$15 million tax break does little to increase car sales, yields no environmental benefit

- Nearly half of sales tax breaks for electric vehicle buyers go to people living in the wealthiest 10 percent of zip codes in Washington state.

- About 97 percent of electric vehicle sales tax breaks go to Western Washington.

- Tax breaks go primarily to wealthy buyers who would likely have purchased electric cars anyway, so they result in few new electric vehicle sales.

- For the estimated $15.6 million in tax breaks, the environment receives almost no benefit from carbon emissions reduction.

- The same funding could be used elsewhere to reduce 1.2 million metric tons of CO2 – or all of the emissions of 253,803 cars for an entire year.

Introduction

As part of his proposal to cut carbon emissions, Governor Jay Inslee recently announced a range of new benefits for electric car buyers and owners. The Governor said he wants to extend sales tax breaks for electric vehicles, allow single drivers in electric vehicles to use high-occupancy vehicle (HOV) lanes and to ride state ferries for free. The Governor also wants to use state funds to install charging stations for electric vehicle owners.

Despite the claim that these new tax benefits would cut carbon emissions, the data show the tax benefits go mostly to the wealthy, with about half of the benefits going to the top 10 percent of income earners.

Additionally, state data show that about 97 percent of all electric cars – and the sales tax breaks – benefit people living in Western Washington. Of the 6,765 electric cars in Washington state, only 218 are in zip codes east of the Cascades.

Most interestingly, the sales tax breaks would be unlikely to have any meaningful impact on Washington state’s carbon emissions, which is the supposed justification for the policy. Just as the 2009 Cash for Clunkers program gave free money to people who were going to buy a car anyway, the state sales tax exemption and other benefits would make little difference to the wealthy buyers of electric cars. In this study, we match the zip codes of the owners of electric vehicles registered in the state with 2012 IRS income data by zip code to identify the average income of electric vehicle buyers. The results show that electric vehicle owners receiving the tax breaks are among the wealthiest people in Washington state.

At a time when the legislature and governor are considering significant tax increases for people of all incomes, it is ironic they would consider a tax cut that so heavily favors “the rich.”

Further, if legislators want to cut carbon emissions effectively, spending millions on tax exemptions for wealthy electric vehicle buyers is extremely ineffective and wastes public resources that could be used to make real investments in cutting emissions.

Where electric vehicle owners live

The Washington State Department of Licensing (DOL) maintains data for electric vehicles registered in the state. As part of the registration data, DOL records the zip code of all electric vehicle owners and the vehicle model. The Nissan Leaf accounts for 75 percent of all electric vehicles in Washington, with the Tesla Model S and the Tesla Roadster accounting for another 20 percent. The remainder is a mix of Mitsubishi, Mercedes-Benz, Ford and others.

Based on DOL’s data, nearly 97 percent of electric vehicles are registered in Western Washington, with King County alone accounting for 60 percent of the statewide total.

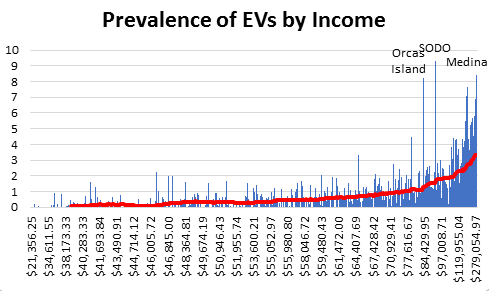

To determine the average income level of electric vehicle buyers, we used IRS tax data for 2012, the most recent available. Matching electric vehicle ownership data with the IRS data, we counted the number of electric vehicles in each zip code and then sorted by average income. Finally, because zip codes vary in size, we divided the number of electric vehicles by the population of each zip code to provide an adjusted standard for accurate comparison.

The results are consistent, showing that the wealthier a zip code, the more electric vehicles are registered there and the greater tax benefits these residents receive.

Taking the entire group of electric vehicles, the ownership trend accelerates as zip codes become more wealthy. The three highest zip codes for electric vehicle registration per 1,000 in population are the South Downtown district (SODO) of Seattle, Orcas Island and Medina.

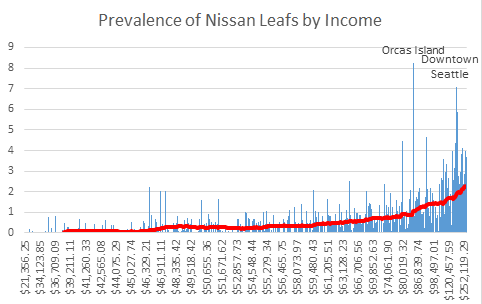

Some argue that while expensive electric cars, like the Tesla Model S, which can retail for over $105,000, may be out of reach of the middle class, other electric vehicles are affordable. The Nissan Leaf, for example, accounts for about 75 percent of all electric vehicle sales in Washington state and sells for just under $30,000 each.

