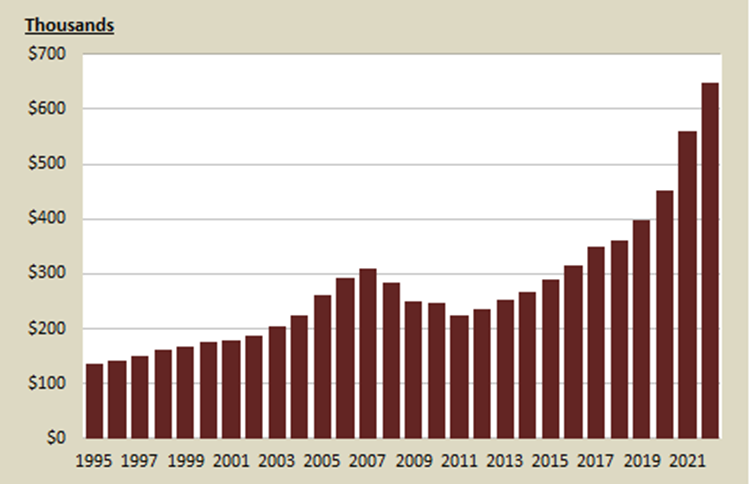

The Washington State Office of Financial Management (OFM) has produced a report showing that since 2017 home prices in Washington State have roughly doubled to about $650,000. That’s the state-wide median price https://ofm.wa.gov/washington-data-research/statewide-data/washington-trends/economic-trends/median-home-price. (see graph below)

The average price in King County is over $840,000. The OFM report informs us that, “In general home prices in the U.S. are about three times annual household income levels”. What the report fails to mention is that home prices in the Puget Sound region are now 6.9 times annual household income (see the 2023 Demographia Housing Affordability Survey dhi.pdf (demographia.com)). Rental costs typically closely follow house prices, so it is no surprise that rents have similarly escalated.

How did housing in Washington become so expensive? Many factors contribute to housing costs, including increasing demand from a growing population, supply that is constrained by local zoning and tight urban growth boundaries, and permitting costs. Taxes are another driver of housing costs, and last month’s decision by the Sound Transit Board to bump up that agency’s slice of the property tax to $0.167 per $1,000 of assessed value, the maximum allowed under state law, adds to the burden.

In 2024 Sound Transit expects to collect $172 million in property tax. Sound Transit’s 2024 Financial Plan indicates that amount is expected to increase steadily so that through 2046 a total of more than $6.1 billion in property tax will have been extracted from property owners within the Sound Transit taxing district. That tax will translate directly into rising housing costs and rents.

The property tax is not the only Sound Transit revenue source that is contributing to higher housing costs. Sound Transit’s largest source of revenue is a 1.4% sales and use tax. That tax is expected to produce a whopping $77.6 billion in revenue from 2017 through 2046. Not only does that tax reduce the income available to households to pay for housing, the tax also increases the cost of housing. For example, if you are having a home built or remodeled, or if you are a developer building new homes, that 1.4% tax will apply to materials used in construction. This adds thousands of dollars to the cost of a new home, costs that are also passed along to renters as developers and owners of rental properties try to offset the impact of the tax.

Sound Transit also collects Motor Vehicle Excise Tax, which generates over $350 million in revenue per year. When businesses pay that tax on the trucks and vans they use for making deliveries, and tradesmen for the vehicles they use on construction projects, the costs are passed on to customers in the form of higher prices. That adds to the cost of housing while at the same time reducing the disposable income available to families who pay vehicle excise tax on their own automobiles.

The irony in all this is that in 2016 Sound Transit made a commitment to support affordable housing as part of their ST3 plan. To that end Sound Transit established a $5 million revolving fund that helps finance affordable housing projects. Sound Transit is also making surplus property available for affordable housing development. But, as the numbers in the Sound Transit Financial Plan show, the multi-billion dollar burden from the onerous Sound Transit taxes far outweighs the very modest benefits from the small increase in affordable housing attributable to Sound Transit programs. If the Sound Transit Board was really interested in making housing across the region more affordable the quickest and easiest way would have been to reduce their property tax rate rather than voting to increase it as they did on November 22. Happy Thanksgiving.