Download the full Legislative Memo

Key Findings

- Over the last ten years state revenues will have grown by 75%, from $28.5 billion in 2009-11 to the forecasted $50 billion for 2019-21

- With state tax revenues projected to rise by more than $4 billion for the next budget, lawmakers should reduce the financial burden they impose on families with a sales tax cut.

- When it was first imposed in 1935, Washington’s sales tax rate was just two percent.

- It is currently at 6.5%, more than three times higher, and citizens have not seen a rate reduction since 1982.

- Cutting the state sales tax rate would reduce the tax burden for families and provide savings for every household and business in Washington state.

Introduction

Washington’s growing economy is generating more tax money for state lawmakers, providing them the opportunity when they adopt the new state budget during the 2019 Legislative Session to provide families a sales tax cut.

The state’s projected total budget reserves are more than $3 billion and taxpayers continue to provide record amounts of revenue. In fact, according to the state Economic Revenue and Forecast Council on Washington’s November revenue forecast:

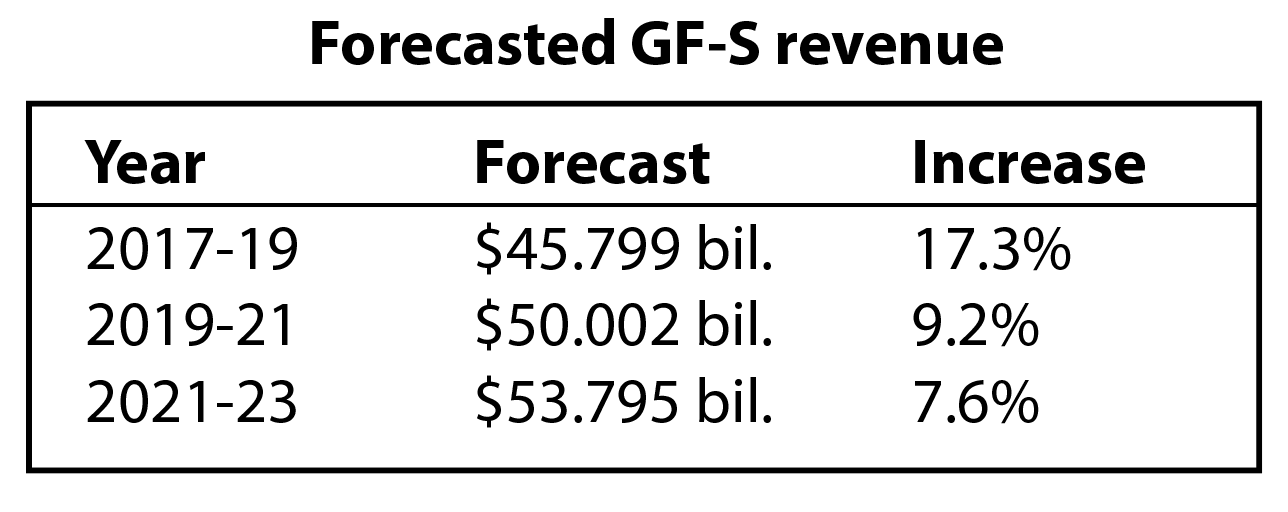

“Forecasted Near GF-S revenue for the 2017-19 biennium is now $45.799 billion, 17.3% more than that of the 2015-17 biennium. Forecasted Near GF-S revenue for the 2019-21 biennium is now $50.002 billion, 9.2% higher than expected 2017-19 biennial revenue, and forecasted Near GF-S revenue for the 2021-23 biennium is $53.795 billion, an increase of 7.6% over expected 2019-21 biennial revenue.”

These numbers illustrate state revenues continue to increase substantially under current tax rates. Over the last ten years state revenues will have grown by 75%, from $28.5 billion in 2009-11 to the forecasted $50 billion for 2019-21. This growth rate is far above the 17 percent inflation rate during that time.

During this time of increasing revenue, however, the legislature has not provided significant tax relief to Washingtonians, other than a temporary, one-time property tax reduction planned for 2019 (the one-year reduction comes after higher tax rate imposed in 2017).

With the state Supreme Court having approved the legislature’s long-term K-12 McCleary funding plan and state revenues continuing substantially to increase, lawmakers should now provide families tax relief with a sales tax cut.

Download the full Legislative Memo