Related Articles

Relevant Topics

Introduction

A long-standing Washington Policy Center recommendation is that the state transition from costly defined-benefit pension plans to more predictable defined-contribution retirement plans for new state employees. A defined-benefit plan promises workers they will receive a certain dollar benefit level every month after they retire, while a defined-contribution plan provides workers a stable contribution towards pension savings during their working lives, along with tax-free employee contributions, which the worker can draw from during retirement.

The private sector has been moving steadily away from defined-benefit plans for

decades, instead offering employees defined-contribution pensions that provide

retirement payments to an employee’s pension while helping companies accurately

project future pension costs.

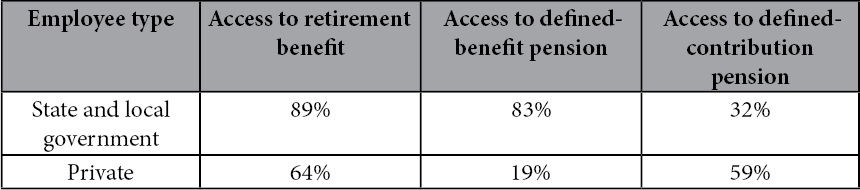

Two bills currently advancing in the legislature would move the state in this direction (SB 5851 and SB 6305). Both bills are considered “Necessary to Implement the Budget” (NTIB) and were not subject to the recent cutoff. Below is a table based on national data from the U.S. Department of Labor, Bureau of Labor Statistics, showing the pension comparison of private and public employees:

SB 5851, “creating a defined-contribution retirement plan option for public employees,” would set up a new optional defined-contribution pension plan for current state workers and for new hires. The proposal could save state and local government (that is, taxpayers) an estimated $436 million over the next 25 years.

A different proposal, SB 6305, “creating a defined-contribution retirement plan option for elected officials,” would set up a new defined-contribution plan for public officials elected to office after July 1, 2016. The fiscal note for SB 6305 is “indeterminate,” but the bill could result in state and local government (taxpayer) savings of $92 million over the next 25 years.

Details of SB 5851: “Creating a defined-contribution retirement plan option for public employees”

The intent section of SB 5851 says (in-part):

“The legislature recognizes the need for public employees, public safety employees, teachers, and school employees, to have a secure and viable retirement benefit, not only for their own financial protection, but also so that public funds are spent prudently for their intended purpose.

“The legislature also recognizes the need for public employers and taxpayers to have consistent and predictable pension funding obligations in support of employee retirement benefits.

“Therefore, it is the intent of the legislature to provide a defined-contribution retirement plan option for new public employees, teachers, and school employees that uses best practices of defined-contribution plans to provide opportunity and flexibility to accrue a viable retirement benefit, while providing stable funding requirements for public employers and taxpayers.”

To accomplish this goal, the bill would provide state employees who are currently in the state’s open defined-benefit pension plan (Plan 2) and the hybrid defined-benefit/defined-contribution plan (Plan 3), as well as new hires, the option of enrolling in the new defined-contribution plan. The state’s most costly defined-benefit plan (which currently has billions in unfunded liabilities) was closed to new enrollees in 1977.

Details of SB 6305: “Creating a defined-contribution retirement plan option for elected officials”

The intent section of SB 6305 says:

“The legislature recognizes the need for persons who offer public service as an elected official to have the option of participating in a retirement savings plan that can contribute towards a secure and viable retirement benefit. The legislature also recognizes the need for public employers and taxpayers to have consistent and predictable pension funding obligations in support of employee retirement benefits.

“Therefore, it is the intent of the legislature to provide a defined-contribution retirement plan option for elected officials that uses best practices to provide the opportunity and flexibility to accrue a viable retirement benefit, while providing stable funding requirements for public employers and taxpayers.”

To accomplish this goal the bill would create a new defined-contribution “Washington Elected Officials Retirement Savings Plan (EORSP).” This would be the only retirement plan offered to public officials elected to office after July 1, 2016. The exception to this would be for elected officials who are currently members of the PERS pension system and are over age 50, and all elected judges who would remain in the current pension plan.

According to the National Conference of State Legislatures:

- New lawmakers receive no pension for legislative service in: Alabama, California, Louisiana, Nebraska, New Hampshire, North Dakota, Rhode Island, South Dakota, Vermont and Wyoming.

- New lawmakers receive a defined-contribution pension in: Alaska, Indiana, Michigan, Minnesota and Utah.

In addition, Oregon lawmakers in a special session last year closed the state’s pension system to newly elected lawmakers.

Next Steps for Reforming Washington’s Pension System

For future pension benefits, it would serve the public interest for Washington to transition to a defined-contribution plan, as proposed by SB 5851 and SB 6305.

These plans are now common and widely supported in the private sector because they provide a retirement benefit for employees while helping companies accurately project future pension costs. Employees in such plans own their retirement savings, plus all contributions and investment earnings, and are not forced to rely on political conditions that might change in the future.

Washington Policy Center recommends that effective state pension reform should be based on the following principles:

- Do not skip any pension payments;

- Close the current defined-benefit plan to new hires;

- Direct all savings toward paying down unfunded pension liabilities;

- Enroll new hires into a defined-contribution plan;

- Constitutionally require the actuarially-recommended pension payment and require a supermajority vote to enact new benefits.

Conclusion

It is important to maintain diligence on the state’s existing pension obligations while pursuing additional reforms. Part of what has contributed to the state’s nearly $6 billion unfunded pension liability is that legislators and past governors have not made the required contributions over the past decade so that lawmakers could spend that money on other programs. Washington’s multi-billion dollar pension problem was not created overnight, so it will take time to pay off these unfunded liabilities. Starting these reforms will require the conviction to adopt public policies in the best interest of all citizens and state workers, not just narrow special interests.

While Washington has already implemented many of the pension reforms just now being considered across the country (which is why the state’s unfunded pension liability compares well relative to other states), more still can be done to limit future taxpayer liability for pension payments and the share of the general fund devoted to pension costs, while still providing a retirement benefit for public service.

Moving to a defined-contribution pension option as proposed by SB 5851 and SB 6305 would be a step in right direction. The new defined-contribution plan should be the only pension option offered to new hires and to newly elected public officials. The state’s remaining defined-benefit plans would then be closed, and the burden of their financial liability on taxpayers gradually reduced. Any long-term savings realized by adopting SB 5851and SB 6305 should be used to pay down the state’s multi-billion dollar unfunded pension liability to reduce the temptation for lawmakers to increase state spending elsewhere in the budget.

Download a PDF of this Legislative Memo here.