The Democrats in the State House released their proposed budget and outlined how $306 million of the revenue from the state’s new CO2 tax will be used in the 2023-25 biennium. An examination of the budget line items shows that more than half of the expenditure goes to expanding government functions – planning, permitting, staffing, and the like.

The Department of Ecology claimed recently that revenue from the Climate Commitment Act (CCA) would be used “be used to fund critical climate projects focused on clean transportation, clean energy, climate resiliency, and environmental justice initiatives.” When the budget was released, Former State Senator Reuven Carlyle tweeted that he dreamed that the taxes “would one day fund investments in climate action, resiliency, equity to build a clean economy & reduce emissions.”

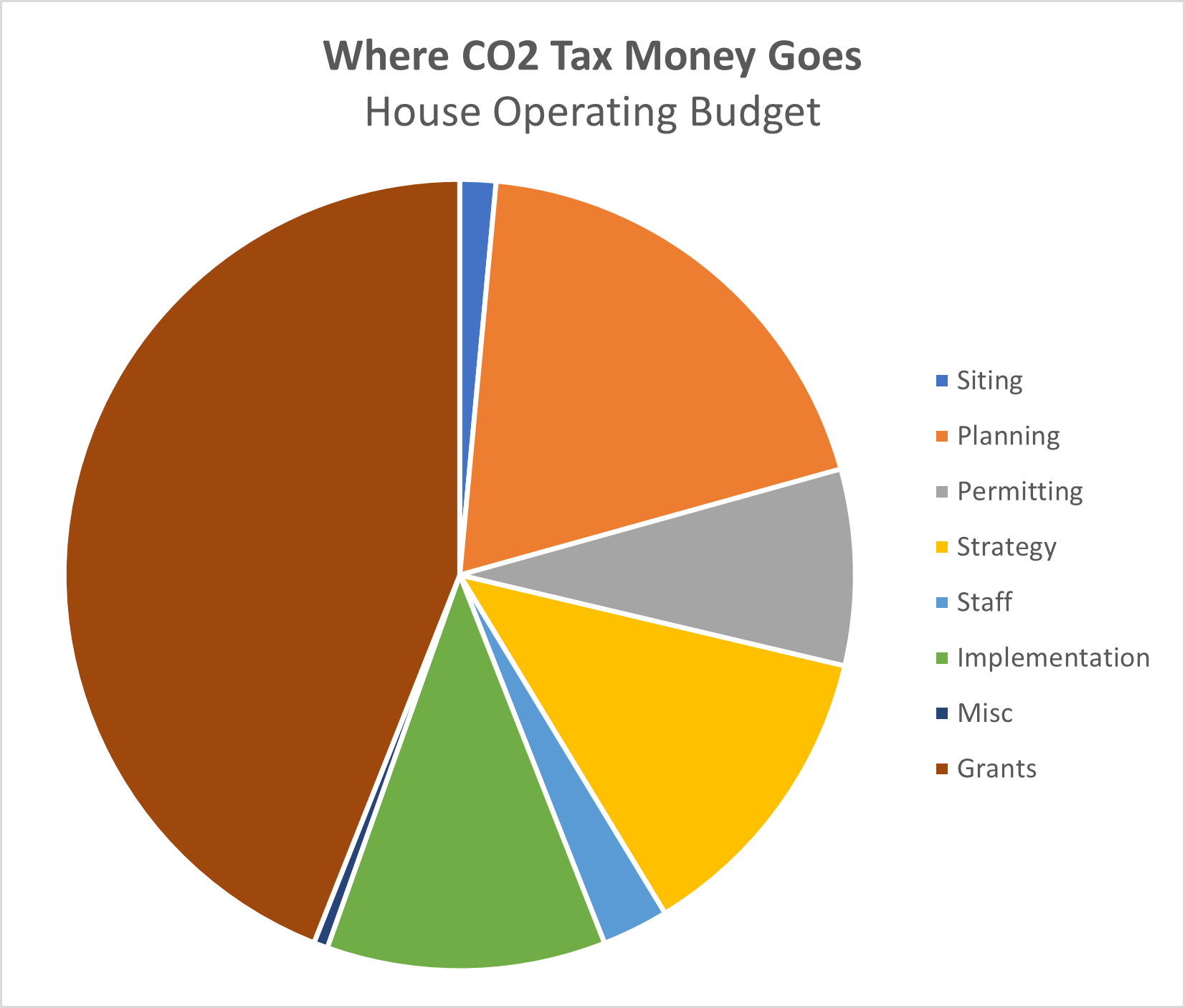

I categorized the expenditures included in House Budget Summary into several groups – siting, planning, permitting, strategy, implementation, grants and miscellaneous. With the exception of grants, all other categories fund government staff and operations.

