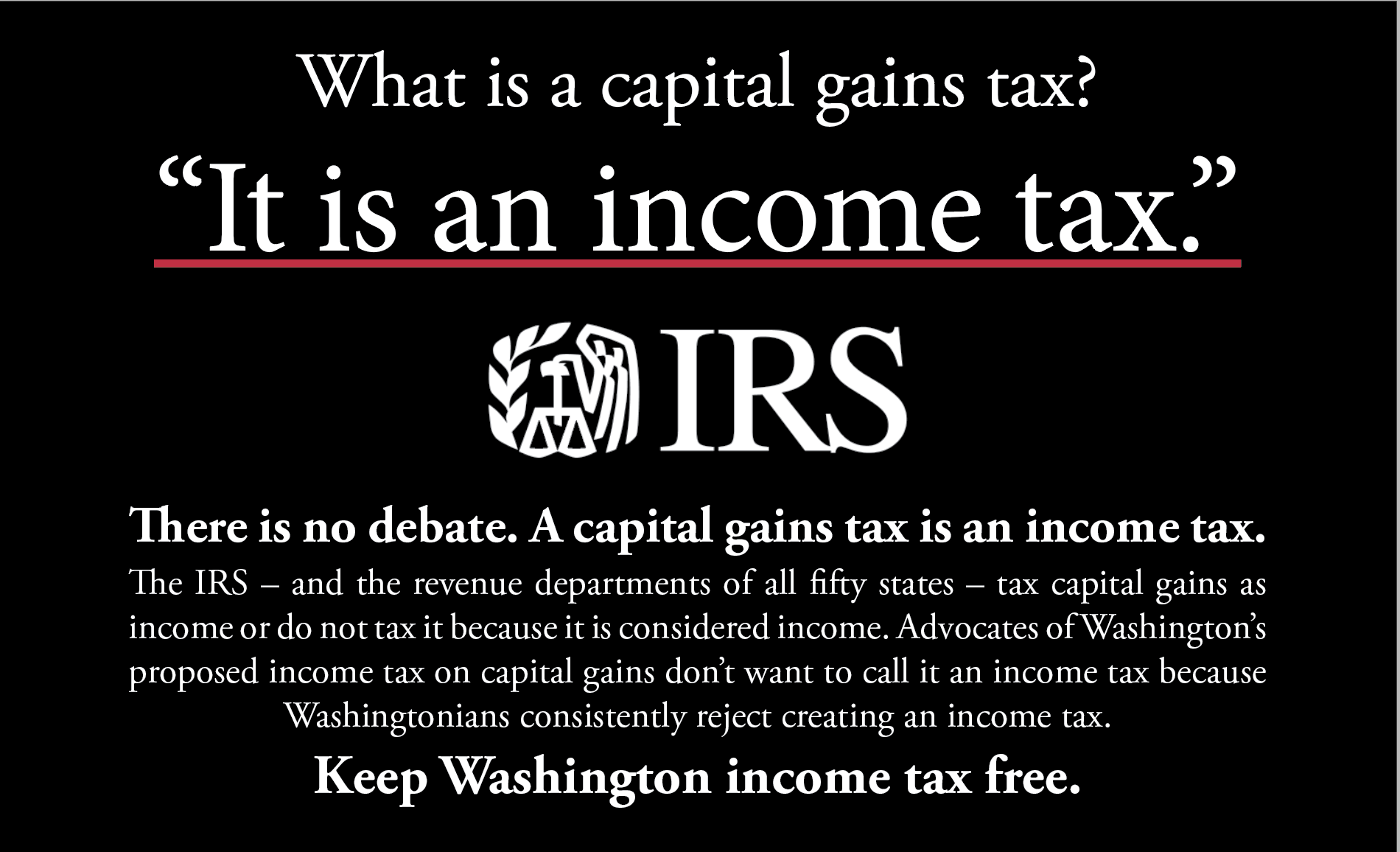

Proponents of a capital gains tax need to be honest and call it what it is, an income tax. Every state revenue department in the country calls a capital gains tax an income tax. The IRS recently answered this question directly saying, “It is an income tax.” If you want an income tax in Washington stop playing games to try to evade the state’s prohibition on graduated income taxes and propose a constitutional amendment.

Imposing an income tax, however, will throw away what Washington’s Department of Commerce calls a “competitive advantage” and “great marketing” for the state. A capital gains tax in particular will inject extreme volatility into the state’s revenues and budget.

Additional resources on the proposed capital gains income tax:

Now thanks to public records we can see what Washington’s Department of Revenue (DOR) has been saying about capital gains income tax proposals.

“This is in response to your inquiry regarding the tax treatment of capital gains. You ask whether tax on capital gains is considered an excise tax or an income tax? It is an income tax. More specifically, capital gains are treated as income under the tax code and taxed as such."

- State Revenue Departments Describe Capital Gains Income Taxes

“All state revenue departments describe capital gains as income. Those that tax capital gains do so via their income tax codes. No state taxes capital gains as an excise tax.”

This video proves a capital gains tax IS an income tax in just a couple minutes!

Not only is a capital gains tax an income tax, it is also bad policy for Washington state! Here's a new video that details why in under two minutes!

More information:

- Is capital gains income a stable and sustainable tax source?

- Which states don’t have a capital gains income tax?

- WA Department of Commerce: No state income tax "is great marketing" for Washington

- Are capital gains taxes "secure and stable" or highly volatile?

- New poll shows strong opposition to income tax in any form

- Timeless advice from WA Supreme Court on income taxes

- National tax experts agree – capital gains taxes are income taxes

- Income tax on capital gains: Follow the bouncing ball edition

- House Democrats propose state income tax on capital gains

- House Democrats want to impose an income tax in Washington state

- Call capital-gains tax for what it really is — an income tax