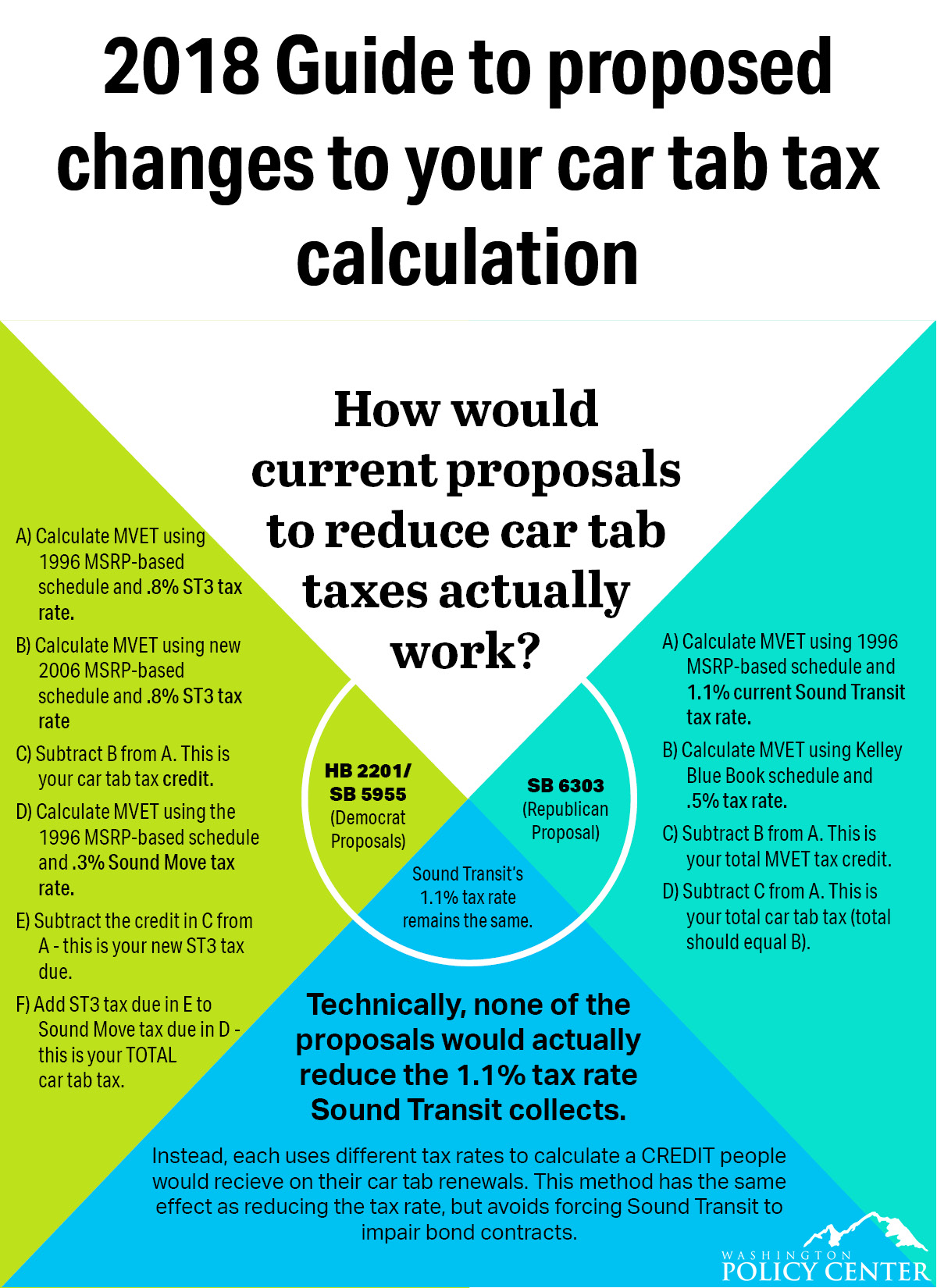

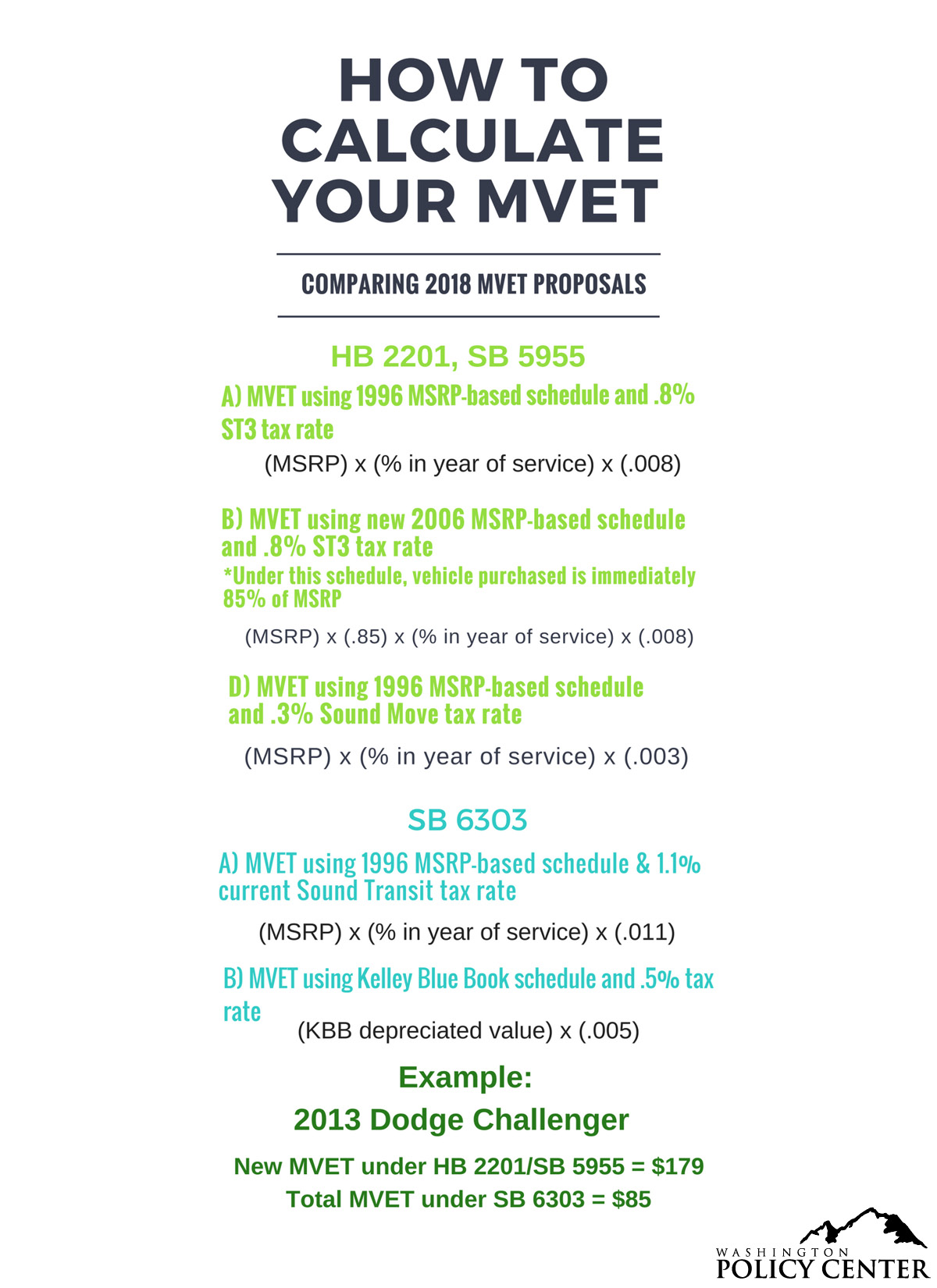

There are three legislative proposals this year that target Sound Transit's unfair collection of inflated car tab taxes from taxpayers in parts of Snohomish, King and Pierce counties. None of the proposals would actually reduce the 1.1% tax rate Sound Transit now collects due to the passage of Sound Transit 3 in 2016. Instead, each uses different tax rates and vehicle depreciation methods to calculate a credit people would receive on their car tab renewals, thereby reducing the overall balance due.

Below is a quick breakdown of how each credit calculation works, so you can see the difference in each method and the result it produces for yourself.

For "% in year of service" - you will need to look to the appropriate depreciation schedules.

- The outdated, repealed depreciation schedule from 1996 that Sound Transit prefers to use: RCW 82.44.041.

- The more modest 2006 depreciation schedule in state law: RCW 82.44.035.