![]() Download the full Policy Brief.

Download the full Policy Brief.

Read the summary Policy Note on this subject

Key Findings

- Washingtonians are driving 21 percent more than they did in 1995 and paying more than double per gallon in gas tax.

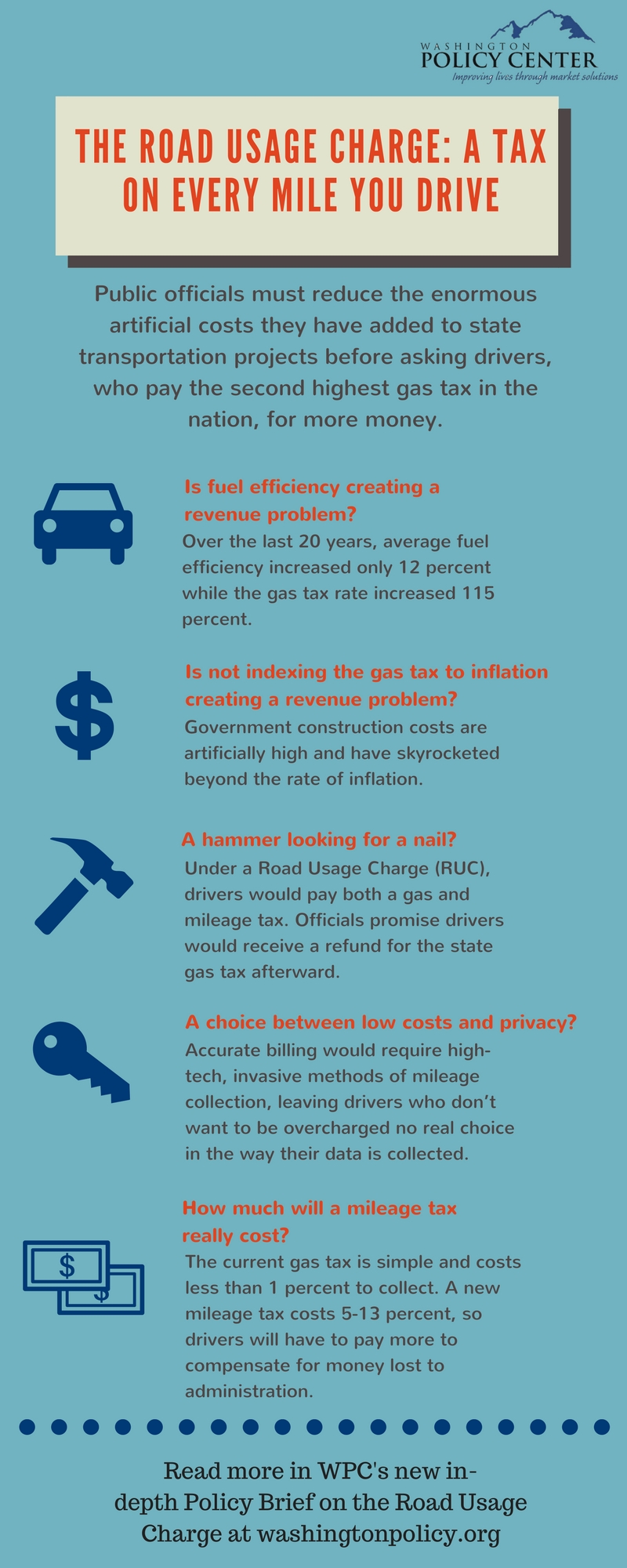

- Public officials say that increasing fuel efficiency means they are not collecting enough money from the gas tax. Yet over the last 20 years, average fuel efficiency increased only 12 percent, while the gas tax rate increased 115 percent.

- Some public officials say the gas tax (and a future mileage tax) should be indexed to inflation to keep pace with construction costs; however, government construction costs are artificially high and increase much faster than inflation.

- Under any scenario in which a mileage tax rate increases automatically every year with inflation, drivers pay more on a per mile basis, in their total bill to the state, or both.

- Under a Road Usage Charge, drivers would pay both a gas and mileage tax, with a rebate for the state gas tax afterward. Officials say they want to keep the gas tax in place and impose it on out of state drivers to maximize the tax revenue they collect.

- The state’s 18th Amendment protects gas taxes paid by drivers for highway purposes only. Some public officials want drivers to pay more for services and programs drivers do not use, so there is no assurance that the mileage tax would be protected by the 18th Amendment.