I categorized the expenditures included in House Budget Summary into several groups – siting, planning, permitting, strategy, implementation, grants and miscellaneous. With the exception of grants, all other categories fund government staff and operations.

For example, several agencies have funding to support “local government climate planning,” which is intended to help local governments add climate change to their growth management plans. The Department of Ecology also receives several million dollars for government projects to implement the CO2 tax, upgrade grant management software, create a carbon sequestration strategy, track expenditures of climate projects, and develop a better inventory of state greenhouse gas emissions.

In total, about 56 percent of the $306 million budgeted in the House proposal goes to government. Some big expenditures stand out. The single biggest line item is nearly $41 million to the Department of Commerce for “local government climate planning,” to add climate change to local growth management plans. As we’ve written previously, adding a fifteenth non-prioritized goal growth management plans won’t reduce emissions but, as this budget expenditure demonstrates, will add a great deal of cost.

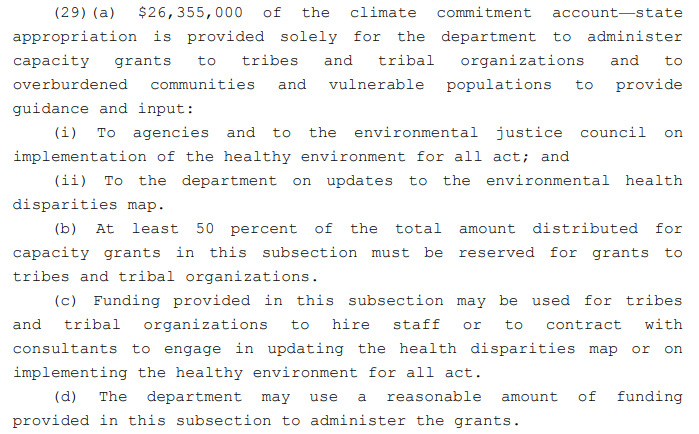

The Department of Health is receiving $26.3 million to fund “Environmental Health Disparity Map Capacity Grants.” The purpose is to give funding to “tribes and tribal organizations and to overburdened communities and vulnerable populations to provide guidance and input” regarding implementation of the HEAL Act and updating the health disparities map. To be clear, the funding does not actually address health disparities. It is provided to hire people to provide input on updating the map of health disparities.

The Department of Health is receiving $26.3 million to fund “Environmental Health Disparity Map Capacity Grants.” The purpose is to give funding to “tribes and tribal organizations and to overburdened communities and vulnerable populations to provide guidance and input” regarding implementation of the HEAL Act and updating the health disparities map. To be clear, the funding does not actually address health disparities. It is provided to hire people to provide input on updating the map of health disparities.

In total, $171.5 million of the $306 million goes to expanding government, and $134.7 million is for grants that are generally aligned with the purported purpose of reducing the impact of climate change.

Of that amount, $25 million is for increased energy assistance to offset a portion of the increased energy costs due to the taxes on CO2-emitting energy.

I did not assess the likely effectiveness of these grants, although some are questionable. For example, there is $22 million for “anaerobic digester development.” Additionally, in the $1.7 million for “GHG emissions reduction” at the Department of Fish and Wildlife, there is about 688,000 for staff and incentives as part of a commute trip reduction program they claim will reduce the agency’s transportation-related emissions by 10 percent. Even if it achieves that goal, which seems unlikely based on the history of such programs, it would cost about $125 per metric ton of CO2. That is extremely expensive. The state’s “social cost of carbon,” which is an estimate of the global damage done by each metric ton of CO2 is $87 per metric ton. WDFW’s commute trip reduction program costs 45 percent more than the benefits it provides across the globe. It does more harm than good.

The items listed in the proposed House Operating Budget aren’t the only expenditures from the new tax on CO2 emissions. Last year, the legislature used some of the revenue to adopt a transportation plan that was heavily focused on transit, biking, and reducing transportation-related CO2 emissions.

Of course, not all grant programs are wasteful. Projects to reduce the fire risk in state forests, to restore salmon habitat, reduce flooding on the Nooksack, and fund soil health projects are all worthy efforts.

But a needless amount of the expenditures from the CO2 tax revenues are simply about more planning, permitting, strategy writing, and expanding government in the hope that someday in the future such planning will pay off. Following this approach, Washington state has consistently missed its CO2 targets. To effectively reduce the state’s CO2 emissions, the state should focus more on effective projects and less on expanding government bureaucracy.