Last year, members of the Washington State Transportation Commission (WSTC) ran a pay-per-mile pilot program. The program tested several options, including a GPS-enabled transponder attached to your car and a mileage reporting app for your phone. I was a pilot participant and tested both tracking methods.

For me, the pilot was simple but shocking.

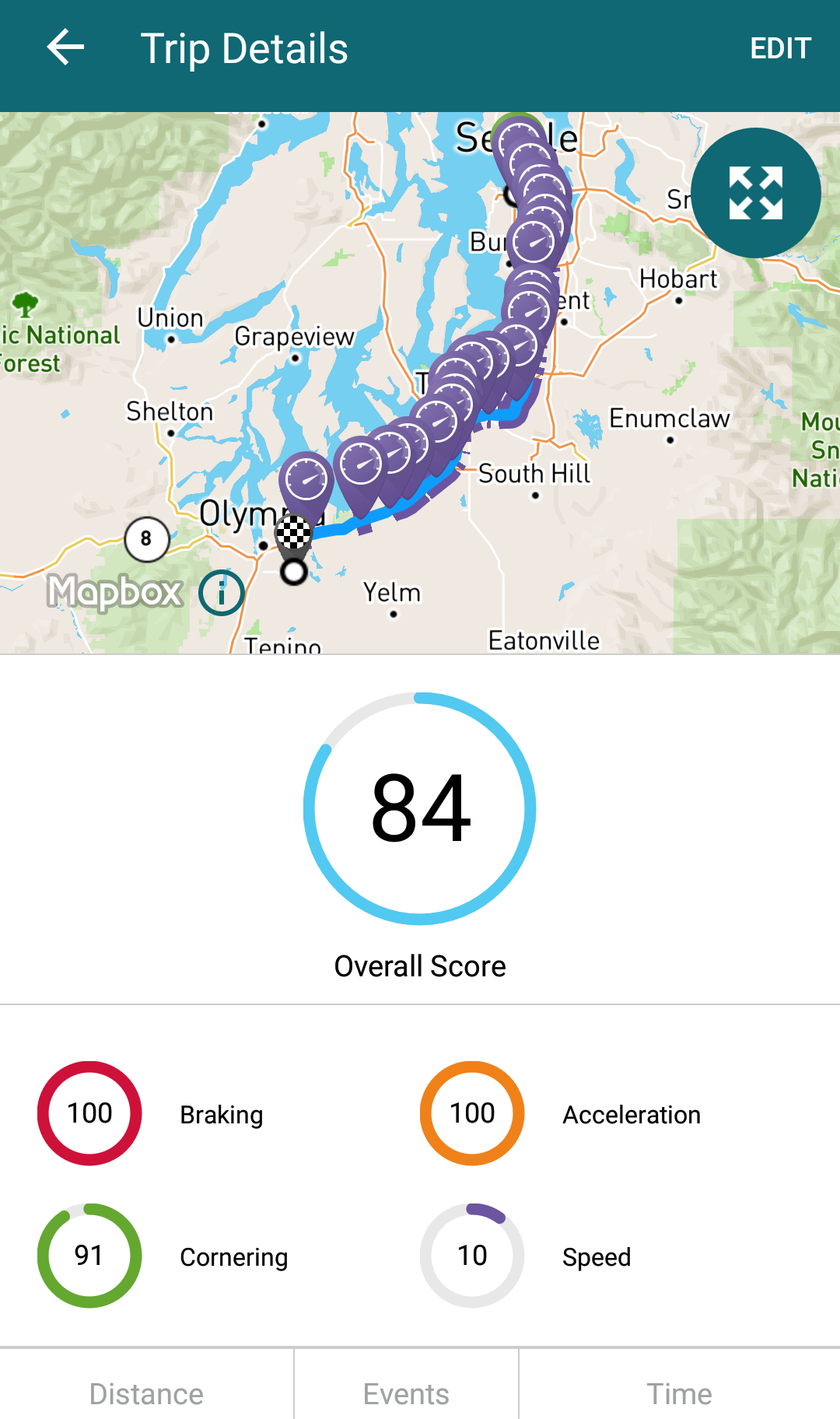

My driving was graded based on acceleration, speed, braking, and cornering. During a one-hour trip, the transponder reported every time I exceeded 60 miles per hour – and for how long and where. It also tagged me for "harsh cornering." The Commission calls this a “value added feature.”

It is not hard to picture how this information could easily be used to issue scores of traffic tickets.

The Commissioners will make their final recommendations about imposing a mileage tax to the state Legislature in December. Since many bureaucrats believe that gas taxes are dropping more rapidly that they really are, they are in a hurry to replace the gas tax with a mileage tax. So it is no surprise that Commission members are now rolling out their marketing campaign for the tax by leaning heavily on survey results from pilot participants who make up less than 0.03 percent of the state’s licensed drivers.

There are problems. The state has bond obligation debt tied to gas tax revenue. So what is likely to happen is the public will end up with both taxes on the books.

Officials promise the gas tax we pay will be credited back to us on mileage tax bills, but as we witnessed last session, legislative promises are often broken, rendering them meaningless.

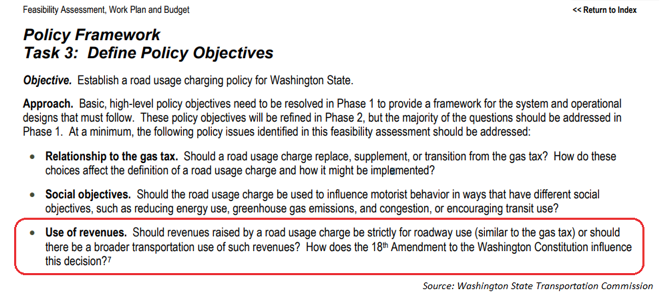

The Commission will also likely say that any per-mile charge should be constitutionally protected by the state’s 18th amendment, which restricts money drivers pay for highways and bridges only, making it a user fee. The gas tax cannot be used to fund transit or other government programs.

However, the Commission also knows that this contradicts what powerful state public agencies say they want, which is the ability for transportation dollars to go into an unprotected, general pool of money that public officials can spend on mass transit, road diets, and other ideological initiatives. This is what they actually mean when they say the money will be used for transportation (rather than highway) funding.

For the driving public, the hardest pill to swallow may be the violation of privacy, with either the state or a contractor tracking where you go and how often, and when and where you drive. The natural proclivity of government is to store and use private data once its collected. The Commission says that personal information cannot be disclosed without consent or knowledge unless required or permitted by law. The problem is – no one believes them.

To make this proposal even more unpalatable, Seattle officials say they want to use a mileage tax to restrict access to downtown streets to only those drivers who agree to enroll in the tracking program. Further, for those who are enrolled, officials envision a mileage tax that they could increase based on time of day and driver location, taking more money during the busiest hours of the day when people are trying to get to work or back home to their families.

Throughout last year’s pilot project, the Commission argued time and time again that a per-mile tax would simply replace the gas tax to help pay for roads. Yet the Commission itself questions whether spending the tax revenue only on roads is the right approach.

In a 2013 report, they ask, “Should revenues raised by a road usage charge be strictly for roadway use (similar to the gas tax) or should there be a broader transportation use of such revenues? How does the 18th Amendment to the Washington Constitution influence this decision?”

In 2020, the legislature will review the Commission’s final recommendations. As they consider a tax on every mile we drive, they should recognize it for what it is – a political tool for which the public would pay enormously, both in the diversion of money from roads, and in reduced privacy, autonomy and mobility for everyone.