If House and Senate budget writers get their way, some Washington residents will receive $200 checks this year using revenue from the tax on CO2 emissions – but there are some interesting conditions.

- The Senate proposal requires checks be sent in 2024.

- The House version cancels some payments if voters support Initiative 2117 and repeal the tax on CO2 this fall.

- Both budgets require utilities and organizations that send the payments to use government-approved language when they are delivered.

These restrictions clearly have an eye on this November as voters decide whether to pass Initiative 2117 which would repeal the state’s climate policy known as the Climate Commitment Act.

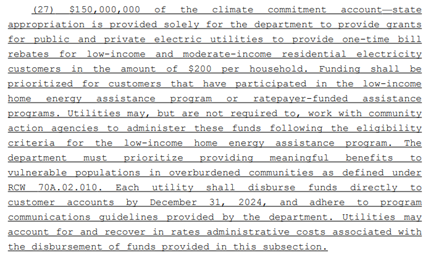

Section 130 (27) of the Senate Democrats’ supplemental budget and Sec. 130 (29)(a) of the House supplemental budget would provide one-time vouchers of $200 per household from the Climate Commitment Account, the budget funded with revenue from the CO2 tax. The amount is not related to actual expenses incurred by households due to the CO2 tax. Instead, the checks would go to all qualifying low- and moderate-income residential utility customers.

The Senate budget requires utilities to send the money to customers by December 31, 2024. This is noteworthy because it is the only expenditure in the entire supplemental budget using funds from the CO2 tax that must be spent by the end of the year. By way of contrast, there are 35 expenditures from the Climate Commitment Account that may not be spent before January 1, 2025. Senate budget writers want the checks to go out in 2024.

The Senate budget requires utilities to send the money to customers by December 31, 2024. This is noteworthy because it is the only expenditure in the entire supplemental budget using funds from the CO2 tax that must be spent by the end of the year. By way of contrast, there are 35 expenditures from the Climate Commitment Account that may not be spent before January 1, 2025. Senate budget writers want the checks to go out in 2024.

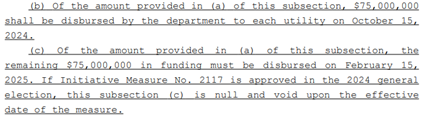

The proposed House budget deals with the payments slightly differently. Their proposal requires half of the funding “shall be disbursed by the department [of Commerce] to each utility on October 15, 2024.” These first checks will prioritize customers “at or below 80 percent area median income.” In King County, for example, this would be those making less than about $93,000. In Spokane County households making less than $56,000 would qualify, and in Yakima County, those making less than $52,000.

The other $75 million must be disbursed by February 15, 2025, unless voters approve Initiative 2117, which repeals the CO2 tax. In that instance, the checks are cancelled. It is worth noting that although the House proposal would cancel the payments, it isn’t because the state budget wouldn’t have the money. The taxes have already been collected and the initiative does not refund the taxes that have already been collected. The money would simply go into the general fund.

The other $75 million must be disbursed by February 15, 2025, unless voters approve Initiative 2117, which repeals the CO2 tax. In that instance, the checks are cancelled. It is worth noting that although the House proposal would cancel the payments, it isn’t because the state budget wouldn’t have the money. The taxes have already been collected and the initiative does not refund the taxes that have already been collected. The money would simply go into the general fund.

The apparent purpose of canceling the payments in the House budget is to tell voters if they pass I-2117 in November, they won’t get the $200 checks. The legislature would simply spend that money on whatever they wanted to in the future.

Both budgets list this as a one-time expenditure. For low-income families, there is no promise that they will be compensated for future costs from the CO2 tax in either budget.

Both budgets stipulate that when sending checks to customers, utilities must “adhere to program communications guidelines provided by the department” of Commerce. Those guidelines have not yet been developed but are reminiscent of last year’s decision by the members of the Utilities Commission (and suggested by the Office of the Attorney General) to prohibit utilities from listing the cost of the of the CO2 tax on customer bills.

When checks go out, some legislators want to make sure the message accompanying those checks is approved by the Inslee Administration.

Although this is the second largest expenditure in the proposed supplemental budget, the summary of “Significant Spending Items” provided by the Senate Ways & Means Committee does not include it. When the House Democrats tweeted out their list of budget highlights, they did not mention the $150 million for the payments, even though it is as large or larger than some of the other expenditures they mentioned.

For such a large expenditure, it is notable that it is not highlighted.

The bottom line is there are several suspect provisions associated with sending the checks.

The payments are the only budget item using CO2 tax revenue that must be spent this year in the Senate proposal. The House version requires the first round of checks be sent three weeks before the 2024 election and cancels the checks for some low-income families if I-2117 passes. It is a one-time payment and does not address any future costs associated with the tax on CO2. And utilities must use government-approved language when sending the payments to customers.

The combination of these very specific restrictions will leave some voters with the opinion that sending these checks is more about election year politics than ameliorating the harmful financial impact of the tax on CO2.