Washington’s new tax on CO2 emissions took effect on January 1 and fuel distributors have been increasing prices to cover the cost of the new law. Despite objections from staff at the Department of Ecology, this is the correct approach.

Who says so? The Washington State Department of Revenue, who recommend that businesses collect taxes to cover their liabilities as those sales are made.

This is just the latest example of where the messages from Ecology staff about the state’s new CO2 cap-and-trade system are at odds with other agencies that implement similar taxes. The costs of the new system are being paid by Washington state residents and Ecology’s lack of candor about those costs make it difficult for legislators and others to assess the impact the system is having on the state.

The first auction of CO2 emission allowances under Washington’s new cap-and-trade system is scheduled for February 28. When results are announced by the Department of Ecology about a week later, it will be the first time we know the actual cost of the new program.

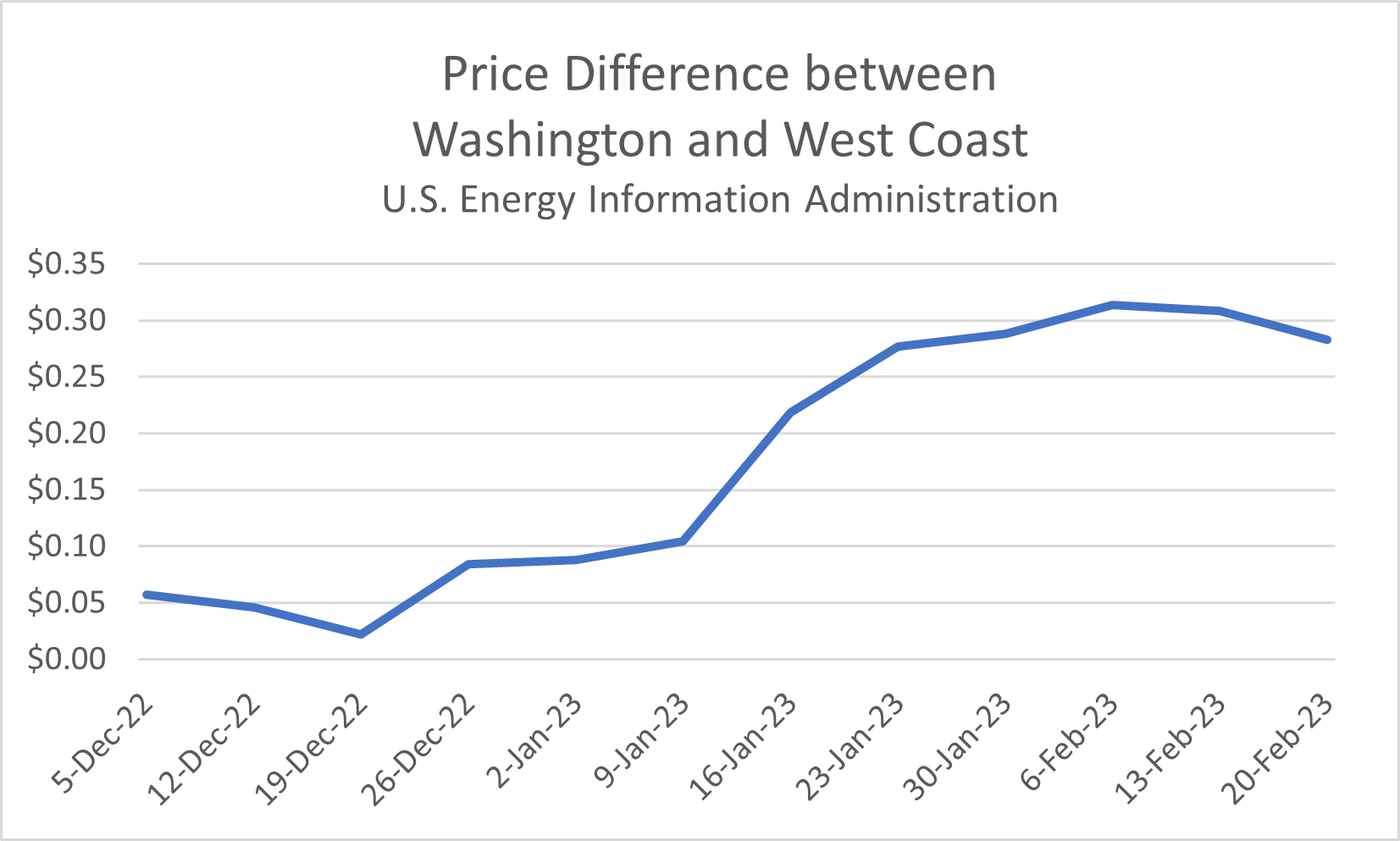

Whatever the cost, fuel distributors are liable for the cost of allowances for fuel they’ve already sold in the first two months of the year. Since the beginning of the year, gas prices in Washington have jumped about 24 cents per gallon more than the other states on the West Coast according the U.S. Energy Information Administration. The gap has slightly narrowed in the last week, but is still in the same range it has been for the past month. Distributors will have to purchase allowances to cover the fuel they’ve already sold.

Whatever the cost, fuel distributors are liable for the cost of allowances for fuel they’ve already sold in the first two months of the year. Since the beginning of the year, gas prices in Washington have jumped about 24 cents per gallon more than the other states on the West Coast according the U.S. Energy Information Administration. The gap has slightly narrowed in the last week, but is still in the same range it has been for the past month. Distributors will have to purchase allowances to cover the fuel they’ve already sold.