To test that claim, we applied the same zip code/income analysis to the Nissan Leaf alone, to see whether it was more prevalent among middle-class residents. The data are clear that the answer is “no.”

As with electric vehicles in general, the Nissan Leaf is largely a car for the rich, with 40 percent of Leafs owned by the wealthiest 10 percent of zip codes. The bottom 50 percent of owners account for only 12 percent of all Leaf purchases. The purchases are overwhelmingly skewed toward the upper incomes. The claim that the Nissan Leaf is well-suited to the middle class is not borne out by the data.

Electric vehicle tax breaks don’t reduce carbon emissions

The justification for the tax breaks on luxury cars is to provide an incentive to purchase an electric car instead of a cheaper, gas-powered car. The data demonstrate that tax breaks are predominantly going to car buyers whose buying decisions are least influenced by those tax cuts – the wealthy. For those buying a Tesla Model S, the tax credit is a welcome, but meaningless, part of their decision process. For people willing to spend $100,000 for a new car, a few thousand dollars in tax reduction is not going to steer them toward an electric vehicle.

The environmental benefit of the tax break comes when buyers choose an electric car instead of a gas-powered car based on cost. Since few electric car buyers base their decision on price, the environmental value of the break is near zero. Many electric car buyers report they didn’t know about the tax break prior to buying the car.

Some argue, however, that tax breaks for the Nissan Leaf will encourage more people to purchase that lower-cost electric vehicle. The hope is that the tax break will lead middle-class buyers to substitute the Leaf for a comparable gas-powered car. In reality, the Leaf is significantly more expensive than comparable substitutes.

According to Nissan’s web page, the retail price of a Leaf is $21,510 after federal tax subsidies. The Nissan Versa, which is comparable in size and interior space, is $7,330 less, with a price of $14,180. Even with the sales tax break, on top of the federal tax credit of up to $7,500, the Leaf is still more than 30 percent more expensive than the gas-powered alternative.

The data also show the same wealthy demographic purchasing Teslas is buying the Leaf. Ironically, the tax break creates even less incentive for those purchasing a Leaf, because the tax break they would receive is smaller, between $2,000 and $3,000. Buyers are not choosing the Leaf because of the subsidy, but because it is more suited to their needs and driving habits.

The data show the tax break is not encouraging middle-class car buyers to purchase the Leaf and, as a result, it is not helping reduce carbon emissions.

A Waste of resources

According to the Washington State Office of Financial Management, the electric vehicle sales tax break will reduce state and local tax revenue by an estimated $15.6 million for fiscal year 2015. Using the governor’s estimates from his cap-and-trade proposal, that amount of funding could be used elsewhere to reduce 1.2 million metric tons of CO2 – or all of the emissions of 253,803 cars for an entire year. Instead, Washington state taxpayers will subsidize the purchase of a few thousand cars for wealthy consumers, most of whom would have made the purchase anyway.

This failure to spur new electric vehicle sales means the sales tax break, and other proposed incentives, yield almost no environmental benefit. Our previous analysis found that even if one-quarter of sales resulted from the tax break, state taxpayers would receive one dollar of environmental benefit for every $304 spent. That probably exaggerates the true benefit, because the data show the tax breaks go precisely to the people who are least influenced by it, meaning the vast majority of electric cars would be purchased without it.

Environmental activists often admit the tax subsidies do little to cut carbon emissions today. They claim instead that it will help create an electric car market for the future. This claim is spurious. Taxpayer subsidies were not necessary to build the market for mobile phones – a product that also began with wealthy early adopters and later spread to the public at large.

Their excuse, however, undermines the environmental left’s basic claim that climate change is a crisis that must be addressed today. Spending millions of dollars in the hope it will pay off at some point in the future makes clear the left is putting a its ideological vision ahead of the global climate issue they claim is an immediate crisis.

A serious approach to environmental policy would put results ahead of symbolism. The proposal to extend the sales tax break for electric vehicles yields tiny environmental benefits at extremely high cost. There is no doubt that electric cars are cool. Lawmakers should not, however, allow the fashionable attraction of electric cars to trump real environmental benefit. Sadly, the electric vehicle sales tax break does exactly that.