- Officials insist that drivers have a choice to use low-tech methods for reporting their mileage. However, more accurate RUC billing would likely require high-tech, invasive methods of collection, leaving drivers who do not want to be overcharged with very little choice.

- The current gas tax is simple and cheap to collect, and administration costs less than one percent of collections. The cost of collecting and enforcing a new mileage tax is five to 13 percent of collections. Under a mileage tax, there either would be less funding going to roads or drivers would have to pay more to keep funding at the same level as the gas tax.

- Transportation officials want to reduce the amount people drive to 1997 levels by 2042 and have codified driving reductions in state law. If they achieve their goal, any falling gas or mileage tax revenues become self-fulfilling, as one state policy goal works against another.

- Public officials can increase public trust by reducing the artificial costs they have added to transportation projects and by stopping the practice of diverting money from drivers to non-highway purposes.

Executive Summary

Drivers pay most of the taxes and fees that fund the state’s transportation programs. Nationally, and in Washington state, the highway system was constructed largely on the premise that users of roads should pay to build and maintain them.

Policymakers have used this user-fee principle successfully to build thousands of miles of all-weather roadway, which allows Washingtonians to drive more than 60 billion miles per year, producing industrial growth, mobility, economic freedom, and a higher quality of life for everyone.

With the rise in economic prosperity and population, traffic congestion has increased and reduced reliable commute times for many working families. Much of the region’s crippling traffic congestion, however, is the result of policy choice. Over the last 30 years, the public demand for highway capacity has grown to exceed supply. As the public need for highway travel outpaces the supply of travel lanes provided by public officials, drivers experience decreased mobility, lost time, and lost productivity.

In the Central Puget Sound region, average weekday delay on major corridors (Interstate 5, Interstate 405, Interstate 90, State Route 520, and State Route 167) increased by 35.7 percent between 2013 and 2015 alone. This rises to 91.2 percent when viewed over the four-year period between 2011 and 2015.

Public officials’ preference for creating and managing congestion rather than providing congestion relief, coupled with government clean air and energy regulations, has pushed some people to consider fuel-efficient, alternative-fuel and electric vehicles.

Government officials have even provided tax credits to incentivize drivers to purchase these types of vehicles, although electric vehicle sales remain low. Now officials say increased fuel economy and lower gas consumption will result in slower increases in gas tax revenues in the long-term. They rebuke drivers of fuel-efficient cars for paying “little to nothing in gas tax” and say this demonstrates that the gas tax is unsustainable and inequitable.

Thus, officials now say they need more revenue. The Washington State Transportation Commission (WSTC) recently received a $3.8 million federal grant to explore the idea of imposing a mileage tax on Washington state residents. The grant-funded research is called the Road Usage Charge Pilot Project. The project explores how to get the public to accept paying a mileage tax. A mileage tax would require drivers to pay a certain rate per mile traveled rather than per gallon purchased at the pump.

This paper examines whether the mileage tax, as proposed, is a true replacement of the gas tax and whether predictions of a future revenue problem are well-founded. We evaluate the mileage tax in terms of:

- The state’s 18th Amendment, which provides that gas tax revenue must be spent on highway purposes only;

- The threat to individual privacy;

- The higher cost of creating and administering a mileage tax compared to a gas tax;

- The transition period that would require drivers to pay twice, and receive a rebate for the state gas tax afterward;

- The unfair impact a mileage tax could have on certain groups of drivers.

We conclude that even if these problems were solved, the mileage tax still looks more attractive in theory than it would be in practice. Our state has a long history of officials diverting taxes and fees paid by drivers to non-highway purposes, as well as artificially inflating the cost of public road projects. State officials must first demonstrate they can be more honest with the money they already collect, before they consider imposing a new tax on the traveling public.

Additionally, the concerns of public officials about declining gas tax revenue seem to contradict their strong ideological preference for transit, promotion of fuel economy, and goals that mandate a 50 percent reduction in annual per capita vehicle miles traveled by 2050. This suggests that at least some of the so-called gas tax revenue crisis is a result of their own preferred policy.

If their goal is to collect more revenue for highways while advancing the state’s clean transportation goals, public officials should tax fuel consumption rather than driving itself, while working to reduce congestion and increase mobility for everyone.

![]() Download the full Policy Brief.

Download the full Policy Brief.

Read the summary Policy Note on this subject