Ben Franklin Transit is flush with cash and is in a great position to give taxpayers who are dealing with skyrocketing costs a much-needed break.

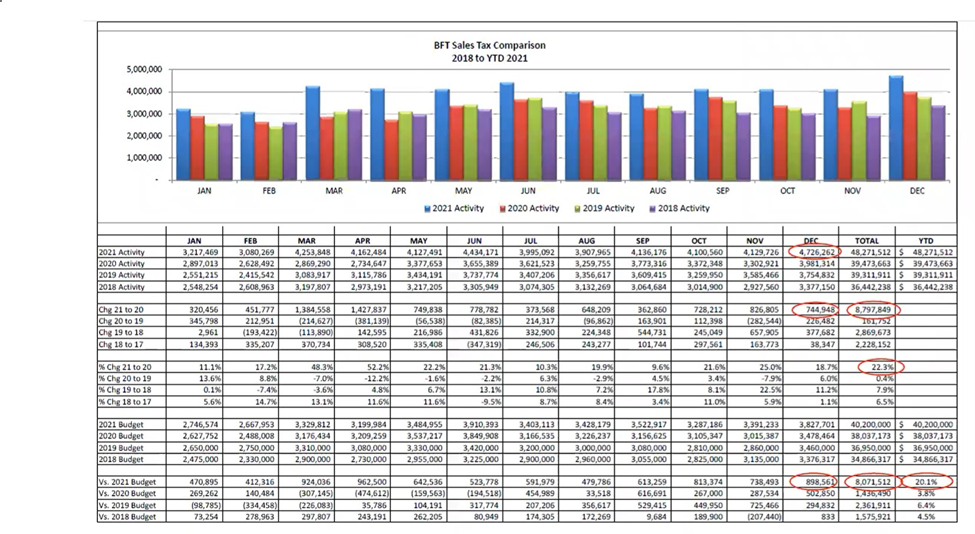

At their last board meeting in early March, BFT reported that the agency saw an incredible growth of 22% in sales tax revenue from 2020 to 2021. Board member Richard Bloom commented, “We’re collecting way more sales sax than we expected to. We can adjust what we collect in taxes.”

Other board members agreed. Some members suggested that the board pass a resolution reflecting that the Board would choose not to collect a portion of sales tax revenue on a temporary basis – a suspension of the full tax collection since the Board can’t permanently remove a sales tax without a public vote. Board member Clint Didier suggested that they pass a resolution moving this issue to the ballot so that the public, which pays for Ben Franklin Transit services, could vote on it for themselves. Both resolutions will be considered at the next board meeting.

Currently, BFT collects a 0.6 percent sales tax. The proposal from board members is to lower that to 0.5 percent, leaving plenty of funding for BFT.

Naturally, transit lobbyists like Seattle’s Transportation Choices Coalition, are calling this “cruel” and taking to social media and local papers to slam the board for considering modest relief for the public given the agency’s rosy financial outlook. Their approach – the usual crisis peddling - is dishonest.

Since 2010, Ben Franklin Transit revenue has increased 47% (inflation adjusted), while ridership plunged -64%. While some of that decrease was exacerbated by COVID, transit lobbyists like to omit the fact that ridership was decreasing in years prior. From 2010 to 2019, ridership at BFT decreased 38%.

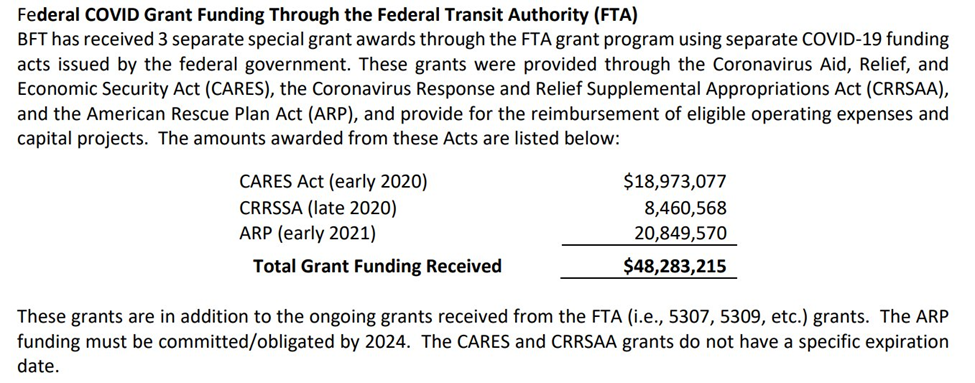

While serving significantly fewer people, BFT has raked in a substantial amount of federal relief dollars. This includes:

- $18.9 million through the Coronavirus Aid, Relief and Economic Security Act (CARES) funding in early 2020

- $8.4 million in Coronavirus Response and Relief Supplemental Appropriations Act (CRRSSA) funding in late 2020

- $20.8 million in American Rescue Plan Act (ARP) funding in early 2021

From BFT’s budget:

BFT also reports being very healthy financially, with $67 million in total cash and equivalents on hand, or about $40 million if you deduct reserves.

“If we don’t need the money, there’s no need to collect, I totally agree,” said Bloom at the board meeting. He argued that a temporary suspension by the board would allow them to recover the sales tax in the future if necessary, especially if BFT doesn’t have access to federal grant dollars as they do now.

“It’s time to give the people a little break when we can. And that’s why I’m in favor of letting them choose,” said Didier.

The BFT Board meets the second Thursday of each month. We expect they will address both resolutions at this month’s meeting.

Additional Resources:

Ben Franklin Transit officials increase spending as ridership declines (2018)

Tri-Cities Ben Franklin Transit puts agency’s interests above the community (2021)