Related Articles

Yesterday, Governor Inslee signed a two-year transportation budget into law. The $7.6 billion plan includes about $5 billion for the Washington State Department of Transportation over the next two years, $430 million for the Washington State Patrol, and dedicates about $1.5 billion to pay off Nickel and TPA bonds. The budget for the 2015-2017 biennium also funds other transportation-related offices and departments, like the Department of Licensing. The state has yet to post the final budget, but you can view the spending plan as passed the legislature here, and the governor’s vetoes, here.

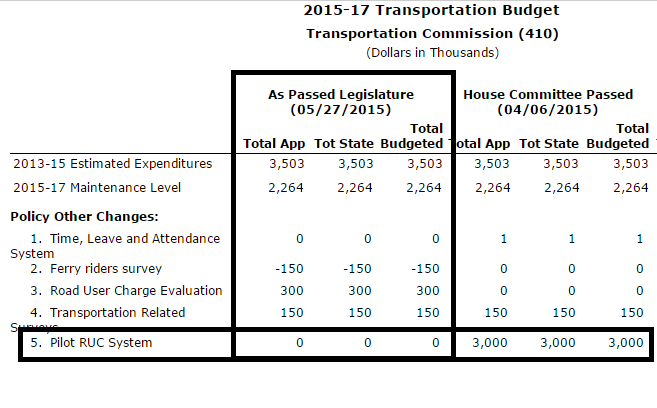

Perhaps the most interesting thing that didn’t make it through the budget negotiations, however, was a pilot program to test out a new tax on drivers, called a “Road User Charge,” or RUC. Back in April, the House Transportation Committee passed their version of the budget that included $3 million for the program, but through negotiations the program was scrubbed. Instead, state leaders opted to fund $300,000 in ongoing evaluations of a new per-mile tax.

Over the past few years, the state legislature has tapped the Washington State Transportation Commission to study alternative ways to pay for transportation projects – including a per-mile tax. Officials say that fuel efficiency and a possible decline in the amount people drive could negatively impact gas tax revenues, threatening maintenance and preservation of the road system (although driving is up over five percent this year).

Yet a RUC, as it stands today, has many problems. For example, the costs of collection and administration could be as high as 10% of revenues, compared to a gas tax, where collection and administration are less than one percent.

In addition, drivers may feel wary about installing a GPS unit in their car or a using a smartphone app due to privacy concerns. While officials may find ways to alleviate some of these concerns, the current plan wouldn’t actually eliminate the gas tax. As the plan sits now, officials would continue charging drivers a gas tax and add a new per-mile tax, and then credit the gas taxes paid when drivers pay their mileage bill.

Some state lawmakers likely decided against the pilot program because they are currently talking about raising the gas tax to fund a transportation package; or maybe they just don’t like the idea of a per-mile tax. The State Treasurer also has concerns with the idea.

Either way, officials still have a long way to go before they can convince the public to abandon a well-known, constitutionally-protected tax for a completely new tax mechanism based on miles-traveled.