Seattle’s status as the city with the most expensive Uber rides in the United States, averaging $60 for a 30-minute ride, is no accident. A recent study by NetCredit highlights this reality, and is a result of the city’s heavy-handed regulatory approach to rideshare services like Uber and Lyft. While these regulations are often framed as protecting drivers and promoting fairness, they have significantly increased costs for consumers, reduced driver earnings, and strained the innovative rideshare market.

The primary driver of these price hikes is Seattle’s 2020 “Fare Share” ordinance, which mandates minimum per-mile and per-minute compensation for drivers, along with benefits and expense reimbursements. On paper, this policy purportedly aims to ensure drivers earn a living wage. However, in practice, it has inflated fares by 50-60% compared to pre-pandemic levels. For example, a ride from downtown Seattle to Sea-Tac Airport, according to Uber, once $35-$40 during non-surge times, now costs $55-$70. The ordinance’s rigid pay structure ignores the dynamic nature of rideshare pricing, forcing companies to pass costs directly onto riders.

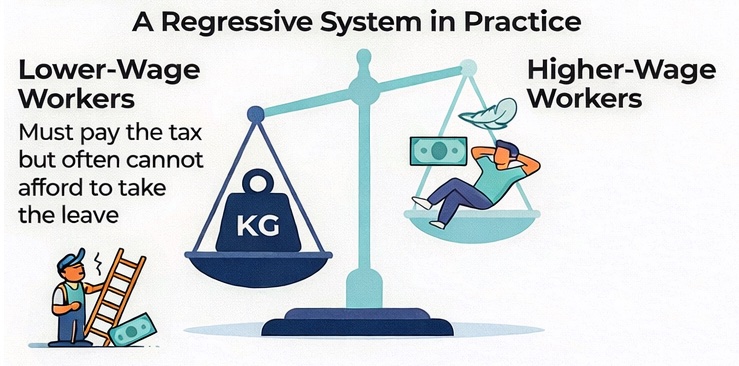

Additionally, the city imposes a 51-cent fee per ride to fund affordable housing, transportation projects, and a driver dispute resolution center. This fee, combined with the mandated driver pay, creates a cumulative burden that makes Seattle’s rideshare market one of the priciest in the nation. The Fare Share law also fails to account for market realities like driver supply and rider demand, which further distorts pricing.

Another factor is the oversaturation of drivers, exacerbated by regulatory barriers that discourage efficient market adjustments. A 2024 protest by Seattle-area rideshare drivers highlighted how an influx of new drivers, encouraged by the promise of guaranteed pay, has led to congestion and reduced ride availability. With too many drivers chasing fewer passengers, companies rely more heavily on surge pricing to balance supply and demand, further inflating costs. Seattle’s regulations, which prioritize driver pay over market flexibility, inadvertently contribute to this imbalance.

Seattle has a history of meddling in the free market. Prior to 2019, before Uber and Lyft became popular, the city attempted to gerrymander the transportation business by regulating the Taxi license market (known as Medallions) and limiting supply. The program, created to artificially inflate the cost of a license, was rendered obsolete when Uber and Lyft began operating and completely de-valued the investment Taxi drivers had made in purchasing the licenses in the first place.

The economic ripple effects are clear. Higher fares discourage riders, reducing overall demand and leaving drivers with fewer trips and longer idle times. This undermines the very goal of the Fare Share ordinance, as drivers report earning less despite higher per-ride costs. Meanwhile, consumers face sticker shock, with Seattle’s Uber prices surpassing even New York City’s, where a 6.2-mile ride averages $34.74 compared to Seattle’s $60 for a 30-minute trip.

Seattle’s regulatory approach ignores the fundamental principles of a free market, where prices adjust dynamically to balance supply and demand. By imposing rigid pay structures and additional fees, the city has created a system that benefits neither drivers nor riders. Instead of addressing root causes like housing costs or traffic congestion, these regulations simply shift the financial burden onto consumers.

It’s time for Seattle to rethink its approach. Policymakers should engage with gig platforms, and workers to craft solutions that preserve the free market. Rolling back overly restrictive ordinances, like the deactivation law would reduce costs and restore order volume. Without change, Seattle risks losing the convenience and economic benefits of the gig economy, leaving consumers with higher prices and workers with fewer opportunities.