I was a guest this week on TVW's Inside Olympia discussing what the election means for the state's budget outlook and the options for lawmakers to balance the budget. Joining me was Marilyn Watkins of the Economic Opportunity Institute. Here is the video of our exchange:

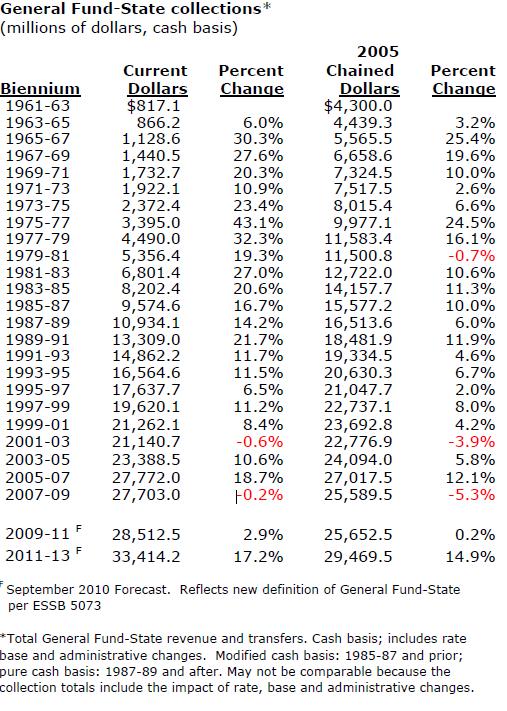

Next week lawmakers will get the final revenue forecast before the 2011 Session begins. Here is the breakdown of the revenue growth projected as of the September forecast:

If revenue is projected to increase, why is the state facing nearly a $5 billion shortfall?

According to the Office of Financial Management, here are the components of the projected 2011-13 shortfall:

- Replacement of Federal Recovery Act funding with state funds would cost about $2 billion in 2011-13, and $2.1 billion in 2013-15.

- Pension funding obligations (above the current base) would add nearly $700 million to 2011-13; and $1.2 billion in 2013-15.

- Basic education improvements adopted by the 2010 Legislature and statutory requirements to fund voter approved measures ( I-728 and I-732) suspended in the current budget would cost about $1.7 billion in the 2011-13 Biennium, and $4.0 billion in 2013-15.

- Covering expected shortfalls in the Education Legacy Account would add $139 million to the 2011-13 budget and $317 million in 2013-15.

- When salaries are projected, the following percentage increases apply:

- Restoration and continuation of Initiative 732 COLA for education staff: 1.2%, 2.5%, 3.9% and 4.2% per year based on the Consumer Price Index (CPI), plus staff growth, based on the Consumer Price Index (CPI).

- Other employees: 1.7%, 1.9%, 2%, and 2% per year, based on the Implicit Price Deflator (IPD), plus staff growth.

- Employee health benefits are expected to grow at 7.5 percent per capita per year, plus staff growth.

- Medical Assistance is projected at a 5.0 percent annual per capita cost increase, plus caseload growth.

- Health Care-related programs (Development Disabilities, Long-Term Care, Alcohol and Substance Abuse Services, Mental Health) grow at 60 percent of the rate of medical inflation.

- Vendor Payments 1.7%, 1.9%, 2%, and 2% per year, based on the Implicit Price Deflator (IPD).

- All other program costs are increased by the IPD general inflation factor plus associated caseload/population cohort growth.

- Baseline expenditures are projected to grow as follows: FY 2012 – 2.9%; FY 2013 – 3.2%; FY 2014 – 2.8%; FY 2015 – 3.0%

With revenue poised to grow substantially (as of September) yet a multi-billion shortfall still projected, it is clear that business as usual is no longer an option. The budget base must be reset.