For those laid off as a result of the COVID-19 crisis, there is some relief in state and federal unemployment benefits being available to cover the bills. The state doesn’t have unlimited funds, however, and the Unemployment Insurance Trust Fund (UITF) account that is used to pay unemployment benefits, is starting to run out of money.

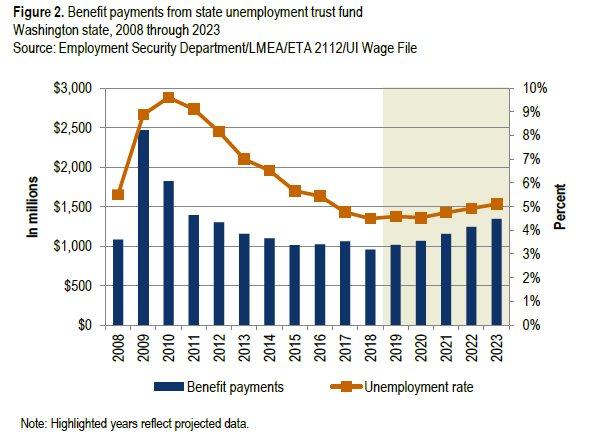

The UITF account, as of November 2019 had a $4.86 billion fund balance, which according to the Employment Security Department (ESD) equates to about 15.5 months of benefit payments with an assumed 5% unemployment rate. The projected benefit payout for 2020 was $1.07 billion dollars with payroll and businesses taxes replacing the spent funds throughout the year.

Things are not going as projected and if conditions with the lockdown do not change, the fund will be depleted very quickly.

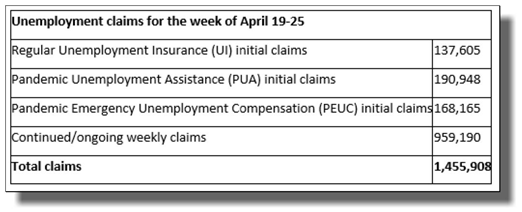

In the first few months of 2020, due to the COVID-19 lockdown, the demand on the fund has outstripped the incoming tax revenue. It’s a double hit to the fund. Not only are tax revenues severely down because business is not operating, but unemployment claims are up at record levels. On April 30th, 2020, the Employment Security Department (ESD) released the latest unemployment numbers for April 19th-25th.

The state projection assumes an unemployment rate of 4.53% for 2020 based on the November 2019 data. With ESD’s projection that we are currently at 20% unemployment, that’s a 4-5 times larger unemployment rate than projected. ESD paid out over $988 million for the week April 19-25 (an increase of $811.2 million from the previous week), which is close to the $1.07 billion they projected for the payouts for the entire of 2020.

While there are still revenues coming into the account they are significantly down and certainly will not be enough to refill the account to continue paying unemployment benefits at the current rate.

At the current burn rate of almost $1 billion per week, a portion of which is paid from federal dollars, the fund will be deplated within weeks. The state could borrow money from the federal government, but this money has to be repaid at some point in the future. This will create a liability for the state budget as California discovered when it borrowed money to cover its shortfall in previous years.

It is critical that the state re-open business as fast as possible, once it is safe to do so with the appropriate guidelines for post COVID-19 operation. This will begin to replenish the fund and reduce the unemployment claims on the fund as workers go back to work.

The COVID-19 virus continues to have a devastating effect on employment in Washington.