I don't understand how you propose we pay for public services

After recent commentary from Jason Mercier was published, he received the following email:

Dear Mr. Mercier,

I read your article on taxes in the newspaper recently. I didn’t understand how you proposed we pay for public services. We can’t individually pay for things like roads, schools, and government. We do need taxes for these things. Income tax isn’t perfect but it does seem like the best way to be fair and transparent. -- Sheri

If you're reading this, you're likely a regular WPC blog reader and are likely to recommend the site to friends. Since one or more of them might have the same question, I thought it'd be good to publish Jason's response so that we could all benefit:

Thank you for your email.

Washington’s current tax structure is producing record revenues and is the envy of the nation for its stability. As noted in the state’s most recent bond rating:

“Washington's revenues have historically exhibited less cyclicality than others (due in part to the lack of a personal income tax) . . . we have observed that capital gains-related tax revenues are among the most cyclical and difficult to forecast revenues in numerous other states."

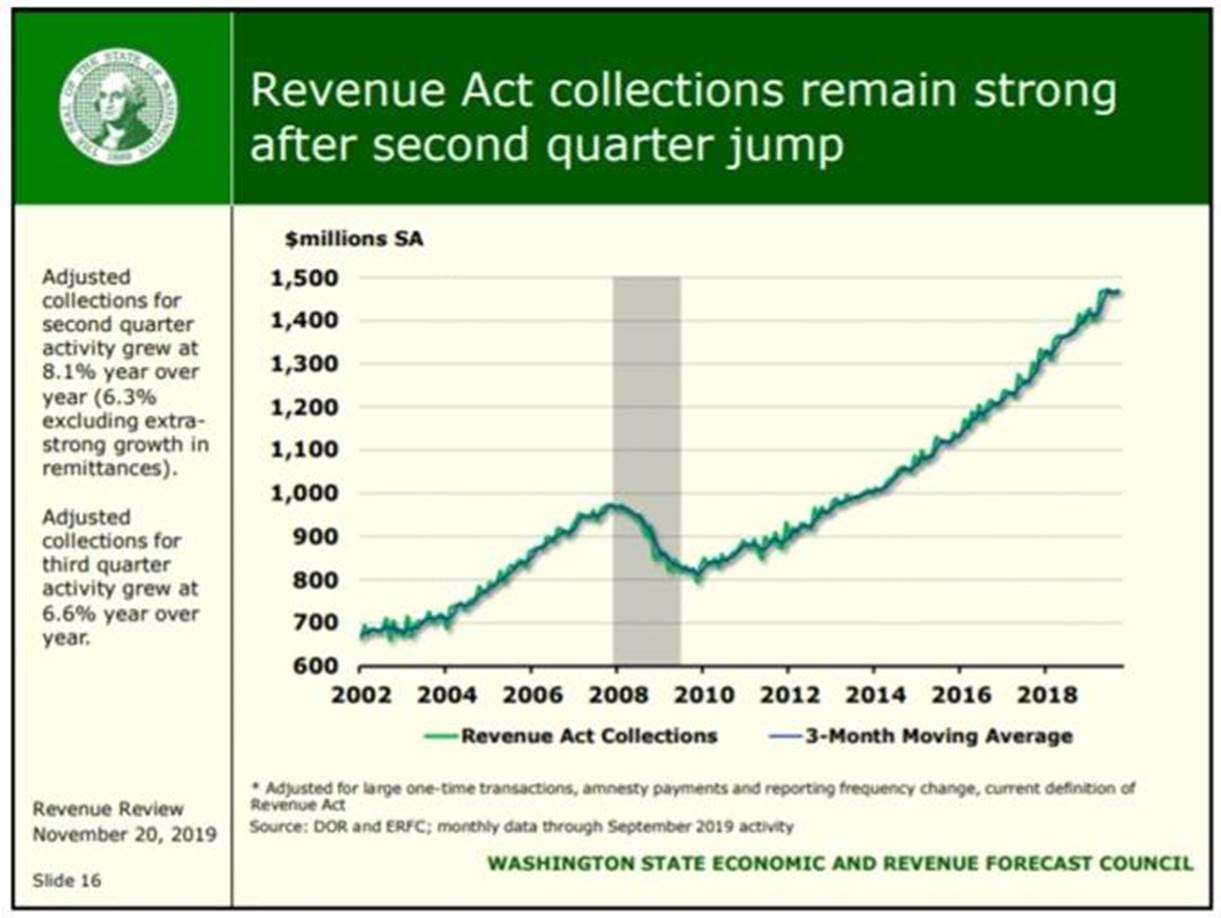

Here is the current growth in state tax revenues:

This chart shows tax revenues consistently grow from $31.1 billion in 2011-13 to a projected $51.7 billion in 2019-21 (GFS).

Now that’s not to say that everything is perfect. Earlier this year we testified at a House Finance Committee Tax Structure Work Session and offered these tax reform options.

So now, if you're telling people about what you've read about taxes from Jason (and you should be telling people), you'll be able to point to this and say, "I think this explains how we'd pay for services."