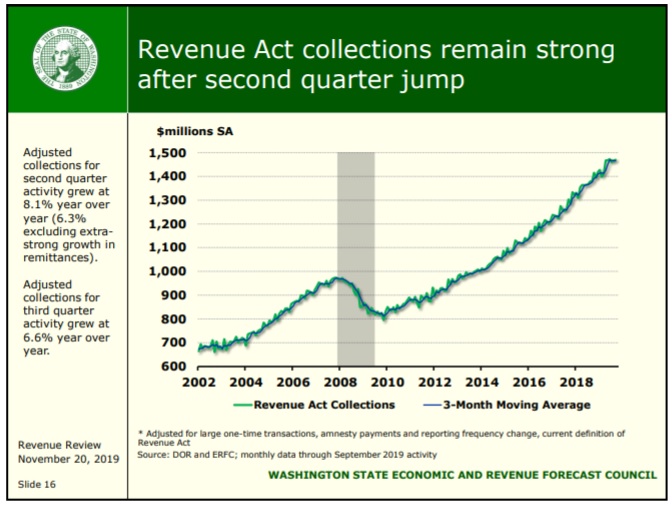

There have been many deep cultural debates in recent years. Is the dress blue and black, or white and gold? Yanny or Laurel? Did Geno Smith call heads or tails? Now just in time for Thanksgiving, here is a Washington tax structure Rorschach test that you can give your family and friends. What do you see in the chart below: A hopelessly broken tax system in need of a capital gains income tax, or a dependable and stable tax structure consistently growing?

For me personally, I see a tax structure producing stable revenue growth that other states would be envious of. Others appear to agree as noted by Standard and Poor’s when issuing Washington’s August 2019 bond credit rating:

“Washington's revenues have historically exhibited less cyclicality than others (due in part to the lack of a personal income tax) . . . we have observed that capital gains-related tax revenues are among the most cyclical and difficult to forecast revenues in numerous other states."

Now that’s not to say that everything is perfect. Earlier this year we testified at a House Finance Committee Tax Structure Work Session and offered these reform options.

What is clear, however, from seeing revenues consistently grow from $31.1 billion in 2011-13 to a projected $51.7 billion in 2019-21 (GFS) is that there is no need to blow up Washington's stable tax structure with a highly volatile capital gains income tax.