The price being charged is a guess on the part of fuel distributors because although the law took effect at the beginning of the year, the Department of Ecology was not able to put the auction system in place on time. As a result, Ecology staff are criticizing companies struggling to comply with the uncertainties created by Ecology’s own tardiness.

Rather than acknowledge that fuel distributors, and ultimately customers, are already liable for those, albeit unknown, costs, staff at the Department of Ecology continue to claim no costs have yet been incurred, claiming that “At this point, no fuel supplier or business has incurred fees or compliance costs” since businesses have until November 2024 to turn in allowances. Fuel distributors and others covered by the cap-and-trade system, however, can’t feasibly go back and collect taxes on previous sales and the best approach is to collect taxes at the time the liability is incurred. Waiting until the last minute is not a responsible strategy.

Washington state sales taxes are due on the 25th of the month after sales occurred. In the same way that fuel distributors don’t have to turn in allowances to comply with the cap-and-trade system, retailers don’t have to pay sales taxes until the following month, following the logic of Ecology staff.

But the Department of Revenue understands that doesn’t make sense. I asked DOR, “Even though the sales taxes are not due until the following month, are businesses allowed to collect the sales taxes before it is due to the state (i.e. at the time of sale)?” They noted that not only are businesses allowed to collect taxes, “Businesses should collect sales tax on items at the time of its sale” (emphasis mine).

The Washington State Department of Revenue encourages businesses to do exactly the thing that staff at the Department of Ecology are questioning.

Anecdotal evidence from California indicates fuel distributors there are doing the same thing – adding the price of CO2 taxes to fuel based on the current price of allowances rather than buying allowances only when they are due to the state.

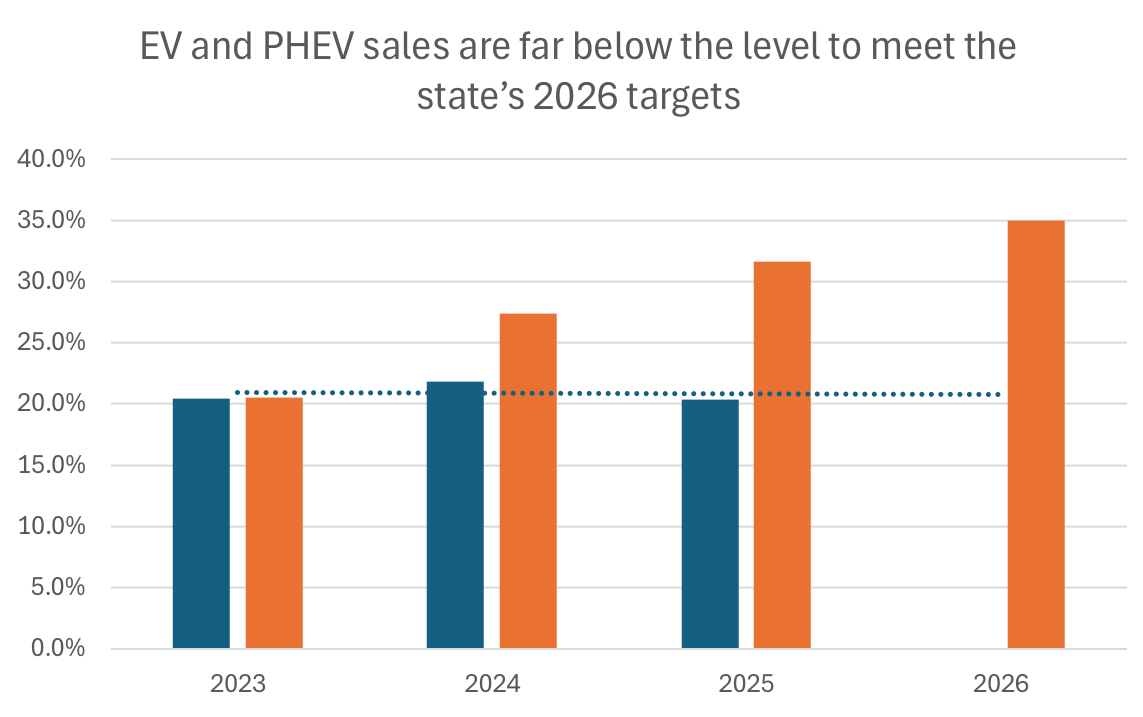

As we’ve noted before, the claims by Ecology staff are strange because the purpose of putting a price on CO2 emissions is to drive the cost of gasoline up and encourage people to switch to more fuel-efficient or electric vehicles. Ecology staff claim that when gas prices went above five dollars per gallon in 2022, “people responded by buying more fuel efficient vehicles, switching to electric vehicles, or driving less.” This is the goal – to discourage use of fuels that emit CO2.

Ecology staff are simultaneously arguing that taxing CO2 emissions doesn’t increase gas prices while also saying that increases in the price of gasoline are good because they incentivize people to reduce CO2 emissions.

As we’ve noted before, no other state plays these word games to hide the impact of their policy. California is very open about the impact CO2 taxes have on gasoline. Oregon has a web page dedicated to the cost of their low-carbon fuel standard, where they note it added 5 cents per gallon in 2021.

Washington state residents and legislators need accurate and trustworthy information from Ecology staff to plan and make the state’s new CO2 system effective and keep costs down. The current approach of obfuscating the actual impact makes that more difficult.